Estimated Reading Time: 7 minutes

in this article you will learn how to use advanced trailing stop-loss techniques to protect your investments while maximizing your returns. This post explains how to set dynamic and volatility-based stop-losses, helping you capture gains and minimize losses, even in a volatile market. By the end, you'll know how to apply these strategies effectively to enhance your portfolio's performance.

If you are looking for a way to boost your investment profits while keeping risk low, you have come to the right place. In this blog post, we will look at advanced trailing stop-loss techniques that help you lock in your profits and protect against market downturns.

Why It Is Important to Keep Losses Low

In my over 38 years of investing experience, I noticed people often lose their ability to think clearly when they face big losses. I am sure you have also experienced this.

Their careful judgment disappears.

The confidence (perhaps too much) they had when markets were going up turns to fear when headlines are scary, and they and friends are losing money.

I learned that my judgment gets cloudy and far too negative in tough times. But I have seen that if you keep your thinking and your money intact, the rare periods of market panic create special opportunities, like in 2008 when everything got cheap.

If you have the emotional strength and cash to buy during these times, you can make big games gains. That is when we started the special Market Crash portfolios for newsletter subscribers, both of which posted great returns.

This means then you avoid large losses, your capital works like a ratchet. You make money, keep it, then try to make more.

That is why it is never a good idea to compare yourself too strictly to benchmarks. Obviously, you need to make a return. The great thing if you don't chase benchmarks is you don't lose money, and whatever return is left is yours.

For Beginner and Advanced Investors

Whether you're just starting out or have been investing for years, this guide will give you practical tips and insights. We'll explore the technical aspects of trailing stop-losses and touch on the emotional side of investing.

Basics of Trailing Stop-Loss Orders

Let's first talk about what a trailing stop-loss order is.

A trailing stop-loss order is a type of order you place with your broker to sell a stock if it falls by a certain percentage from its highest price since you bought it. This means if your stock goes up, the stop-loss level moves up with it, helping you lock in profits.

You do not have to enter a trailing stop loss order with your broker.

I do not.

I track the trailing stop loss limits in my portfolio spreadsheet on a weekly basis and only enter an order weekly. This keeps my dealing costs low and stops me from trading too much.

Unlike a traditional stop-loss order, which is set at a fixed price (usually below your buy price), a trailing stop-loss adjusts as the stock price increases. This gives you the flexibility to ride the upward trend of your stocks while protecting yourself from significant losses if the price drops.

It's a good way to capture gains without constantly watching the market.

Click here to start getting STOP LOSS ALERTS on all your investments NOW! - Click here

Research and Evidence Supporting Trailing Stop-Loss Strategies

But do trailing stop losses work?

Yes, a LOT of research supports the effectiveness of trailing stop-loss strategies.

One study by Kaminski and Lo in 2008 showed that a 10% stop-loss strategy over a 54-year period resulted in higher returns and lower losses. They found that during market downturns, switching to bonds was a smart move, and this strategy worked well even during significant crashes.

Another study by Snorrason and Yusupov in 2009 tested trailing stop-losses on the OMX Stockholm 30 Index. They found that a trailing stop-loss level between 15% and 20% outperformed a buy-and-hold strategy, especially during volatile periods. This research suggests that trailing stop-losses can help you achieve better returns with less risk.

Advanced Trailing Stop-Loss Techniques

Now, let's get into some advanced techniques.

Dynamic Trailing Stop Loss Levels

Dynamic trailing stops adjust the stop-loss level based on market volatility.

This means your stop-loss level will be more flexible, tightening when the market is unstable and loosening when the market is calm.

For example, imagine you own shares of a tech company that have recently surged from $50 to $70. Using a dynamic trailing stop, you set it to adjust based on the stock's volatility. When the market is calm, your stop-loss might be set at 20%, meaning if the stock drops to $56, it triggers a sell.

However, if the market becomes more volatile and the stock price fluctuates more widely, the trailing stop might tighten to 15%. This means your new stop-loss level would be $59.50, offering more protection during unstable periods.

By using dynamic trailing stops, you can better manage the ups and downs of the market, ensuring you lock in more of your profits when the market is volatile while still giving your investment room to grow when conditions are stable.

Volatility-Based Stop Loss Levels

Another technique is using volatility-based stops.

These stops are set using the stock's volatility, which helps you avoid being stopped out during normal price fluctuations.

For example, you can use the Average True Range (ATR) to set your stop-loss level. This way, your stop-loss adjusts according to how much the stock price typically moves.

Imagine you own shares of a retail company. The ATR, which measures the stock's average price movement over a specific period, is currently $2. If you set your stop-loss at 2 x ATR, it means your stop-loss level will be $4 below the highest price the stock reaches.

If the stock price climbs to $50, your stop-loss will be set at $46. If the price then rises to $55, your stop-loss will move up to $51.

This method ensures that your stop-loss level adjusts to the stock's typical movement, helping you stay invested through normal price fluctuations while still protecting your downside.

By using the ATR to set your stop-loss, you can more effectively manage your trades, keeping your investments safe from being prematurely stopped out during regular market movements.

Click here to start getting STOP LOSS ALERTS on all your investments NOW! - Click here

Implementing Trailing Stop-Loss Strategies in Your Portfolio

Choosing the right percentage for your trailing stop-loss is crucial.

Most research suggests that a range between 15% and 20% is ideal. This range allows for normal market fluctuations while protecting you from significant losses.

Think about your investment goals and risk tolerance when setting this percentage.

How To Set Up a Trailing Stop Loss Order with Your Broker

Setting up trailing stop-loss orders with your broker is easy.

Log into your brokerage account and select the stock you want to protect. Choose the trailing stop-loss option and enter your desired percentage. Review and confirm your order.

Make sure to adjust your stop-loss levels regularly based on market conditions and your investment strategy.

How To Track a Trailing Stop-Loss in Your Portfolio Spreadsheet

If you want to track your trailing stop-loss orders using a spreadsheet, here’s an effortless way to do it. It is the system I use for my portfolio.

Every Monday, update your stock prices in the spreadsheet. Adjust the highest value the stock has reached so far. Then, calculate a percentage drop from this highest value. If this drop is more than 20%, enter a sell order with your broker.

I prefer using a spreadsheet to track my trailing stop-losses because it lets me to avoid big market fluctuations that might trigger a stop-loss unnecessarily.

By checking and updating weekly, I can see if the stock recovers, which often happens, and avoid selling prematurely. This way, you can control your investments without having to react to every minor dip.

Psychological Aspects of Using Trailing Stop-Loss Strategies

Using trailing stop-losses can be emotionally challenging. It's hard to watch a stock fall and not intervene. But sticking to your plan is crucial.

When your stop-loss level is hit, sell the stock without hesitation.

This discipline can help you avoid emotional decisions that might harm your portfolio. The most common is holding onto a loss-making position with the hope that it will recover and let you sell without a loss.

But hope is not a strategy!

Consistency is important. Sticking to your trailing stop-loss strategies can improve your investment performance over time.

Remember, the goal is to protect your profits and minimize losses. Stay committed to your strategy, and you will see positive results in the long run.

Click here to start getting STOP LOSS ALERTS on all your investments NOW! - Click here

Integrating Trailing Stop-Loss Strategies with Different Investment Styles

Trailing stop-losses aren't just for traders.

How Value Investors Can Use Trailing Stop Losses

Value investors can use trailing stops to protect gains without compromising their strategy.

By setting a reasonable stop-loss percentage, you can ride out short-term market fluctuations while safeguarding your investments.

It can also help you avoid value traps, where a cheap stock continues to fall and gets cheaper all the time. Yes, buying more at a lower price may be a great deal BUT it may also blow a big hole in your portfolio as this investment did to mine.

How Growth Investors Can Use Trailing Stop Losses

Growth investors, who often invest in high-volatility stocks, can benefit greatly from trailing stops. These stops allow you to lock in gains from rapid price increases and protect against sudden drops.

How To Get Trailing Stop Loss Triggers by Email

Setting up email alerts for your trailing stop-loss triggers on all your investments makes them a lot easier to track.

You can easily do this using our stock screener's alert function.

How To Set Up Your Trailing Stop Loss Trigger

First, navigate to the alert dashboard by clicking on the 'My Alerts' icon, which looks like a bell, on the left side of the screener.

Here, you can see your active alerts and those that have been triggered recently.

To create a new alert:

- Search for the company you’re interested in by clicking the magnifying glass icon, typing the company name, and selecting it.

- Once you’re on the company’s dashboard,

- Click 'Add alert' at the top right corner.

You can set alerts for various metrics, including price changes and specific ratios.

For trailing stop-loss alerts, select either 'Trailing stop (top)' or 'Trailing stop (bottom)'.

For example, with 'Trailing stop (top)', the alert triggers if the stock price falls more than a set percentage from its highest value. If you set it at 20%, and the stock reaches $50, the alert will trigger if the price drops below $40. If the price then rises to $60, the stop-loss adjusts to $48.

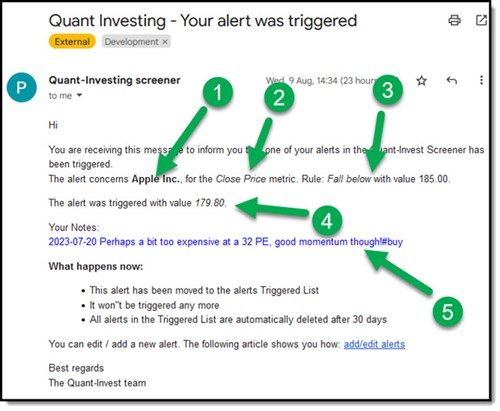

When an alert is triggered, you’ll receive an email notification with details about the company, the indicator or ratio that triggered the alert, and the current value.

You can also add notes to your alerts to remind yourself why you set them and what action to take.

This feature ensures you never miss critical changes in your portfolio, helping you make fast decisions without having to watch the market constantly.

The email tells you:

- What company

- Which indicator or ratio triggered the alert and

- The alert value you entered

- The current value that triggered the alert

- Your notes for the company.

Click here to start getting STOP LOSS ALERTS on all your investments NOW! - Click here

You can read more about the screener’s alert function here:

- How to effectively use the screener’s company alert function

- Trailing Stop (top)

- Trailing Stop (bottom)

Will a Trailing Stop-Loss Strategy Always Work?

Will a trailing stop-loss strategy always work?

No, it won't, and here's why.

Markets can be unpredictable and sometimes stocks experience temporary dips before rebounding. This can cause your stop-loss to trigger, selling your stock at a loss just before it climbs back up. Additionally, sharp, rapid declines can sometimes trigger a stop-loss before you have a chance to react.

Despite these downsides, trailing stop-losses are still a great idea because they help you systematically manage risk and protect profits. By using trailing stops, you have a predefined exit strategy that takes the emotion out of selling decisions, helping you stick to your plan and safeguard your investments from significant downturns.

Conclusion On Using Trailing Stop Losses

In summary, trailing stop-loss strategies help you maximize your profits and minimize risks. By using advanced techniques, you can do this even more focused.

Remember to choose the right percentage, stay disciplined, and adjust your strategy as needed.

Now it's time to act!

Start implementing these trailing stop-loss strategies in your portfolio and see how they can improve your investment returns.

Click here to start getting STOP LOSS ALERTS on all your investments NOW! - Click here

Trailing Stop Loss Frequently Asked Questions (FAQ)

What is a trailing stop-loss order, and how does it differ from a traditional stop-loss order?

A trailing stop-loss order is a type of order placed with your broker to sell a stock if it falls by a certain percentage from its highest price since you bought it.

Unlike a traditional stop-loss order, which is set at a fixed price below your buy price, a trailing stop-loss adjusts as the stock price increases. This allows you to lock in profits as the stock price rises while protecting yourself from significant losses if the price drops.

How can trailing stop-losses help in managing investment risk?

Trailing stop-losses help manage investment risk by automatically adjusting your stop-loss level as the stock price increases. This ensures that you capture gains during upward trends while limiting losses during downturns.

It allows you to stay invested without constantly monitoring the market, reducing the emotional stress of making selling decisions based on market fluctuations.

What is the ideal percentage range to set for a trailing stop-loss?

Most research suggests that setting a trailing stop-loss percentage between 15% and 20% is ideal. This range allows for normal market fluctuations while protecting you from significant losses.

The exact percentage should be based on your investment goals and risk tolerance. It's important to adjust this percentage according to market conditions and individual stock volatility.

How do dynamic trailing stops work, and why should I consider using them?

Dynamic trailing stops adjust the stop-loss level based on market volatility. This means the stop-loss level tightens when the market is unstable and loosens when the market is calm.

For example, if a stock price is highly volatile, the trailing stop may tighten to protect more of your gains.

Using dynamic trailing stops helps manage the ups and downs of the market more effectively, ensuring you lock in more profits during volatile periods while allowing for growth during stable periods.

Can you explain volatility-based stop-loss levels and how to set them?

Volatility-based stop-loss levels are set using a stock's volatility, often measured by the Average True Range (ATR). For instance, if the ATR of a stock is $2, setting your stop-loss at 2 x ATR means your stop-loss level will be $4 below the highest price the stock reaches.

This ensures that your stop-loss level adjusts according to the stock's typical price movements, helping you stay invested through normal fluctuations while protecting against larger drops.

How can I track trailing stop-losses without placing an order with my broker?

You can track trailing stop-losses using a spreadsheet.

Update your stock prices weekly, adjusting the highest value the stock has reached so far. Calculate the percentage drop from this highest value, and if it exceeds your stop-loss percentage, you can manually place a sell order with your broker.

This method helps you avoid unnecessary trading costs and prevents premature selling due to minor market fluctuations.

Are there any downsides to using trailing stop-loss strategies?

While trailing stop-loss strategies are effective, they are not foolproof. Markets can be unpredictable, and temporary dips might trigger a stop-loss, causing you to sell at a loss just before a stock rebounds.

Additionally, rapid declines can trigger stop-losses before you have a chance to react.

Despite these downsides, trailing stop-losses give you a systematic way to manage risk and protect profits, helping you stick to a predefined exit strategy and avoid emotional selling decisions.

What is a trailing stop-loss, and how does it protect my investments?

A trailing stop-loss is a tool that sells a stock if it drops a certain percentage from its peak. It locks in profits as your stock rises while reducing losses if it falls.

How do I decide the right percentage for my trailing stop-loss?

Testing suggest 15-20%. Choose based on your risk tolerance and investment goals, allowing room for normal market fluctuations.

Can a trailing stop-loss strategy help me during volatile markets?

Yes, dynamic trailing stops adjust according to market volatility, tightening in turbulent times to protect gains while loosening during calm periods for growth.

Is it better to set a trailing stop-loss directly with my broker or track it manually?

Tracking manually using a spreadsheet, updated weekly, helps avoid unnecessary trading and prevents selling during minor market dips.

How does using the Average True Range (ATR) help set a stop-loss?

ATR helps set stop-loss levels based on a stock’s typical price movement, avoiding stops triggered by normal fluctuations.

Are there any risks to using trailing stop-losses?

Trailing stops can trigger sales during temporary dips, potentially causing you to miss rebounds. They’re not foolproof but help manage risks systematically.

Can trailing stop-losses fit my value investing strategy?

Yes, they help protect gains without compromising your strategy, especially by avoiding value traps where a stock keeps dropping.

What emotional challenges might I face using trailing stop-losses?

Watching a stock drop and sticking to your plan can be tough, but it’s crucial to avoid emotional decisions that could harm your portfolio.

How can I ensure my trailing stop-loss strategy works long-term?

Consistency is key. Stick to your chosen percentage and regularly adjust your strategy based on market conditions.

Will using trailing stop-losses guarantee better returns?

While they’re not guaranteed to always work, trailing stops help create a disciplined exit strategy that can improve long-term returns by protecting profits.

Click here to start getting STOP LOSS ALERTS on all your investments NOW! - Click here