This is the editorial of our monthly Shareholder Yield Letter published on 14-05-2024. Sign up here to get it in your inbox the second Tuesday of every month.

More information about the newsletter can be found here: The best large cap investment strategy ever

This month you can read the best advice I have found on how to make the most of your investments.

But first the portfolio changes.

Portfolio Changes

Buy Four – Hold One

Four new recommendations this month as the MSCI World index is above its 200-day simple moving average.

The first is a €76.6 billion French insurer with a shareholder yield of 14.3%. Over the past 12 months, it has bought back 8.5% of its shares and paid a dividend of 5.9%.

The second is a €37 billion Spanish bank with a shareholder yield of 12.8%. It made share buybacks of 4.9% in 2023 and paid a dividend of 7.9%.

The third is a €54 billion Dutch bank with a shareholder yield of 12.9%. Over the past year, it bought back 6.0% of its shares outstanding and paid a dividend of 6.9%.

The fourth and last recommendation is a €61.2 billion Italian automotive manufacturer with a shareholder yield of 13.7%. It made share buybacks of 6.1% and paid a dividend of 7.6%.

Hold One

Continue to hold Whitehaven Coal Limited +19.5% (recommended May 2023) as it still meets the portfolio’s selection criteria. It currently has a shareholder yield of 15.4% after having bought back 6.1% of its shares and paid a dividend of 9.3% over the past 12 months.

Getting the Most Out of Your Equity Investments

This month’s editorial is long. But I recommend that you take time and read it as it is most likely the best investment advice you will ever get.

In the last chapter from the 4th edition of the great book What works on Wall Street Jim O'Shaughnessy (Now retired Chairman and CEO of O'Shaughnessy Asset Management) shared his ideas on how you can get the most out of your equity investments.

I have included parts from the chapter as well as my comments, bold text, and ideas.

A Quick Summary

A quick summary of how you can get the best from your equity investments:

Let good strategies work.

Don’t second guess them.

Don’t try to outsmart them.

Don’t abandon them because they’re experiencing a rough patch.

Understand the nature of what you’re using and let it work. This is the hardest assignment of all. It’s virtually impossible not to insert our ego or emotions into decisions, yet it is only by being dispassionate that you can beat the market over time.

This is great advice but as we know, more difficult to follow than it sounds. It however helps to hear it all the time.

In markets moving from extreme speculation to extreme despair, believing in Ockham’s razor—that the simplest theory is usually the best — is almost impossible.

We love to:

- make the simple complex,

- follow the crowd,

- get seduced by some hot “story” stock,

- let our emotions dictate decisions,

- buy and sell on tips and hunches and

- approach each investment decision on a case-by-case basis, with no underlying consistency or strategy.

On the flip side, when equity returns are horrible over a long period of time, we are far too willing to assume that stocks will never generate returns comparable to those of the past and abandon them in favor of less risky assets like bond and money market funds.

Even fourteen years after this book was first published—showing decade upon decade of the results of all the various types of strategies—people were more than willing to throw it all out the window because of short-term events, be they good or bad.

No wonder the S&P 500 beats 70 percent of traditionally managed mutual funds over the long-term!

This is so true because taking the S&P 500 as a benchmark assumes investors stayed invested in it. But as you know that is hardly ever the case.

Just wait for a big correction and you will see how many, so called “passive investors” become VERY active.

Always Use Strategies

You’ll get nowhere buying stocks just because they have a great story. Usually, these are the very companies that have been the worst performers over the full time period of our study.

They’re the stocks everyone talks about and wants to own. They often have sky-high price-to-earnings, price-to-book and price-to-sales ratios. They’re very appealing in the short-term, but deadly over the long haul.

You must avoid them.

Always think in terms of overall strategies and not individual stocks. One company’s data is meaningless, yet can be very convincing.

Conversely, don’t avoid the market or a stock simply because things have been bad over the short-term.

I am sure you have learned that chasing a hot stock tip is a recipe for guaranteed losses. The newsletter is a great example of following a strategy rather than chasing story stocks.

Ignore the Short-term

Investors who look only at how a strategy or the overall market has performed recently can be seriously misled and end up either ignoring a great long-term strategy that has recently underperformed or piling into a mediocre strategy that has recently been on fire.

Over the last 15 years, I cannot count the number of times investors have gotten extremely excited about our strategies as they were doing well relative to their benchmark and the same number of times that investors became despondent about short-term underperformance.

Tragically, investors seem hardwired to inordinately focus on very short periods of time, often completely ignoring how the strategy has done over long periods of time.

Use Only Strategies Proven Over the Long-Term

Always focus on strategies whose effectiveness is proven over a variety of market environments.

The more time periods you can analyze, the better your odds of finding a strategy that has withstood a variety of stock market environments.

Buying stocks with high price-to-book ratios appeared to work for as long as 15 years, but the fullness of time proves that it is not effective.

Many years of data help you understand the peaks and valleys of a strategy.

What’s more, sometimes a strategy might make intuitive sense, like buying stocks that have the greatest annual gain in sales, yet a review of the data tells us that, in the long-run, this is a losing strategy, probably because investors get so excited by those huge annual sales increases that they price the stocks to perfection, which is rarely achieved.

Attempting to use strategies that have not withstood the test of time will lead to great disappointment.

Stocks change. Industries change. But the underlying reasons certain stocks are good investments remain the same. Only the fullness of time reveals which are the most sound.

Invest Consistently

Consistency is the hallmark of great investors, separating them from everyone else.

If you use even a mediocre strategy consistently, you’ll beat almost all investors who jump in and out of the market, change tactics in midstream, and forever second-guess their decisions.

Look at the S&P 500. We’ve shown that it is a simple strategy that buys large capitalization stocks.

Yet this one-factor, rather mediocre strategy still manages to beat 70 percent of all actively managed funds because it never leaves its strategy.

Successful investing isn’t alchemy, it’s a simple matter of consistently using time-tested strategies and letting compounding work its magic.

This is so important! Here is the most important thing you must ask yourself:

The most important question you need to answer for yourself is not:

“How can I earn the highest returns?”

it is,

“What are the returns I can sustain for the longest period of time?”

That is how you make the most of your investments.

Always Bet with the Base Rate

Base rates are boring, dull and very worthwhile.

Knowing how often and by how much a strategy beats the market is among the most useful information available to investors, yet few take advantage of it.

Base rates are essentially the odds of beating the market over the time period you plan to invest.

If you have a ten-year time horizon and understand base rates, you’ll see that picking stocks with the highest multiples of earnings, cash flow, sales or lowest value composite score has very bad odds.

Here is the base rate of a Shareholder Yield investment strategy:

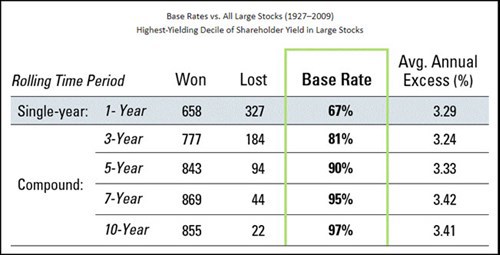

The following table shows you the results of simply buying the 10% of large stocks with the highest Shareholder Yield (dividend yield plus net stock buybacks) over an 80-year backtest period:

Source: 7 Traits for Investing Greatness

Over all 961 (777+184) rolling 3-year periods, the top 10% Shareholder Yield companies beat other large stocks 81% of the time by an average of 3.24% per year.

If you extend the test to all 877 (855+22) rolling 10-year periods, you would have beaten the market 97% of the time by 3.41% per year.

That is an outstanding result!

Never Use the Riskiest Strategies

There is no point in using the riskiest strategies.

They will sap your will and you will undoubtedly abandon them, usually at their low.

Given the number of highly effective strategies, always concentrate on those with the highest risk-adjusted returns.

Always Use More Than One Strategy

Unless you’re near retirement and investing only in low risk strategies, always diversify your portfolio by investing in several strategies.

How much you allocate to each is a function of risk tolerance, but you should always have some growth and some value guarding you from the inevitable swings of fashion on Wall Street.

Once you have exposure to both styles of investing, make sure you have exposure to the various market capitalizations as well.

A simple rule of thumb for investors with ten years or more to go until they need the money is to use the market’s weights as guidelines. Currently, 75 percent of the market is large-cap and 25 percent is small- and mid-cap.

That’s a good starting point for the average investor. Unite strategies so your portfolio can do much better than the overall market without taking more risk.

Additionally, you should have a plan for your entire portfolio, not just the equity portion.

One of the simplest and most effective strategies for your entire portfolio is to rebalance your allocations to various styles and asset classes back to your target allocation at least once a year.

Use Multifactor Models

The single factor models show the market rewards certain characteristics while punishing others. Yet you’re much better off using several factors to build your portfolios.

Returns are higher and risk is lower. You should always make a stock pass several hurdles before investing in it. The only exceptions to this rule are our Composited factors like the Composited Value Factor, the Composited Earnings Quality and so forth. These are essentially multifactor models as they include several factors and require a good score on each for a stock to rise to the top.

Insist On Consistency

If you don’t have the time to build your own portfolios and prefer investing in mutual funds or separately managed accounts, buy only those that stress consistency of style.

Many managers follow a hit-or-miss, intuitive method of stock selection. They have no mechanism to reign in their emotions or ensure that their good ideas work. All too often their picks are based on hope rather than experience.

The Stock Market Is Not Random

Finally, the data proves the stock market takes purposeful strides.

Far from chaotic, random movement, the market consistently rewards specific strategies while punishing others. And these purposeful strides have continued to persist well after they were first identified.

We now have not only what Ben Graham requested—the historical behavior of securities with defined characteristics—we also have a 14-year period where we’ve witnessed their continued performance in real time.

We must let history be our guide, using only those time-tested methods that have proven successful. We know what is valuable and we know what works on Wall Street. All that remains is to act upon this knowledge.

I hope you have found Jim’s ideas as helpful as I have. As always if you have any questions let me know.

Your analyst wishing you profitable investing!