If you are looking for Magic Formula investment ideas in Norway you have come to the right place.

You most likely already know about the Magic Formula investment strategy developed by Joel Greenblatt and described in his excellent book called The Little Book that Still Beats the Market.

It is also the book that got me started with quantitative investing.

Your step by step guide to the Magic Formula in Norway

In this article you can see exactly how (step for step) to find Magic Formula investment ideas in Norway.

You will also see you how you can improve the strategy's returns through a LOT of testing we have done, so keep reading.

First a bit of background information…

Finds quality undervalued companies

The Magic Formula lets you find quality companies that are trading at an attractive price.

It does this by looking for companies with a high earnings yield (companies that are undervalued) and a high return on invested capital (ROIC) (quality companies).

It then ranks the companies on ROIC (where 1 is the company with the highest ROIC), and by earnings yield (where 1 is the company with the highest earnings yield).

To get the Magic Formula rank the ROIC rank and earnings yield rankings are added together.

The best ranked Magic formula company is the one with the lowest Magic Formula rank (the lower the better).

It’s all done for you

If this sounds like a lot of work do not worry - we have done it all for you. You can get a list of the best Magic Formula companies in Norway with a few mouse clicks.

Keep reading to see exactly how.

Does the Magic Formula also work in Europe?

You know the Magic Formula works in the USA as Joel proved in his book and on his website.

But does it also work outside the USA?

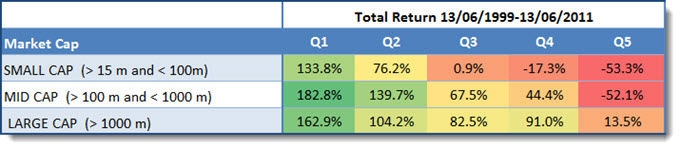

In 2012 that is exactly what we wanted to find out when we tested the Magic Formula investment strategy in Europe over the 12 year period from June 1999 to June 2011.

This is what we tested

The back-test universe was about 1500 companies in the 17 country Eurozone markets during our 12-year test period (13 June 1999 to 13 June 2011). We excluded banks, insurance companies, investment funds, certain holdings companies, and REITS.

We included bankrupt companies to avoid any survivor bias, and excluded companies with an average 30-day trading volume of less than €10 000. For bankrupt companies, or companies that were taken over, returns were calculated using the last stock market price available before the company was de-listed.

This is what we found:

Magic Formula returns in Europe from June 1999 to June 2011 by company size.

Source: Quantitative Value Investing in Europe: What works for achieving alpha

As you can see companies with the best Magic Formula rank, quintile 1 (Q1) in the above table, did a lot better than companies with the worse rank (Q5).

And it did this for small, medium and large companies.

The best ranked companies all substantially outperformed the market which returned only 30.54% over the same 12 year period.

The best Magic Formula companies did up to 152.3% better than the market.

Others have also tested the Magic Formula in Europe and it works

A lot of people also wanted to find out if the Magic Formula works in their home market and, not surprisingly, it does.

Here are some other research studies we have come across:

Does the Magic Formula also work in Finland?

It does, and it was proved in 2013 by Topias Kukkasniemi in his 68 page master’s thesis The Use of Systematic Value Strategies in Separating The Winners From The Losers: Evidence From The Finnish Markets at the Lappeenranta University of Technology in Finland.

Topias tested the Magic Formula on the Finnish stock market over the 13 period from May 1997 to May 2010 and found that the strategy does outperform the market.

Does the Magic Formula also work in Belgium, Luxembourg and the Netherlands?

From 1995 to 2014 the Magic Formula definitely worked in Belgium, Luxembourg and the Netherlands as it would have given you an average yearly return of 7.7% better than the market over the 20 year test period, an impressive return.

Okay it works – here is how you get Magic Formula ideas in Norway

Now for the interesting part where you can see how to get Magic Formula investment ideas for your portfolio.

I have set it up for you

I have already saved a Magic Formula screen for you so all you have to do is load it.

Here is how to do it:

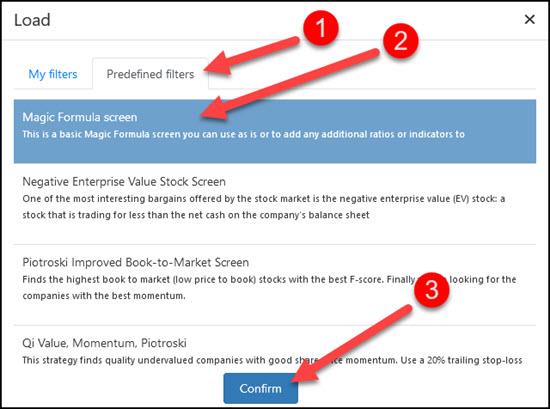

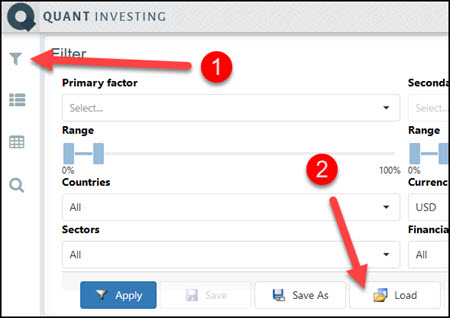

After loading the screener click the Filter icon then click the Load button as shown below:

Then click on the Predefined filters tab, scroll down and click on the Magic Formula Screen. To load the screen click the Confirm button.

Select Norway, daily value and company size

You then have to select:

- Norway

- The minimum Daily trading volume and

- The minimum Market value

of the companies you want to screen for.

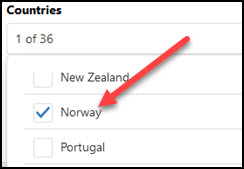

To do this click the drop down list item below Countries and check the box next to Norway.

Next enter the minimum daily trading volume and the minimum market value of the companies you want to screen for. Please note the numbers you enter are in thousands, this means if you enter $125 it is equal to $125,000.

Click image to enlarge

That is all you have to do.

When you are done click the Apply button to get your Norwegian Magic Formula investment ideas.

But the Magic Formula can be improved - a lot

As I mentioned you can improve the returns of the Magic Formula a lot, up to 600.5% in the testing we have done.

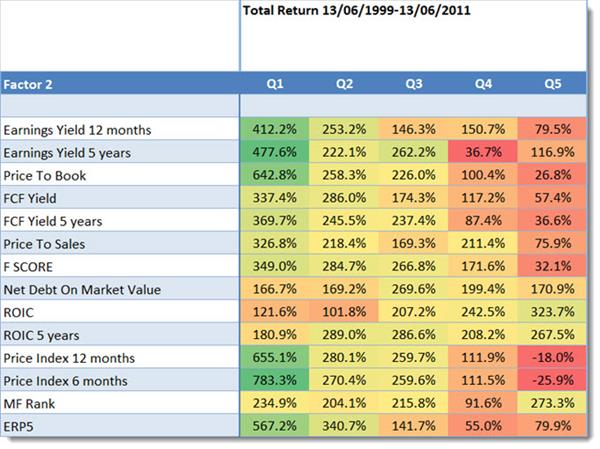

We tested the strategy with 13 other ratios and as you can see in the table below the returns of the strategy can be substantially improved.

Click image to enlarge

Magic Formula returns when combined with a third ratio in Europe from June 1999 to June 2011.

Source: Quantitative Value Investing in Europe: What works for achieving alpha

Look at column Q1

Look at the returns in column Q1, it shows the returns generated by first selecting the 20% best Magic Formula companies combined with the ratios in the column called Factor 2.

Best combination +783% was Momentum (600.5% improvement)

This means you could have earned the highest return of 783.3% over the 12 year period if you invested in the best ranked Magic Formula companies that also had the highest 6 month price index (share price momentum).

This is a 600.5% improvement over the best return of 182.8% you could have earned if you used only the Magic Formula to get investment ideas.

Other great combinations

Other good combinations from the table above are:

- Magic Formula and 12m Price index (momentum) +472.3%

- Magic Formula and Price to Book +460%

- Magic Formula and ERP5 +384.4%

- Magic Formula and 5yr average Earnings Yield (EBIT/EV) +294.8%

How to combine the Magic Formula with other ratios

With the screener it is very easy to combine the Magic Formula with other ratios or indicators.

The following screen shots will show you exactly how.

First load the Magic Formula saved screen, select Norway, Daily Trading Volume and minimum Market Value as shown above.

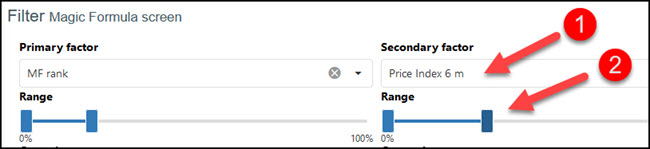

How to add 6 month Price Index (momentum)

To add Price Index 6m (6 months momentum) to the screen click the drop down list below Secondary Factor and, under the heading Momentum click in the Price Index 6 m menu item.

Then move the slider below Price Index 6m so that you select the top 20% or 30% (set the slider to go from 0% to 20% or 30%) of companies with the best six month Price Index.

To get a list of companies click the Apply button.

In the same way you can add:

- 12m Price index (momentum)

- Price to Book

- ERP5

- 5 year average Earnings Yield (EBIT/EV)

Or other good factors you can also use are:

- Free cash Flow yield – to select companies cheap compared to the cash they generate

- Debt to Equity – To select companies with a low amount of debt

- Gross Margin - Novy-Marx (the best quality ratio we have tested)

and many more (you can see all ratios and indicators you can use in the stock screener glossary)

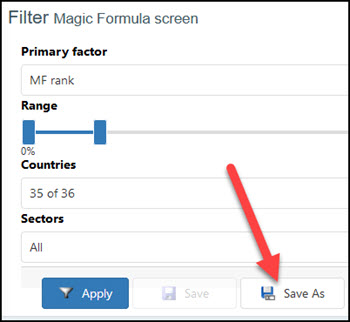

You can save all your screens

Once you have changed the basic Magic Formula screen to fit your investment style you can save it so that you can call it up at any time.

You can save as many screens as you like.

To save your screen click the Save As button.

In the pop-up box give your screen a name and a short description so you can remember what the screen does.

To save the screen click on the Confirm button.

All this costs less than a lunch for two

How much can a tool like this cost, you may be thinking?

To make it affordable, and give you a great return on your investment, even if your portfolio is still small we have made the price of the screener surprisingly low.

It costs less than an inexpensive lunch for two each month (Click here for more information).

Don’t hesitate, you have nothing to lose. If you are not 100% happy you get your money back – guaranteed!

PS: Why not sign up right now, while this is fresh in your mind?

Please note: This website is not associated with Joel Greenblatt and MagicFormulaInvesting.com in any way. Neither Mr Greenblatt nor MagicFormulaInvesting.com has endorsed this website's investment advice, strategy, or products. Investment recommendations on this website are not chosen by Mr. Greenblatt, nor are they based on Mr Greenblatt's proprietary investment model, and are not chosen by MagicFormulaInvesting.com. Magic Formula® is a registered trademark of MagicFormulaInvesting.com, which has no connection to this website.