This is the editorial of our monthly Shareholder Yield Letter published on 2024-07-09. Sign up here to get it in your inbox on the second Tuesday of every month.

More information about the newsletter can be found here: The best large cap investment strategy ever

This month you can read how the newsletter’s ideas have performed since the newsletter was started in May 2023.

But first the portfolio changes.

Portfolio Changes

Buy Four – Hold Three

Four new recommendations this month as the MSCI World index is above its 200-day simple moving average.

The first is a $51 billion US-based insurance company with a shareholder yield of 8.0%. Over the past year, it has bought back 6.0% of its shares and paid a dividend of 1.9%.

The second is a $50 billion global building materials company with a shareholder yield of 11.3% from share buybacks of 7.9% and a dividend of 3.3%.

The third is a well-known $35 billion US-based branded consumer foods company with a shareholder yield of 7.5%. Over the past 12 months, it has bought back 3.7% of its shares and paid a dividend of 3.8%.

The fourth and last recommendation is a JPY 9.6 trillion ($57 billion) Japanese telecommunications company with a shareholder yield of 6.6%. It made share buybacks of 3.4% and paid a dividend of 3.2%.

Hold Three

Continue to hold BP PLC +11.4%, Hays PLC +1.4% and Imperial Oil Limited +46.4% (all recommended July 2023) as they still meet the newsletter’s selection criteria.

Newsletter’s Performance

As you know I sent you the first issue of the newsletter in May 2023, so the newsletter is new, but I still wanted to give you an idea of how all the recommendations performed up till the end of June 2024.

Current ideas

Let’s start with the performance of the ideas in the portfolio at the end of June 2024.

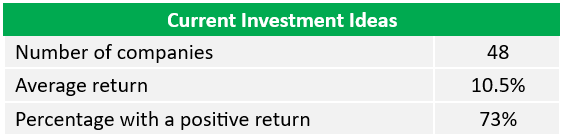

Performance of ideas in the portfolio as of 30 June 2024

As you can see the ideas in the portfolio performed solidly up +10.5%.

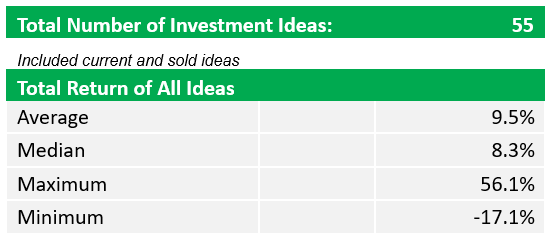

Here is the performance of all the ideas recommended since the first newsletter was published on 16 May 2023.

Performance Since May 2023 – Just Over 1 Year Ago

- Returns are calculated as price change plus dividends in the currency of the company's main listing.

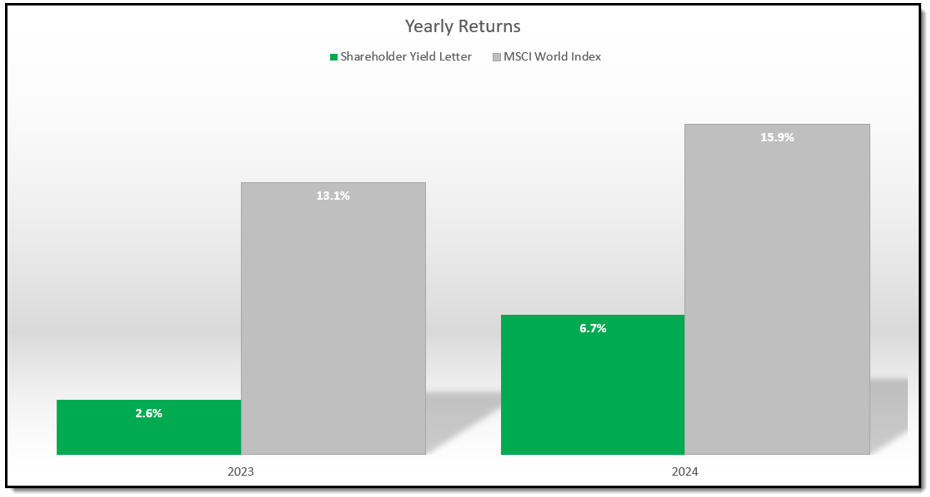

Yearly Returns

The following table shows you the average yearly returns (price increase and dividends) of all ideas in the portfolio in that specific year.

As you know the newsletter only started recommending four ideas per month in May 2023, so it missed all returns before that date.

Also, its focus is on high shareholder yield companies, that return cash to shareholders through dividends and buybacks. This means it deliberately avoided hot AI (that needs continued investment) and overvalued tech stocks.

As these stocks significantly drove the market upwards, the newsletter's missed these gains.

Go Back to The Base Rate

This conservative approach, which gives you cash now might lag the market now, but the story is not over by a long shot yet.

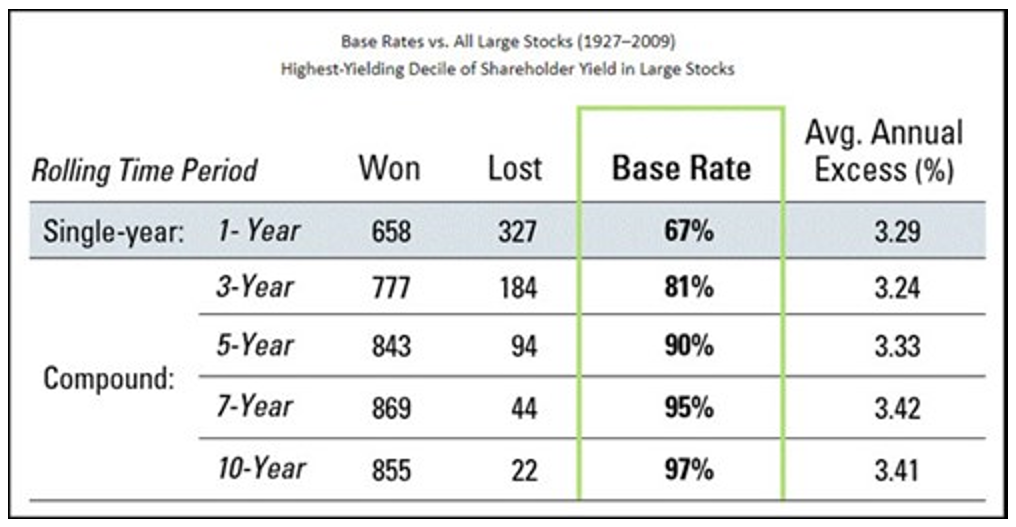

To get the best idea of how a strategy will perform over the long term you have to look at the base rate as Jim O'Shaughnessy mentioned in the great article 7 Traits for Investing Greatness where he summarised an 80 year (1927–2009) back test of the shareholder yield investment strategy.

In the article, Jim wrote:

“In the stock market, I believe the surest way forward is to look at the long-term results for an investment strategy and how often — and by what magnitude — it beat its underlying benchmark.”

The following table shows you the results of simply buying the 10% of large stocks with the highest Shareholder Yield (dividend yield plus net stock buybacks) over an 80-year backtest period:

Source: 7 Traits for Investing Greatness

Overall 961 (777+184) rolling 3-year periods, the top 10% Shareholder Yield companies beat other large stocks 81% of the time by an average of 3.24% per year.

If you extend the test to all 877 (855+22) rolling 10-year periods, you would have beaten the market 97% of the time by 3.41% per year.

That is an outstanding result!

So, we must be patient for these results to be reflected in the newsletter’s returns.

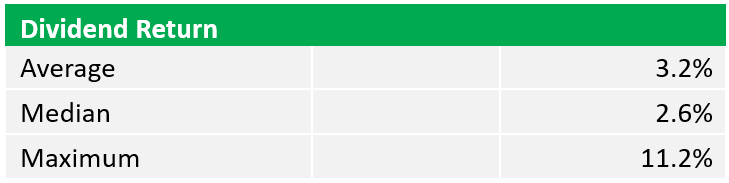

Dividend income

As the main criteria of the newsletter is Shareholder Yield (Dividend Yield + Stock Buyback Yield) we do not specifically look for companies with a high dividend.

But as the back tests have shown these companies on average also pay attractive dividends.

This is the dividend return of the newsletter:

Average dividend return of all ideas

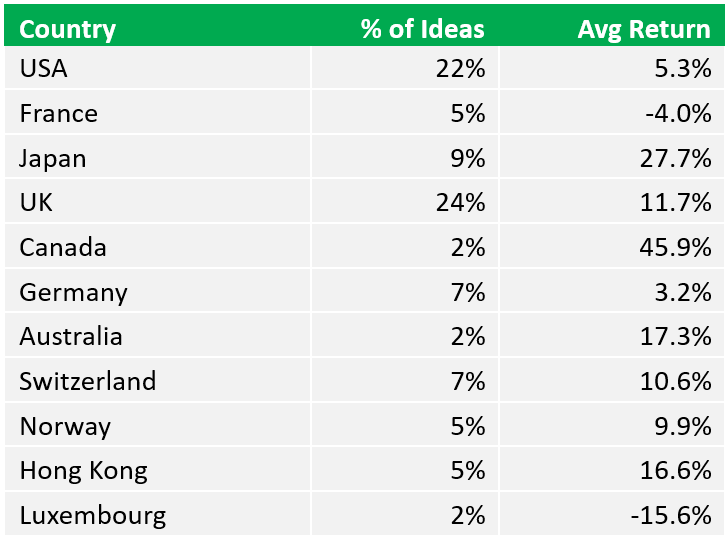

Country performance

This is where companies were recommended and how they performed:

Where ideas were recommended and the average return

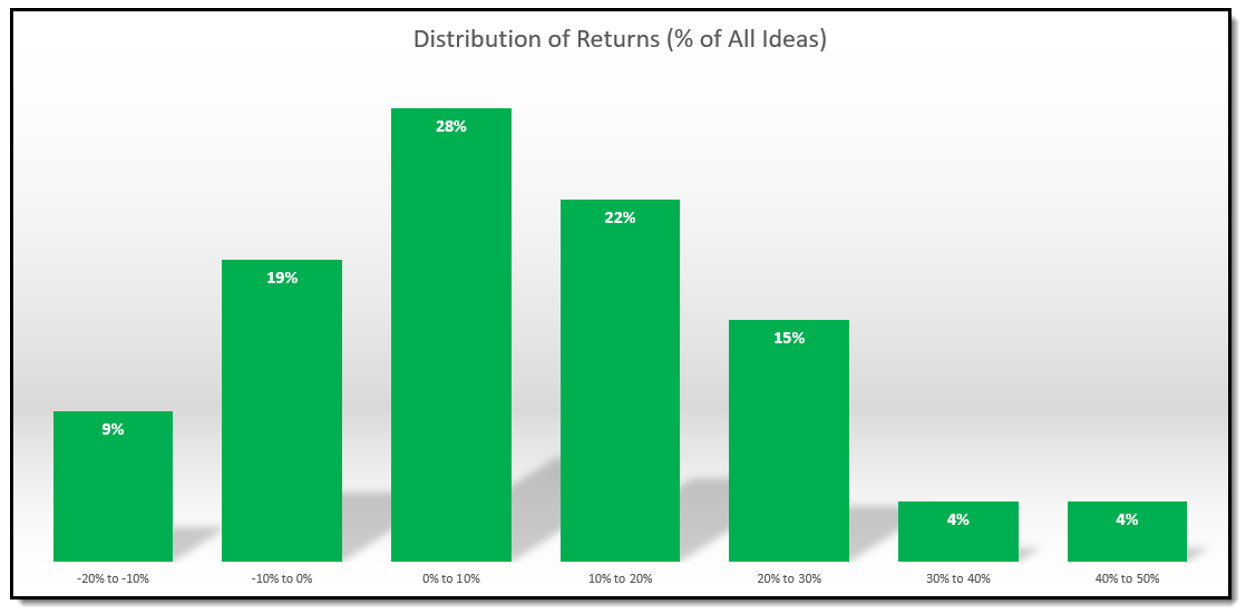

Distribution of returns

You know investing works best when you cut your losses fast and let your winners run. That is why the newsletter follows a STRICT 20% trailing stop loss system.

The following two charts show you how successful the newsletter has been at doing this.

To date, 73%, nearly three quarters of all ideas, would have given you a positive return, with the highest return of +56.1% (the second highest was +45.9%).

Chart Showing percent of all recommended companies:

Distribution of newsletter returns – Percent of all ideas

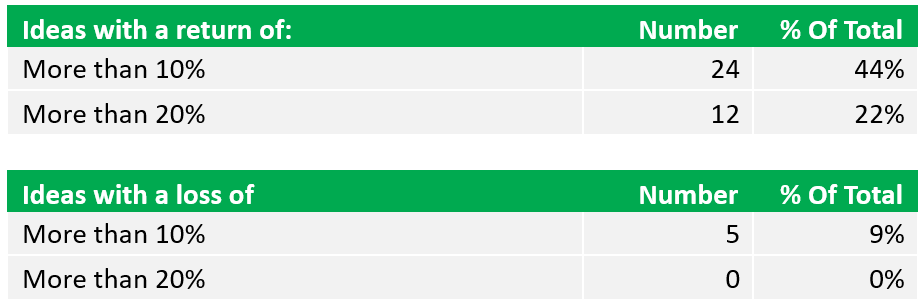

Over 5 to 1 more winners than losers

4.8 times more winners over 10% than losers

As you can see the positive returns FAR outnumber negative returns.

For example, returns of more than 10% are 4.8 (24/5) times higher than losses of more than 10%.

This is because of three things:

- A great time-tested investment strategy

- The strict stop loss system

- Stop buying when markets fall

As I said there is not much to report on yet but as you can see performance has been solid and is moving in the right direction.

Your analyst wishing you profitable investing!