In this article you can see exactly how (step for step) to implement a low price to book value and Piotroski F-Score investment strategy in your portfolio world-wide.

First a bit of background information…

What the Piotroski F-Score does

The Piotroski F-Score was developed by Professor Joseph D. Piotroski in his search for a ranking system that can increase the returns of a low price to book investment strategy.

I am not going to show you how the Piotroski F-Score is calculated you can read all about that over here: This academic can help you make better investment decisions – Piotroski F-Score

Does it work - F-Score back test?

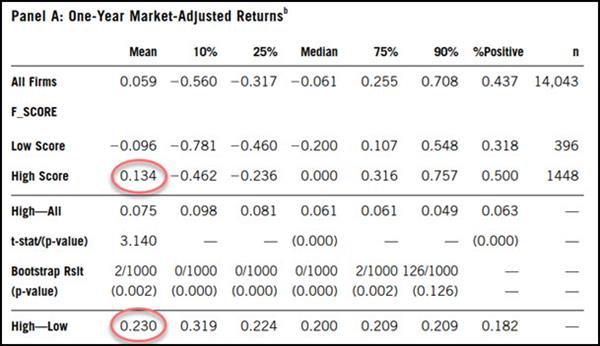

When Prof Piotroski tested the F-Score over the 20 year period from 1976 to 1996 it exceeded his most optimistic expectations.

By buying only companies that scored the best (8 or 9) on his nine-point scale, or F-Score as he called it, over the 20 year period from 1976 to 1996 led to an average yearly outperformance over the market of 13.4%.

Even more impressive were the results of a strategy of investing in the highest F-Score companies (8 or 9) and shorting companies with the lowest F-Score (0 or 1).

Over the same period from 1976 to 1996 (20 years) this strategy led to an average yearly return of 23.0% better than the market.

Summary of the back test

Here are two tables from Professor Piotroski’s research paper: Value Investing: The Use of Historical Financial Statement Information to Separate Winners

Source: Value Investing: The Use of Historical Financial Statement Information to Separate Winners from Losers p16

High Score = Low price to book companies with a Piotroski F-Score of 8 or 9

Low Score = Low price to book companies with a Piotroski F-Score of 0 or 1

High-Low = Long investment in High Score companies and short Low Score companies

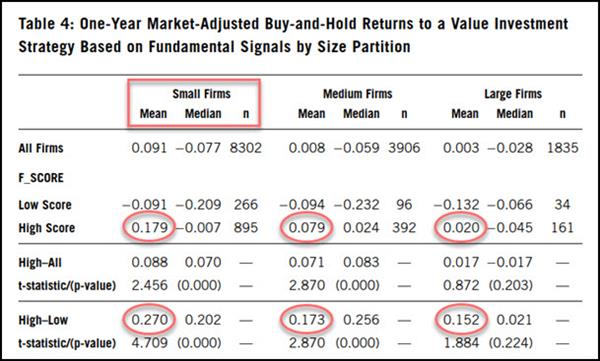

Worked best on small companies

These were the back tested returns when he split the results between small, medium and large companies.

Source: Value Investing: The Use of Historical Financial Statement Information to Separate Winners from Losers p19

As you can see small companies would have given you the best returns. But, because of their size they would most likely not work for a long short strategy.

Important! - Companies to avoid like the plague

Avoiding low F-Score companies is a great idea as you can see for all three groups of companies these companies substantially underperformed the market of between -9.1% to -13.2% per year for 20 years!

So whatever you do don't buy companies with a Piotroski F-Score of 0 or 1.

Click here to get the Piotroski F-Score working in your portfolio

Back testing Price to Book and the Piotroski F-Score

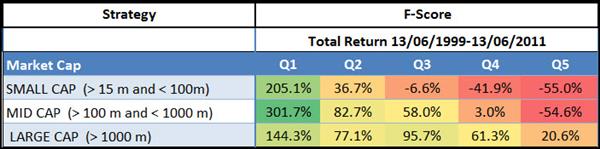

In the research paper Quantitative Value Investing in Europe: What Works for Achieving Alpha we tested 168 different investment strategies, on companies in the Eurozone, to find what strategies would have given you the best investment return over the 12-year period from 13 June 1999 to 13 June 2011.

In spite of the test period being quite short it was not a good time to be invested in the stock market, as it included the internet stock market bubble (1999), two recessions (2001, 2008-2009) and two bear markets (2001-2003, 2007-2009).

The Piotroski F-Score - A remarkable finding

In spite of the Piotroski F-Score being a quality indicator (it can’t tell you if a company is undervalued) if you used it as a single factor to select investment ideas you would have done surprisingly well as the Piotroski F-Score was the fifth best single factor strategy we tested.

The following table shows you what your returns you could have earned if you used only the Piotroski F-Score to get investment ideas.

Piotroski F-Score returns in Europe from June 1999 to June 2011 by company size.

Source: Quantitative Value Investing in Europe: What Works for Achieving Alpha

Q1 was companies with the best (high) Piotroski F-Score and Q5 companies with the worst (lowest) F-Score.

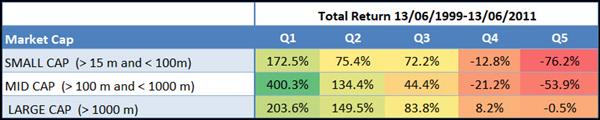

The Price to Book ratio test

When testing the Price to Book ratio this is what we found:

Low price to book returns in Europe from June 1999 to June 2011 by company size.

Source: Quantitative Value Investing in Europe: What works for achieving alpha

As you can see companies with the lowest price to book value, quintile 1 (Q1) did a lot better than companies with a high price to book ratio (Q5). And it did this for small, medium and large companies.

Also note that the returns all decline from Q1 to Q5. This mean that it is a good valuation ratio to use because the lower the price to book ratio the higher the returns. The lowest price to book value companies all substantially outperformed the market which returned only 30.54% over the same 12 year period. The best performers were Mid Cap companies which increased 369.8% better than the market.

Market returned only 30.5%

For all company sizes the companies with the lowest Price to Book ratio and best F-Score substantially beat the market which over the 12-year period of the study returned 30.54 % or 2.25% pa, dividends included.

Piotroski F-Score with other ratios improved returns over 200%

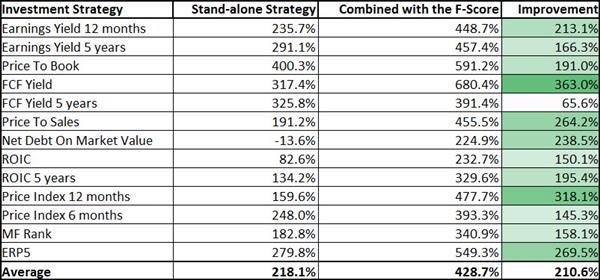

We also tested the Piotroski F-Score with 13 other ratios and indicators to see if it could increase your returns.

In this back test we first selected companies with a Piotroski F-Score of 8 or 9 then selected one of the 13 strategies.

What we found was remarkable

With the exception of two other ratios (ROIC and Net Debt on Market Value), combining the F-Score with another ratio would have given you a lot higher returns.

The following table shows you how much the return of the stand-alone strategies were improved by selecting only companies with a good Piotroski F-Score.

Click image to enlarge

Source: Quantitative Value Investing in Europe: What Works for Achieving Alpha

Best single ratio strategy = Price to book +400.3%

As you can see in the Stand-alone strategy column price to book was the best stand-alone strategy you could have used over the period. This may have been because the test period contained two market crashes (internet bubble and the 2008 financial crisis) after which a low price to book strategy usually does very well.

However, be careful of a low price to book investment strategy because it has long periods of market underperformance. You can read more about it here: Be careful of this time tested value ratio

Adding the F-Score improved Price to Book returns 191%

As you can see if you added the Piotroski F-Score to low Price to Book companies it would have increased your returns by 191.0%, nearly 2 times your original investment over 12 years!

Best strategy with Piotroski F-Score = Free cash flow yield (FCF Yield) +680.4%

The strategy combined with the best Piotroski F-Score companies that gave the best returns over the 12 year period was FCF Yield which returned just over 680%.

Not bad at all I am sure you will agree.

Click here to get the Piotroski F-Score working in your portfolio

Okay the F-Score and Price to Book works how can I implement it?

Implementing a low Price to Book and Piotroski F-Score investment strategy in your portfolio is VERY easy as we have done most of the work for you.

Simply log into the screener.

Click the Go to Screener button.

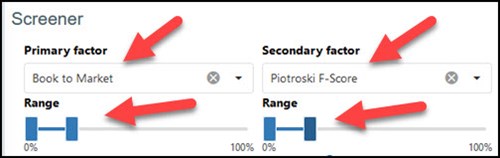

When looking for companies that are undervalued in terms of price to book value we suggest you use the book to market value ratio as your primary factor as shown below. Book to Market is the inverse of Price to Book and it gives you better screening results.

As a second screening ratio select Piotroski F-Score.

Set both slider from 0 to 20% (as shown below) it will give you a list the 20% most undervalued Price to Book companies that ALSO have a high Piotroski F-Score.

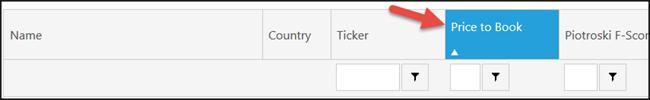

If you prefer price to book

If you want to see your results as price to book value simply select price to book as one of your output columns.

You can then sort this column from low (the most undervalued companies) to high to find the most undervalued companies.

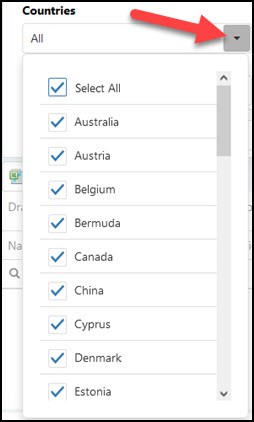

Select your countries

The next step is for you to select the countries where you would like to find investment ideas.

To do this click the drop down list arrow below Countries and check all the countries you would like to select.

Select value and volume

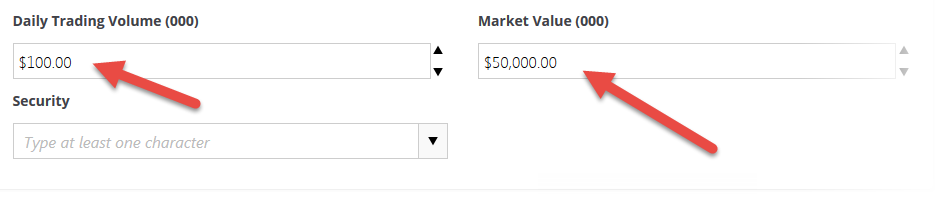

Next you have to choose the minimum daily trading volume and the minimum market value of the companies you want to screen for.

Please note the numbers you enter are in thousands, this means if you enter $100 it is equal to $100,000.

That is all you have to do.

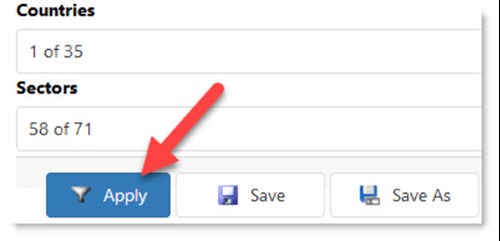

When you are done click the Apply button to run your screen.

This is what your results look like

Dependent on what you selected the result will look something like this:

Summary and conclusion

I am sure this article has convinced you that the Piotroski F-Score is a great indicator that:

- Works great with the Price to Book ratio

- Increases your returns

- Helps you screen out deteriorating companies (bad fundamental momentum)

- Works especially well on small companies

- Increased the return of nearly all strategies we tested

- You can use as a fundamental stop loss (sell if F-Score < 6)

PS Everything you need to implement the Piotroski F-Score in your investment strategy can be found here.

PPS Why not sign up now while it is still fresh in your mind. You can cancel at any time for a FULL refund if you are not happy. Sign up here.

Click here to get the Piotroski F-Score working in your portfolio