You know we recommend that you never use a single ratio to get investment ideas.

That is also the reason we designed the screener with four sliders. This allows you to combine up to four ratios and indicators to get investment ideas. You are of course not limited to only using four ratios. You can also use the filter function in every column as well as export your results to Excel for further analysis.

This advice was confirmed by the great article Price-to-Book Value Ratios: A Long-Term Winner with Long Periods of Underperformance (by James O'Shaughnessy author of What Works on Wall Street).

You know buying low price to book ratio companies work

I am sure you have also read countless books and research papers showing how low price to book ratio (undervalued) companies outperform high price to book (expensive) companies over long periods of time.

But it underperformed

However when James O'Shaughnessy looked at the returns from a price to book investment strategy in the USA for the 36 year period from 1927 to 1963 the 10% of companies with the lowest price-to-book value ratios was the worst performing of all the deciles (10% groups) he tested.

What was surprising was that the second decile (10% to 20%), three (20% to 30%), four (30% to 40%) and five (40% to 50%) of all companies ranked by price to book ratio, all outperformed the market.

This means that companies with a low price-to-book value did well, but not those with the lowest price to book ratio.

In summary what you can learn

In the article James O'Shaughnessy gives three lessons you can learn from the unexpected underperformance of the lowest price to book companies:

- Be very careful of back test studies that cover only a short or a very long period of time.

- It is not always the lowest rankings of a ratio that gives you the best returns.

- The underperformance shows the danger of relying on a single ratio in indicators when selecting investment ideas. To correct for this take a look at the Value Composite One indicator that James created and tested or how you can combine the price to book ratio with the Piotroski F-Score to select better quality companies.

Even though I did my best to give you a good summary of James’ article I strongly suggest that you read the complete article by clicking on the following link Price-to-Book Value Ratios: A Long-Term Winner with Long Periods of Underperformance

More research on low price to book companies

James published another interesting article on the price to book ratio called The Very Cheapest Stocks (Price/Book) Do Very Badly.

In the article he tested the returns you could have achieved if you used a strategy of only buying very cheap (undervalued) price to book companies.

What he found was astounding…

Concentration is bad for you

If you buy only a few low price to book value companies you may as well buy an index fund as you are not going to outperform the market. If you are going to buy low price to book companies you have to buy a basket of at least 25 companies, and buying 100 companies is even better.

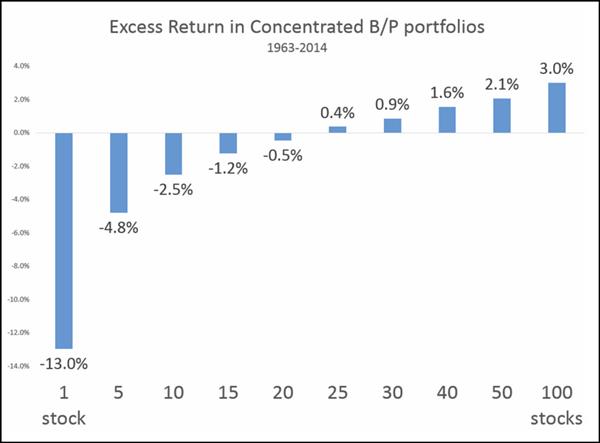

The following chart shows you how various portfolios of low price to book companies performed against the market.

Source: The Very Cheapest Stocks (Price/Book) Do Very Badly

Really bad underperformance

As you can see if you owned a small number of low price to book companies you would not have done well at all.

For example if you owned only five of the lowest price to book companies your returns would have, on average, been nearly 5% worse than the market per year for the whole 51 year test period.

That is really, really bad, and something you want to avoid at all costs.

How can you avoid this?

Luckily it’s easy for you to avoid underperforming the market so badly.

Take a look at the Value Composite One indicator that James created and tested or how you can combine the price to book ratio with the Piotroski F-Score to select better quality companies.

PS Everything you need to implement the Piotroski F-Score or Value Composite One in your portfolio can be found here.

PPS Why not sign up now while it is still fresh in your mind. You can cancel at any time for a FULL refund if you are not happy. Sign up here.