Estimated Reading Time: 12 minutes

In this post you will learn how Joel Greenblatt's Magic Formula has performed in recent backtests across different markets, including Europe and Finland. This post explores how combining the formula with other metrics, like momentum, can significantly increase your returns.

It also shares insights on why the top-ranked stocks aren't always the best picks and how to optimize your strategy. If you're looking to refine your investing approach and potentially improve your portfolio's performance, this post is a must-read.

In this article you can learn how Joel Greenblatt's pioneering book, "The Little Book that Still Beats the Market," laid the foundation for the Magic Formula and kick-started a revolution in quantitative investing, including mine.

It will help you understand the two ratios at the heart of the Magic Formula: Earnings Yield and Return on Invested Capital (ROIC) and discover how they work together to help you identify undervalued, high-quality companies.

Decoding the Ranking Mechanism

The Magic Formula ranks separately ranks companies on ROIC (where 1 is the company with the highest ROIC), and by Earnings Yield (where 1 is the company with the highest earnings yield).

To get the Magic Formula value the ROIC and Earnings Yield rankings are added together. The best Magic formula company thus has the lowest Magic Formula rank (the lower the better).

Empirical Evidence: Back-Test Results Summarised

Below you will find the summarised results of all the Magic Formula back-tests we could find. This lets you see the real-world application and effectiveness of the Magic Formula world-wide. (Scroll down for the most up to date back test).

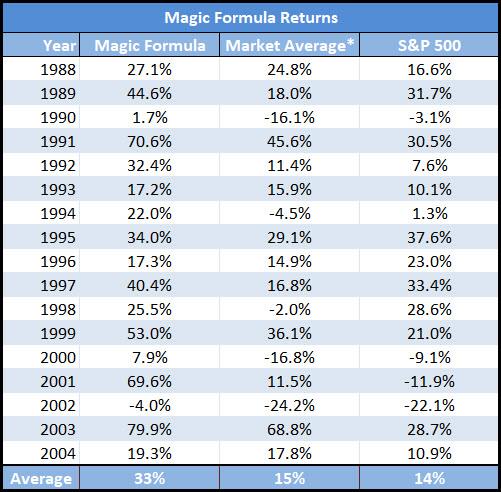

Returns from the Book

This was the original returns from a Magic Formula investment strategy as shown in the book The Little Book That Still Beats the Market:

Click to enlarge

Source: The Little Book That Still Beats the Market 2006

*Market Average return was the return of an equally weighted index of the 3,500-stock universe Joel used when testing the Magic Formula.

As you can see the results were astounding with an average return of 33% over 16 years.

Click here to find Magic Formula ideas where you invest

Magic Formula investing also works outside the USA

Does the Magic Formula also work outside the USA?

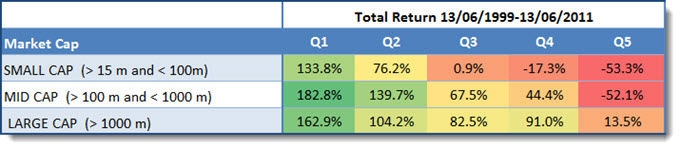

That is what we wanted to know. So we tested the strategy in Europe over the 12 year period from June 1999 to June 2011.

This is what we found:

Magic Formula returns in Europe from June 1999 to June 2011 by company size.

Source: Quantitative Value Investing in Europe: What works for achieving alpha

As you can see companies with the best Magic Formula rank, quintile 1 (Q1) in the above table, did a lot better than companies with the worse Magic Formula rank (Q5), and did this for small, medium and large companies.

Magic Formula did substantially better than the market - up to 152.3% better

The best ranked Magic Formula investing companies all substantially outperformed the market which returned only 30.54% over the same 12 year period.

But, you can improve the returns of the Magic Formula for returns up to 783.3%

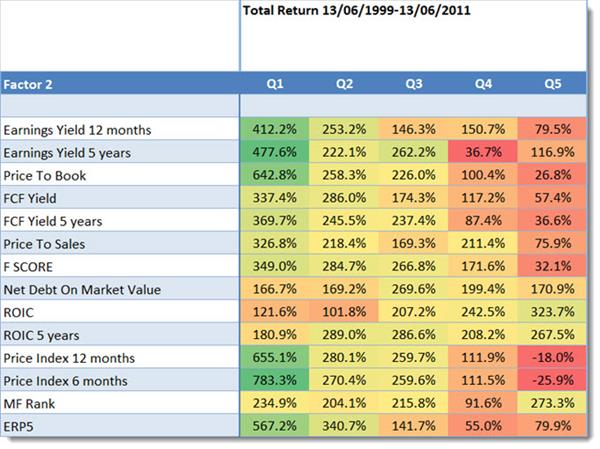

We also tested the Magic Formula investing strategy with 13 other ratios and as you can see in the table below the returns of the strategy can be improved a LOT!

Magic Formula returns when combined with a third ratio in Europe from June 1999 to June 2011.

Source: Quantitative Value Investing in Europe: What works for achieving alpha

Look at the returns in column Q1, it shows the returns generated by first selecting the 20% best Magic Formula investing companies and then selecting only those companies that were best rated with the ratios in the column called Factor 2.

Best combination +783% was Momentum (600.5% improvement)

This means you could have earned the highest return of 783.3% over the 12 year period if you invested in the best ranked Magic Formula companies that also had the highest 6 month price index (share price momentum).

This is a 600.5% improvement over the best return of 182.8% you could have earned if you used only the Magic Formula to get investment ideas.

Click here to get Magic Formula ideas where you invest

The Magic Formula also works in Finland

Does the Magic Formula also work when applied only to companies listed in Finland?

It does, and it was proved in 2013 by Topias Kukkasniemi in his 68 page master’s thesis The Use of Systematic Value Strategies in Separating The Winners From The Losers: Evidence From The Finnish Markets at the Lappeenranta University of Technology in Finland.

Topias tested the Magic Formula on the Finnish stock market over the 13 period from May 1997 to May 2010 and found that it does outperform the market.

Testing the Magic Formula in Finland

Topias tested the Magic Formula slightly differently. Instead of using Return on Invested capital (ROIC) he used Return on Assets (ROA).

He did this for two reasons:

- Because the previous research on the relationship between ROA and high future returns is extensive.

- ROA figures are more easily accessible by small investors than ROIC.

ROA was calculated as follows: Earnings Before Interest and Taxes (EBIT) / Total Assets.

Test portfolios, a great idea

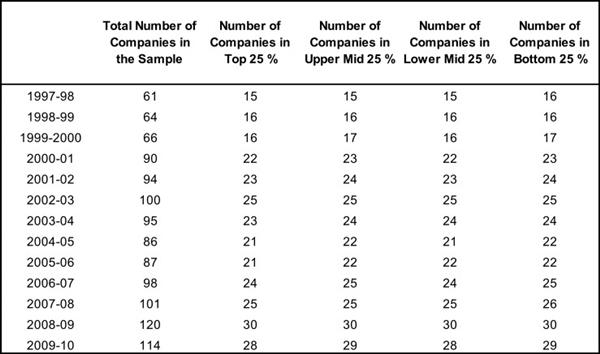

To test the strategies really thoroughly Topias divided companies into four categories (from best – Top 25% to worse – Bottom 25%) based on their Magic Formula rankings.

This resulted in the following portfolios:

As you can see the total number of companies in the investment universe each year varied between 61 and 120. This resulted in the number of companies in the portfolios varying between 15 and 30.

Results

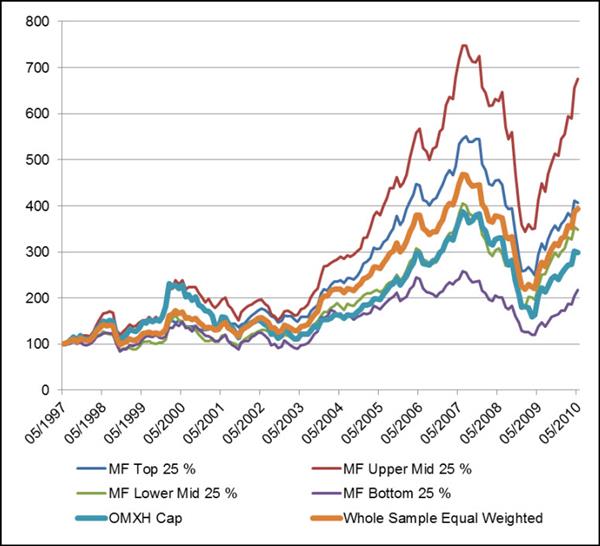

Now we come to the most important part – how well did the Magic Formula do in Finland

Click to enlarge image

As you can see the Magic Formula could definitely have helped you outperform the market.

Surprising Finding - That increases your returns

But the surprising finding of the study is that the best ranked Magic Formula companies (MF Top 25%), thin blue line in chart above, did not perform the best.

You would have gotten better returns if you invested in the companies just below the top 25% of Magic Formula companies (MF Upper Mid 25%) the red line in the chart above.

Why is this, you may be thinking?

Topias speculated as to why it could be saying:

"A possible explanation for this could be that the stocks ranked in the top quartile are cheap for a reason and have only recently taken a turn to the worse so that the accounting ratios still look attractive although the business environment has changed. For some reason, Magic Formula seems to put the biggest gainers in the second 25% of companies."

Conclusion

So the Magic Formula works even if you apply it to a relatively small group of companies only in Finland.

When investing using the Magic Formula it is not the best idea to choose the highest ranked companies but the companies ranked from 26% to 50%.

Click here to get Magic Formula ideas where you invest

The Magic Formula also works in Belgium, Luxembourg and the Netherlands

The Magic Formula investment strategy also works if you apply it to companies in Belgium, Luxembourg and the Netherlands as proved by Pim Postma in his 2015 Bachelor thesis Magic Formula Investing in the Benelux.

Here is the abstract of Pim’s thesis:

“Joel Greenblatt’s Magic Formula trading strategy was able to generate market beating returns without taking additional risk in the United States stock market during the period of 1988 until 2004, and therefore clearly violates the Efficient Market Hypothesis.

This strategy is a simple stock selection method where Return on Invested Capital and Earnings Yield are the key metrics for determining the best common stock investments.

This paper takes this specific Magic Formula trading strategy to the Benelux stock market and performs a back test to see whether this strategy also shows market outperformance in the Benelux stock market.

The answer to this question is clearly a yes.

The Magic Formula trading strategy was able to realize an average 7,70% annual market premium in the Benelux stock market without taking additional risk during 1995 until 2014. This signalizes a market anomaly and also violates the Efficient Market Hypothesis.”

Yes the Magic Formula works

The abstract is just a fancy academic way of saying that from 1995 to 2014 the Magic Formula definitely worked in Belgium, Luxembourg and the Netherlands as it would have given you an average yearly return of 7.7% better than the market over the 20 year test period.

I am sure you will agree it’s an impressive market beating return.

Invested in 10 companies each year

Because the Benelux company universe was so much smaller than the US universe Joel Greenblatt tested in his book a portfolio of only 10 equal weight positions was formed.

Thus year on 31 March a portfolio of the top 10 Magic Formula companies were bought.

This portfolio of 10 companies were rebalanced on 31 March each year because most European companies have 31 December year ends and as of 31 March most of the year-end financial statements will already have been published and he could calculate Magic Formula components for each company.

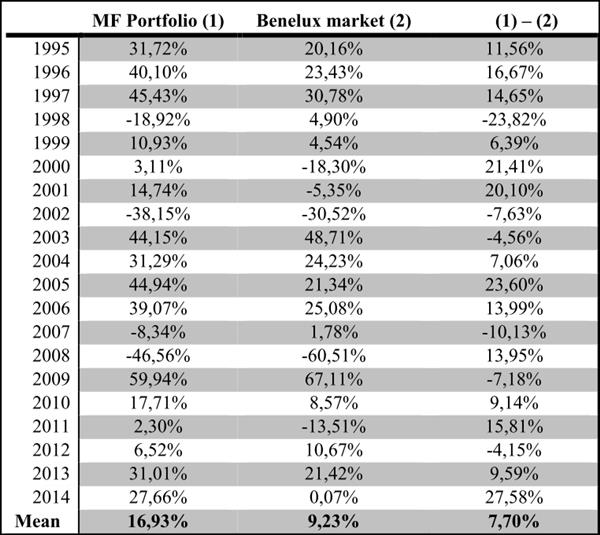

Returns of the Magic Formula

Now for the most important part, just how did the Magic Formula perform?

Click to enlarge image

As you can see the Magic Formula performed very well.

If over the 20 year period from 1995 to 2014 you bought the 10 best Magic Formula companies each year you would have outperformed the market by 7.7% per year.

Performance better than most fund managers

And over the 20 years you would have done better than the market 70% of the time. This is better than most fund managers who underperform the market 80% of the time.

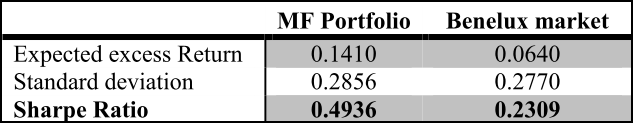

Better risk adjusted return

Not only did you outperform the market, the higher returns you generated would have more than compensated you for the higher volatility of the Magic Formula portfolio which only had 10 investments compared to the market portfolio which had more than 200 companies.

As you can see the table below the Magic Formula portfolio had a substantially higher risk adjusted return or Sharpe Ratio (higher is better) which means you were very well compensated for the higher ups and downs (volatility) of the Magic Formula strategy.

Just how much better did the Magic Formula perform?

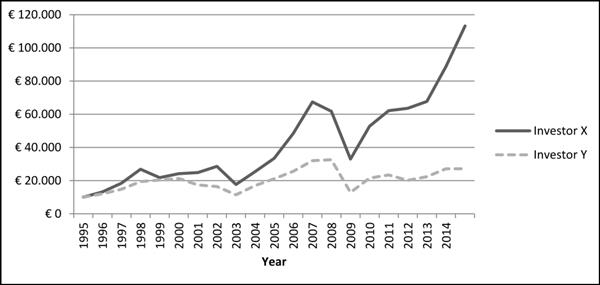

How much better would you have done if you used the Magic Formula?

The following chart shows this very clearly.

Click to enlarge image

Magic Formula gave you 11.3 times your capital

Investor X invested €10,000 in March 1995 using the Magic Formula and at the end of the 20 year period had €113,238 in his investment account. This is 11.3 times the amount he or she started with.

Market portfolio only gave you 2.7 times your capital

Investor Y also started with an initial investment of €10,000 but invested in the Benelux market index and at the end of 20 years had only €27,182 in his investment account, only 2.7 times his or her starting amount.

Conclusion

This research study clearly shows that the Magic Formula investment strategy also works outside the USA as it substantially outperformed the Benelux (Belgium, Luxembourg and the Netherlands) stock markets.

Click here to get Magic Formula ideas where you invest

Magic Formula Normalized vs. Last 12 Month Data

In December 2011 Alpha Architect published interesting research report they called Magic Score: Long-Term vs. Short-Term.

They wanted to see if the long term Magic Formula performed better than a Magic Formula calculated using values from the past 12 months.

The long term Magic Formula

They calculated the long term Magic Formula as follows:

- Valuation = 8-year average earnings before interest and taxes (EBIT)) to total enterprise value (TEV)

- Quality = 8-year average EBIT to net property plant and equipment (NPPE) plus net working capital

The long term Magic Formula is thus just the same as the trailing twelve months version, except that the valuation ratio includes a long term average of EBIT divided by the current enterprise value. And the quality variable is the average past 8-year EBIT/ current equity.

How they did it:

- Calculate the returns for the standard Magic Formula

- Calculate the returns for the long-term Magic Formula

- They excluded the bottom 10% market value companies on the NYSE

- They only included liquid companies with an average daily traded value of more than $1.5mm (adjusted by CPI)

- Test period 38 years from 1972 to 2010.

- LT_MF = long term Magic Formula

- MF = standard (trailing 12 months) Magic Formula

- EW Index = Equal Weight index return

- All portfolios were equal-weight

- They rebalanced the portfolios annually

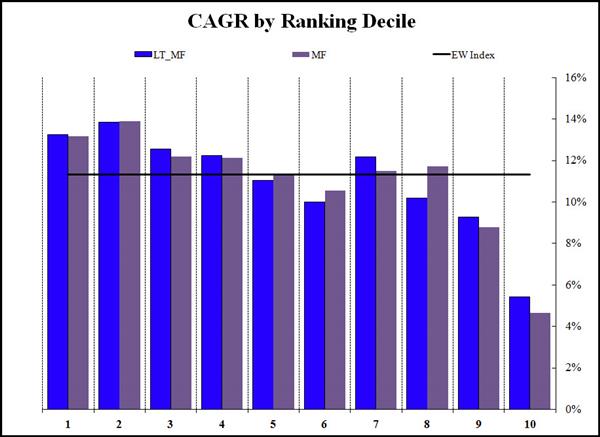

This was the compound annual returns over the 38 year period from 1972 to 2010.

Source: Magic Formula: Long-Term 8-year vs. Short-Term

1 = Best ranked Magic Formula companies

10 = Worse rated Magic Formula companies

Blue bars = 8-year average Magic Formula performance

Grey bars = Trailing 12 months Magic Formula performance

What they found – long term does not add value

As you can see the results were largely the same (blue bars same as grey). Using the long term Magic formula would not have added much to your returns.

This was unusual

What was interesting is that the second 10% of Magic Formula companies (second decile, no 2 in the chart) performed better than the best ranked companies for both the long term and 12 month Magic Formula.

Click here to find Magic Formula ideas where you invest

Does Systematic Magic Formula Investing work? – Data driven back test

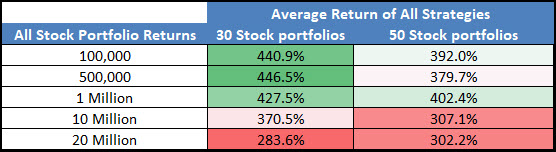

In December 2010 two friends Philip Vanstraceele and Luc Allaeys finished an interesting research paper they called Systematic Value Investing: Does it really work?

Their testing included the Magic Formula investment strategy - Called MF in the tables below.

They wanted to find:

- The best investment strategy in Europe over the 11-years from June 1999 to June 2010

- If small portfolios perform better than large portfolios

- If 30 stock portfolios do better than 50 stock portfolios

The following two tables show you the most important points.

30 Stock Portfolios

Click image to enlarge

50 Stock Portfolios

Click image to enlarge

The tables show you the return of all the strategies for both the 30 and 50 stock portfolios.

What is interesting?

- The pure Magic Formula (MF) did not do well

- The three ERP5 strategies (ERP5, ERP/Piot, ModERP) very did well

- On average the 30 stock portfolios performed better than the 50 stock portfolios

- Returns decreased as the portfolio size (amount invested) increased

- All the strategies performed a LOT better than the market

Let’s look at the portfolio size and number of investments changes returns.

You can clearly see that the more money you have to invest the lower your returns – even though that is a nice problem to have.

Also 30 stock portfolios had higher returns than 50 stock portfolios except if you had €20 million to invest. But never forget diversification is one of the cornerstones of safe investing, and it helps you to sleep well at night – the highest return is not the most important thing.

Conclusion

So what are the main points you can learn from all this analysis?

- Systematic value investing works – all the strategies substantially beat the market

- Smaller – 30 stock portfolios – perform better than large – 50 stock – portfolios

- More money to invest lowers your returns

- Sticking to these strategies – or even just staying invested in the market – is a lot easier than it looks – just look at the maximum declines (Maximum Peak-to-Trough Decline) of all portfolios – Never underestimate your emotions in times of extreme losses.

Click here to get Magic Formula ideas where you invest

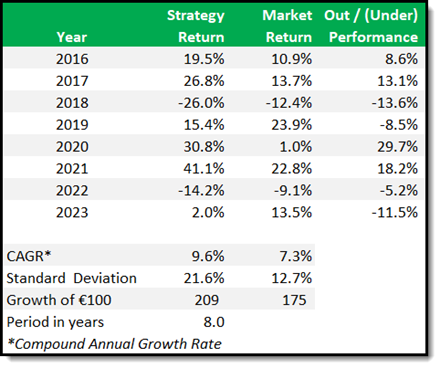

Magic Formula and Momentum investment strategy in Europe - 2016 to 2023

This is the summary results of a back test of the Magic Formula combined with momentum (Price Index 6 months) investment strategy in Europe over the seven year period from January 2016 to January 2023.

It is an update of this back test Magic Formula investing & Price Index 6m momentum investment strategy which covers the 12-year period from 13 June 1999 to 13 June 2011.

How the companies were selected

Here are the exact details of the back tested investment strategy:

- Countries - 17 Eurozone countries (Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia, and Spain)

- Exclude banks, insurance companies, investment funds, certain holdings companies, and REITS

- Exclude companies with an average 30-day trading volume of less than €10,000

- Portfolios formed on the first trading day of the year (Because the back test database is point in time there is not risk of look-ahead bias)

- Returns were compounded on an annual basis

- Select the 20% best ranked Magic Formula companies

- Sort the list by Price Index 6 months from high to low

- Buy the top 50 companies by Price Index 6 months on an equal weight basis

- Rebalance after one year

Magic Formula and Momentum investment strategy performance

Here are the summarised results:

As you can see the strategy performed worse than the market in 2018, 2019 2022 and 2023 but performed great in all other periods. In spite of the underperformance it is still ahead of the benchmark EURO STOXX® Index overall and on a CAGR basis +9.6% compared to +7.4%.

This again shows you how important it is t:

- FIRST find an investment strategy you are comfortable with and

- SECOND stick to that strategy when it underperforms, even over a few years as happened here.

As you may already have seen, the formula does not always work, as mentioned and explained by this investor. You know, this happens to all investment strategies.

So my question to you is - would you have stayed with the strategy after the last two years of underperformance?

PS To find the best Magic Formula investment ideas in the countries you invest in (for less than an inexpensive lunch for two) click here: Sign me up right now

PPS: Why not sign up right now, while this is fresh in your mind?

Click here to find Magic Formula ideas where you invest

Frequently Asked Questions

1. What is the Magic Formula?

The Magic Formula is a strategy created by Joel Greenblatt that ranks companies based on their earnings yield and return on invested capital (ROIC). It helps identify undervalued stocks with high returns.

2. How effective is the Magic Formula?

The Magic Formula has shown strong historical returns, outperforming the market in many backtests across different regions, including Europe and the U.S.

3. Can I use the Magic Formula outside the U.S.?

Yes, studies show that the Magic Formula works in regions like Europe and Finland, with significant outperformance compared to the market.

4. What’s the best way to use the Magic Formula?

Investors have found better results by combining the Magic Formula with other factors, like momentum, which has led to even higher returns.

5. Should I always choose the highest-ranked companies?

Surprisingly, investing in companies ranked just below the top 25% by the Magic Formula can sometimes yield better returns than the top-ranked ones.

6. Does portfolio size affect the Magic Formula's performance?

Smaller portfolios, such as 30 stocks, tend to perform better than larger portfolios when using the Magic Formula, but diversification is still crucial.

7. How often should I rebalance a Magic Formula portfolio?

Rebalancing annually is recommended, as most studies and backtests follow this practice, aligning with the publication of financial statements.

8. What if the Magic Formula underperforms?

Stick with it. Even if it underperforms temporarily, long-term use of the Magic Formula has consistently delivered strong returns.

9. Can I improve the Magic Formula’s returns?

Yes, combining it with other factors, like the 6-month momentum, has shown to significantly improve returns, sometimes by over 600%.

10. Is the Magic Formula too risky?

While it can be volatile, the Magic Formula has historically offered better risk-adjusted returns than the broader market, making it a robust strategy for long-term investors.

Please note: This website is not associated with Joel Greenblatt and MagicFormulaInvesting.com in any way. Neither Mr Greenblatt nor MagicFormulaInvesting.com has endorsed this website's investment advice, strategy, or products. Investments recommendations on this website are not chosen by Mr. Greenblatt, nor are they based on Mr Greenblatt's proprietary investment model, and are not chosen by MagicFormulaInvesting.com. Magic Formula® is a registered trademark of MagicFormulaInvesting.com, which has no connection to this website.