Do you want to increase your Magic Formula investing returns — without added risk? This article shows you how to combine Magic Formula with momentum investing, specifically targeting stocks with strong recent price increases. Testing we did shows this strategy could improve returns by up to 600% over 12 years!

You'll learn simple, step-by-step instructions to screen, select, and manage a Magic Formula + Momentum portfolio. Plus, you'll get tips for both beginners and experienced investors to make the most of this powerful combination.

Estimated Reading Time: 8 minutes

Have you ever wished there was a way to increase your Magic Formula investment returns dramatically, without taking on extra risk? There is!

By combining your Magic Formula investment ideas with a simple momentum indicator, like companies with the biggest price increase over 6 months. In testing we have done you could see your returns increase by as much as 600%.

W show you exactly how you can combine these two strategies. It is simpler and easier than it sounds, and the potential rewards are worth it.

First a bit of background information.

Click here to start finding your own Magic Formula ideas NOW!

What Is the Magic Formula?

The Magic Formula is an investment strategy developed by Joel Greenblatt. It's a simple method to help you find high quality companies at an attractive price.

The formula focuses on two ratios:

- Return on Invested Capital (ROIC): This measures how good a company is at making money with the money it has.

- Earnings Yield: This shows how cheap the stock is relative to its earnings.

By ranking companies based on these two numbers, the Magic Formula helps you find companies that are both high-quality and undervalued.

What Is Momentum Investing?

Momentum investing is also a simple idea. It’s all about finding stocks that have been going up in price and are likely to keep going up.

The momentum ratio we will use is Price Index 6 months, which tells you how much a stock has increased over the past six months. When a stock has strong momentum, it means it has going up the most.

Why Combine Them?

The Magic Formula finds undervalued companies that are great businesses. Momentum finds stocks that are rising in price. By combining the two, you’re picking companies that are not only great but also have the market's attention.

Our testing has shown this combination can give much higher returns.

Back tested Success: Magic Formula + Momentum

The Power of Historical Evidence

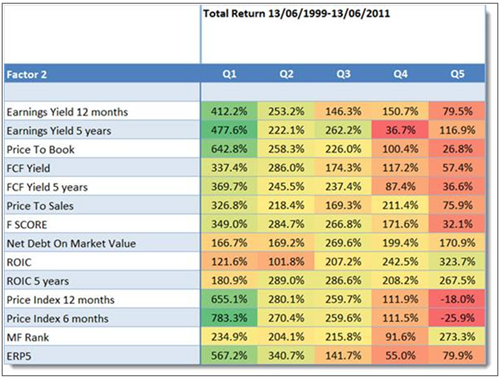

When we tested the Magic Formula in Europe, adding the Price Index 6 months (momentum) gave amazing results. The returns increased by 600% over 12 years, compared to using just the Magic Formula alone.

That’s right—by combining these two simple strategies, you could boost your returns dramatically.

Here’s a comparison:

- Magic Formula alone: 183% return.

- Magic Formula + Momentum: 783% return.

Here is the table that shows you the returns of the Magic Formula with 13 other ratios. As you can see the returns of the strategy can be improved a LOT!

Look at the returns in column Q1, it shows the returns generated by first selecting the 20% best Magic Formula investing companies and then selecting only those companies that were best rated with the ratios in the column called Factor 2.

Magic Formula returns when combined with a third ratio in Europe from June 1999 to June 2011.

Source: Quantitative Value Investing in Europe: What works for achieving alpha

This wasn’t just a lucky outcome. When tested over a long period, this combination continued to outperform. Even when markets were difficult, this strategy still found strong, growing companies.

Click here to start finding your own Magic Formula ideas NOW!

Why Momentum Amplifies Returns

Momentum works because of human psychology. Investors see a stock going up, and they don’t want to miss out, so they buy it. This pushes the price even higher.

Adding momentum to the Magic Formula helps you capture this trend in companies that are already fundamentally strong. The result? You get an increasing stock price, quality and value in one powerful strategy.

Practical Steps to Implementing Magic Formula + Momentum

Now that you know how powerful this combination is, let’s look at how you can put it to work in your own portfolio. Don’t worry, it is easier than you think!

Step 1: Screen for Magic Formula Stocks

To start, you need to find companies that fit the Magic Formula. The best way to do this is by using a stock screener.

You can find screeners online that let you filter for both ROIC and Earnings Yield. If you want a recommendation, try the Quant Investing stock screener, which lets you quickly rank companies based on these metrics. It already has the Magic Formula screen saved for you can use with a few mouse clicks.

Step 2: Add a Momentum Filter

Next, you’ll want to add a momentum filter—specifically, the Price Index 6 months. This is the indicator that tells you which stocks have been on a strong upward trend. In the stock screener, you can set it to show the top 20-30% of companies with the best momentum over the last six months.

Here’s how it works:

- First, screen for Magic Formula stocks.

- Then, apply the momentum filter to only keep stocks with strong price momentum.

Step 3: Constructing Your Portfolio

Now you have your list of top-ranked Magic Formula + Momentum stocks. From here, aim to build a portfolio of at least 20-30 companies. It’s important to spread your investments across several stocks to reduce risk.

Make sure each stock takes up an equal part of your portfolio—this way, no single stock will hurt you much if it drops in value.

Step 4: Stay Disciplined

The hardest part of investing is often sticking to your plan, especially when the market gets volatile. Even the best strategies can have bad months (or years!). But if you trust the data and stay disciplined, you’ll be rewarded over the long term.

Each year, or as often as you want (we recommend not more often as every 6 months), you’ll need to rebalance your portfolio. That means selling stocks that no longer meet the Magic Formula or momentum criteria and buying new ones that do.

By sticking to this process, you ensure you’re always holding the best possible stocks.

Step 5: Add A Strategy to Keep Your Losses Low

To help you stick to the strategy over the long term we recommend that you follow a selling strategy to keep your losses low.

The best one we have come across is a trailing stop loss strategy where you automatically sell a stock if it has fallen 15% or 20% from its all time high since you have bought it.

As your losses are limited you will feel more comfortable investing and as it will keep your emotional stress low you will find it a lot easier to stick to the strategy over the long term.

Case Study of a Successful Magic Formula + Momentum Portfolio

Let’s look at an example to see how this works in real life.

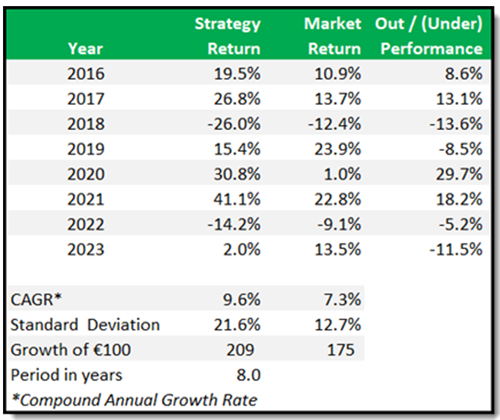

Real-World Example: Portfolio Performance Over 8 Years

Imagine you had invested in a portfolio using the Magic Formula + Momentum strategy in 2016. Over the next eight years, this portfolio could have outperformed the general market by a large margin, despite some tough years in the market.

Here are the results:

Source: Quant Investing Historical Stock Screener (back test function)

Tips for Both Novice and Experienced Investors

For Novice Investors: Keep It Simple, Start Small

If you’re new to investing, don’t feel overwhelmed. You don’t need a lot of experience to make this strategy work. Start small, with a portfolio of 10-15 stocks (not less than that), and get comfortable using the Magic Formula and momentum screeners.

Remember patience is key. Don’t expect results overnight. Investing is a long-term game.

For Experienced Investors: Customizing the Strategy

For those of you with more experience, there’s plenty of room to tweak this strategy for even better results. For example, you might adjust the time frame on the momentum filter to 12 months instead of 6 months. You could also add more filters, like Free Cash Flow or Debt-to-Equity, to further refine your stock picks.

By customizing the strategy, you can find the perfect mix that fits your risk tolerance and goals.

Conclusion

Combining the Magic Formula with momentum is one of the best ways to increase your returns without taking on extra risk. It’s a strategy that’s proven to work across different markets and time periods. By following the steps we have laid out, you can easily start implementing this strategy in your own portfolio today.

Remember: success in investing isn’t about finding the latest “hot” stock. It’s about sticking to a strategy that works, even when the market gets tough. Try this combination of Magic Formula and momentum, and you’ll be on the path to long-term success.

Click here to start finding your own Magic Formula ideas NOW!

Frequently Asked Questions

1. How does the Magic Formula work, and why is it effective?

The Magic Formula focuses on two key ratios: Return on Invested Capital (ROIC) and Earnings Yield. ROIC shows how good a company is at using its money to make profits, while Earnings Yield helps find stocks that are attractively priced. By using these ratios, you can spot quality, undervalued companies with high growth potential. This approach has shown long-term success in finding great investment opportunities.

2. Why add a momentum filter to the Magic Formula?

Adding a momentum filter—looking for stocks with strong price increases over the past six months—helps you pick stocks that are already gaining attention in the market. Stocks with momentum often keep rising because investors don’t want to miss out, which drives prices higher. This combination of value and momentum increases potential returns significantly, as shown by historical testing.

3. What kind of returns can I expect with this strategy?

Backtests showed that combining the Magic Formula with momentum increased returns by up to 600% over 12 years compared to the Magic Formula alone. For example, using the Magic Formula alone gave a 183% return, while adding momentum led to a 783% return. While results vary, this combination has proven successful in both up and down markets.

4. How do I start building a Magic Formula + Momentum portfolio?

Begin by screening for Magic Formula stocks using a screener that ranks companies by ROIC and Earnings Yield. Once you have your list, apply a momentum filter to find the top 20-30% of stocks with the strongest price gains over the past six months. Aim for a portfolio of 20-30 stocks, spreading investments evenly to manage risk.

5. What’s a good way to control losses in this strategy?

Consider using a trailing stop loss of 15-20% to sell stocks that drop significantly from their peak. This helps limit losses and reduces emotional stress, making it easier to stick with the strategy over the long term. Selling when stocks fall below this threshold keeps your portfolio healthy by removing underperforming stocks.

6. How often should I rebalance my portfolio?

Rebalance at least once a year, or every six months if you prefer. Rebalancing means selling stocks that no longer meet the Magic Formula or momentum criteria and replacing them with new ones that do. This keeps your portfolio aligned with the strategy, ensuring you’re always holding the best stocks based on your criteria.

7. Can I adjust this strategy to fit my investing style?

Absolutely! Experienced investors can customize this approach by changing the timeframe for momentum (e.g., using 12 months instead of 6 months) or adding extra filters like Free Cash Flow or Debt-to-Equity. Adjusting the strategy lets you tailor it to your risk tolerance and investment goals, making it a versatile tool for different market conditions.

Click here to start finding your own Magic Formula ideas NOW!

Please note: This website is not associated with Joel Greenblatt and MagicFormulaInvesting.com in any way. Neither Mr Greenblatt nor MagicFormulaInvesting.com has endorsed this website's investment advice, strategy, or products. Investment recommendations on this website are not chosen by Mr. Greenblatt, nor are they based on Mr Greenblatt's proprietary investment model, and are not chosen by MagicFormulaInvesting.com. Magic Formula® is a registered trademark of MagicFormulaInvesting.com, which has no connection to this website.