Imagine you could consistently pick stocks that move in your favour, leading to regular, profitable trades. The dream of every swing trader, right?

Well, we are here to help you make that dream a reality.

In this article, we’ll explore how you can build a robust swing trading investment universe. Whether you’re just starting out or you’ve been trading for years, you’ll find practical insights and actionable advice.

We’ll focus on four key areas: liquidity, volatility, momentum, and fundamentals, the building blocks of a strong swing trading strategy.

Understanding Swing Trading

As you know swing trading is all about taking advantage of short-term price movements in the stock market. Unlike day trading, which involves buying and selling within a single day, swing trading allows you to hold stocks for several days or even weeks.

This strategy gives you more flexibility and can reduce the pressure of having to make quick decisions. As you know the key to successful swing trading lies in selecting the right stocks.

This means focusing on

- Liquidity,

- Volatility,

- Momentum, and

This article will help you find stocks more likely to move in predictable patterns, making it easier for you to profit from price swings.

Start Building Your Swing Trading Investment Universe Now!

Liquidity

Liquidity As Daily Traded Value

Liquidity is crucial for swing trading. It refers to how easily you can buy or sell a stock without affecting its price. High liquidity lets you enter and exit trades quickly and smoothly.

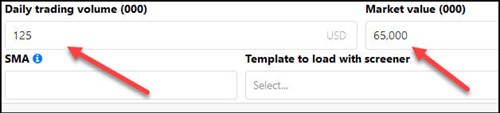

To find liquid stocks, use the Daily Trading Volume (USD) (calculated as the total number of shares traded in a day multiplied by the stock's price) to set the minimum liquidity you need.

You can use your position site 110 or 1000 times.

This is how you do it:

You can use Traded Value USD as an output column to see the value and filter the results using the column heading.

Liquidity Using Company Size

You can also use the Market Value (MV) Size (calculated as the total market capitalization of a company in USD).

Market value does not automatically give you stocks with a lot of liquidity, but it can help. For example, you can select a minimum market value of $1 billion.

Volatility

Volatility measures how much a stock's price fluctuates. For swing trading, you want stocks that have some volatility but not too much. Excessive volatility can lead to unpredictable price swings, making it harder to plan your trades.

You can of course set your own volatility preference.

Use indicators like Volatility 12m, Volatility 6m, Volatility 3m, Volatility 36m (calculated as the standard deviation of the stock's returns over the specified periods).

This is how you can select stocks that are not very volatile:

Momentum

As you know momentum is all about trends. Stocks with strong momentum are moving consistently in one direction, either up or down. For swing trading, you want to catch these trends early and ride them to profits.

Price movement over a period

To help you find stocks with the trend you are looking for the screener has Price Index indicators you can use from 1 month to 60 months. (calculated as the current price divided by the price at the start of the period).

It also has a Price index of 12-1 month to help you avoid stocks with a large movement in the past month that may reverse.

Adjusted slope – Smoothed Momentum

You may also want to look at two other momentum indicators we have Adjusted Slope 125/250d and Adjusted Slope 90d (calculated as the slope of the regression line adjusted for volatility over the specified days).

These help you find stocks with a smooth up or downwards moving price.

Composite Momentum Indicator

The Momentum Composite indicator combines several momentum indicators into one easy to use indicator.

It is calculated as follows:

Firstly, all stocks in the screener are ranked against the universe using the following four indicators:

- Price Index 3m, (Three-month price momentum) - Higher is better

- Price Index 6m, (Six-month price momentum) - Higher is better

- Price Index 9m (Nine-month price momentum) - Higher is better

- Volatility 12m (Twelve-month price volatility) - Lower is better

Secondly, the four rankings are combined into a single number for each company.

You can read more about the Momentum Composite indicator here: Meet the Momentum Composite Indicator! Your key to finding high momentum low volatility stocks

Start Building Your Swing Trading Investment Universe Now!

Fundamentals

Fundamental is a personal thing. Some swing traders use them others only look at price patterns.

I am giving a few examples here in case you want to include fundamentals in your investment universe.

Strong fundamentals mean the company is well-managed and financially healthy, making it a safer bet.

Here are a few ratios you can consider:

Quant Value Composite a composite score (the lower the better) based on various value metrics:

- Price to Sales: The lower, the better,

- Price to Earnings (PE): The lower, the better,

- EBITDA Yield or EBITDA to EV: The higher, the better,

- FCF Yield (FCF to EV): The higher, the better,

- Shareholder Yield: The higher, the better.

Value Composite Two score (the lower the better) is like the Quant Value Composite but with different valuation metrics:

- Price to book value

- Price to sales

- Earnings before interest, taxes, depreciation and amortization (EBITDA) to Enterprise value (EV)

- Price to cash flow

- Price to earnings

- Shareholder Yield (Dividend yield + Percentage of Shares Repurchased)

Putting It All Together

Now, let’s combine these criteria to build your swing trading universe.

- Start by using a stock screener to filter stocks based on liquidity, volatility, momentum, and fundamentals.

- This will narrow down the universe to your best candidates.

- Then select the output columns you want to see.

Once you have your list, you can look at each stock more closely. If you prefer to do this in Excel, the output of the screener can easily be exported to Excel or in CSV format.

You can use this list of stocks to import into your swing trading charting software to better find the right chart set-up for your swing trading strategy.

Psychological Aspects of Swing Trading

As a swing trader, you know this already, but it is always worth mentioning again.

Swing trading isn’t just about picking the right stocks. It’s also about managing your emotions. The market can be unpredictable, and staying disciplined is key to success. Create a trading plan that outlines your entry and exit points and stick to it.

Remember, it’s okay to make mistakes. Every trader does. The important thing is to learn from them and adjust your strategy.

Keep a trading journal to track your trades and review them regularly. This will help you identify patterns in your trading and improve your decision-making process over time.

Conclusion

Let’s recap the key points:

- Focus on liquidity, volatility, momentum, and fundamentals when building your swing trading universe.

- Use tools like the Quant Investing Stock Screener to help you find the best stocks.

- Don’t forget to manage your emotions and stick to your trading plan.

Now it’s time to act. Start by setting up your first screen using the criteria we’ve discussed.

Experiment with different indicators and see what works best for you.

Remember, the goal is to the right universe for your swing trading strategy.

Additional Resources

For more detailed information on each indicator and to access helpful tools, check out the following links: