This post explains how you can implement the Magic Formula, a strategy that identifies undervalued yet high-quality companies. You'll learn step-by-step how to use a Magic Formula screener to find these opportunities, even in markets outside the USA.

The post also shows how combining the Magic Formula with other ratios can significantly improve your returns, up to 783%. By the end, you'll have practical tools to enhance your investment strategy.

Estimated Reading Time: 6 minutes

If you found this page you most likely already know about the Magic Formula investment strategy developed by Joel Greenblatt and described in his excellent book called The Little Book that Still Beats the Market. It is also the book that got me started with quantitative investing.

In this article you can see exactly how (step for step) to implement the Magic Formula investment strategy on companies worldwide. You will also see you how you can improve its returns through a LOT of testing we have done, so keep reading.

Magic Formula Ideas in Your Home Market - Not Just The USA

This article shows you how to find Magic Formula investment ideas, not only in the USA, but in all the main markets world-wide including your home market.

First a bit of background information…

The Magic Formula Finds Quality Undervalued Companies

The Magic Formula helps you find high quality companies that are trading at an attractive price.

It does this by looking for companies with a:

- high earnings yield (companies that are undervalued) and

- high return on invested capital (ROIC) (quality companies)

It then ranks the companies on ROIC (where 1 is the company with the highest ROIC), and by earnings yield (where 1 is the company with the highest earnings yield). To get the Magic Formula rank the ROIC rank and earnings yield rankings are added together.

The best ranked company is the one with the lowest Magic Formula rank (the lower the better).

We Do All the Work for You

If this sounds like a lot of work don't worry - we do it all for you. You can get a list of the best Magic Formula companies with a few mouse clicks.

Keep reading to see exactly how.

I want to find Magic Formula ideas Now - sign me up!

How to Find Your Magic Formula investment ideas

Now for the part where you can see how to get Magic Formula investment ideas for your portfolio.

We have saved a Magic Formula screen for you

We have already saved a stock screen for you so all you have to do is load it with a few mouse clicks.

Here is how you do it:

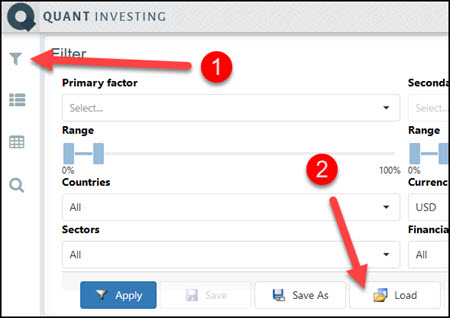

After logging into the screener click the Screener icon then click the Load button as shown below:

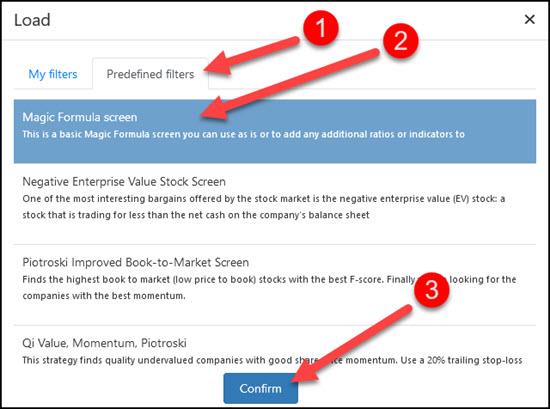

Then click on the Predefined filters tab, scroll down, and click on the Magic Formula Screen. To load the screen click the Confirm button.

Select Your Countries, Daily Value and Company Size

All you then have to do is select:

- The Countries

- The minimum Daily trading volume and

- The minimum Market value

of the companies you want to screen for.

The following countries are included in the screener: Countries included in the Quant Investing stock screener

To choose your countries click the drop down list item below Countries and check all the countries you would like to select.

Next you have to enter the minimum daily trading volume and the minimum market value of the companies you want to screen for. Please note the numbers you enter are in thousands, this means if you enter $125 it is equal to $125,000.

I’m interested in Magic Formula ideas sign me up!

That is all you have to do.

When you are done click the Apply button to get your Magic Formula investment ideas.

But the Magic Formula Can Be Improved - a LOT

As I already mentioned you can improve the returns of the Magic Formula a lot, up to 600.5% in the testing we have done.

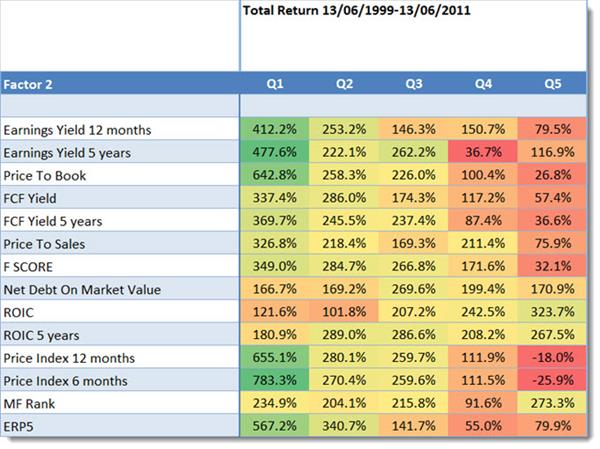

We tested the strategy with 13 other ratios and as you can see in the table below the returns of the strategy can be substantially improved.

Click image to enlarge

Magic Formula returns when combined with a third ratio in Europe from June 1999 to June 2011.

Source: Quantitative Value Investing in Europe: What works for achieving alpha

Look At Column Q1

Look at the returns in column Q1, it shows the returns generated by first selecting the 20% best Magic Formula companies combined with the ratios in the column called Factor 2.

Best combination +783% was Momentum (600.5% improvement)

This means you could have earned the highest return of 783.3% over the 12 year period if you invested in the best ranked Magic Formula companies that also had the highest 6 month price index (share price momentum).

This is a 600.5% improvement over the best return of 182.8% you could have earned if you used only the Magic Formula to get investment ideas.

Other Great Combinations

Other good combinations from the table above are:

- Magic Formula and 12m Price index (momentum) +472.3%

- Magic Formula and Price to Book +460%

- Magic Formula and ERP5 +384.4%

- Magic Formula and 5yr average Earnings Yield (EBIT/EV) +294.8%

How to Combine the Magic Formula With Other Ratios

With the stock screener it is very easy to combine the Magic Formula with other ratios or indicators.

The following screen shots will show you exactly how.

To start load the Magic Formula saved screen (see above), select the Countries, Daily Trading Volume and minimum Market Value as shown above.

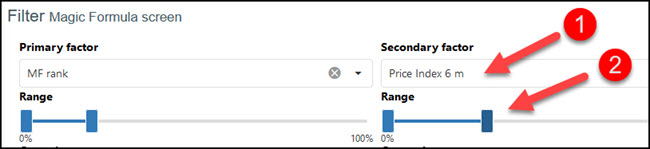

How to Add 6 Month Price Index (Momentum)

To add Price Index 6m (6 months momentum) to the screen click the drop down list below Secondary Factor and, under the heading Momentum click in the Price Index 6 m menu item.

Then move the slider below Price Index 6m so that you select the top 20% or 30% (set the slider to go from 0% to 20% or 30%) of companies with the best six month Price Index.

(In the screener Magic Formula Rank is called MF Rank)

To get a list of companies click the Apply button.

In the same way you can add:

- 12m Price index (momentum)

- Price to Book

- ERP5

- 5 year average Earnings Yield (EBIT/EV)

You can see all ratios and indicators you can combine with the Magic Formula here: Glossary of all screener ratios and indicators.

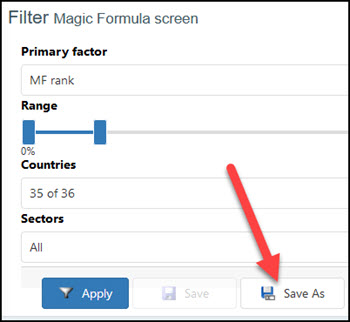

You Can Save All Your Screens

Once you have changed the basic Magic Formula screen to fit your investment style you can save it so that you can call it up at any time with a few mouse clicks.

You can save as many screens as you like.

To save your screen click the Save As button.

In the pop-up box give your screen a name and a short description so you can remember what the screen does.

To save the screen click on the Confirm button.

All This Costs Less Than a Lunch for Two

How much can a tool like this cost, you may be thinking?

To make it affordable, and give you a great return on your investment, even if your portfolio is still small we have made the price of the screener surprisingly low. It costs less than an inexpensive lunch for two each month (Click here for more price information).

Don’t hesitate, you have nothing to lose. If you are not 100% satisfied you get your money back – guaranteed!

PS: Why not sign upright now, while this is fresh in your mind?

Click here to get Magic Formula investment ideas where you invest

More Information About The Magic Formula

The following articles give you more information about the Magic Formula:

Frequently Asked Questions About Implementing the Magic Formula Investment Strategy

What is the Magic Formula investment strategy?

The Magic Formula investment strategy, developed by Joel Greenblatt, focuses on identifying quality companies trading at attractive prices. It ranks companies based on high earnings yield (undervalued companies) and high return on invested capital (ROIC) (quality companies).

The companies with the best combined ranks are considered the top Magic Formula picks.

How can I implement the Magic Formula in my portfolio?

To implement the Magic Formula, use a stock screener that allows you to filter companies based on earnings yield and ROIC. Many stock screeners, like the Quant Investing screener, have predefined filters you can load to simplify the process. Select your desired countries, minimum daily trading volume, and minimum market value to screen for suitable companies.

Can I use the Magic Formula outside the USA?

Yes, the Magic Formula can be used to find investment opportunities globally. The Quant Investing screener includes companies from major markets worldwide. Simply select the countries you want to include in your screen to find Magic Formula investment ideas in your home market or other international markets.

How do I get started with the Quant Investing screener for the Magic Formula?

After logging into the Quant Investing screener, click the Screener icon, then the Load button. Under the Predefined filters tab, select the Magic Formula Screen and confirm. Choose your countries, daily trading volume, and market value. Click Apply to get a list of Magic Formula investment ideas.

How can I improve the returns of the Magic Formula strategy?

You can enhance the Magic Formula's returns by combining it with other ratios. For instance, adding a momentum factor like the 6-month Price Index can significantly boost returns. The Quant Investing screener allows you to add secondary factors to the Magic Formula screen, improving potential returns based on historical backtests.

What are some effective combinations with the Magic Formula?

Some effective combinations include:

- Magic Formula and 6-month Price Index (momentum) for a 783.3% return over 12 years.

- Magic Formula and 12-month Price Index (momentum) for a 472.3% return.

- Magic Formula and Price to Book for a 460% return.

- Magic Formula and ERP5 for a 384.4% return.

- Magic Formula and 5-year average Earnings Yield (EBIT/EV) for a 294.8% return.

How do I save my customised Magic Formula screens?

After adjusting the basic Magic Formula screen to fit your investment style, click the Save As button on the screener. Name your screen and provide a short description to remember its purpose. Click Confirm to save the screen. You can save and load multiple screens for easy access in the future.

Please note: This website is not associated with Joel Greenblatt and MagicFormulaInvesting.com in any way. Neither Mr Greenblatt nor MagicFormulaInvesting.com has endorsed this website's investment advice, strategy, or products. Investment recommendations on this website are not chosen by Mr. Greenblatt, nor are they based on Mr Greenblatt's proprietary investment model, and are not chosen by MagicFormulaInvesting.com. Magic Formula® is a registered trademark of MagicFormulaInvesting.com, which has no connection to this website.