Discover how deep value investing can help you find undervalued stocks for long-term success. This article shows you why now is the perfect time to focus on deep value stocks, which are trading at historically low valuations and poised for exceptional returns.

Learn how to avoid value traps with smarter metrics like the Quant Value Composite and F-Score. Whether you’re a beginner or seasoned investor, this guide gives you actionable steps to make deep value investing part of your portfolio.

Estimated Reading Time: 6 minutes

Imagine finding a $10 bill priced at $5. That’s the essence of deep value investing. You buy stocks that the market has mispriced—stocks trading far below their true value. Over time, as the market recognizes their true worth, you reap the rewards.

Deep value investing has a strong history of delivering exceptional returns. It’s not flashy like chasing the latest tech trends, but it’s reliable. And in today’s market, where high-growth stocks dominate, deep value may be your ticket to consistent, long-term success.

Why Deep Value Investing Makes Sense Today

A Historic Opportunity in Deep Value Stocks

Right now, the opportunity to invest in deep value stocks is extraordinary.

Catherine LeGraw, a fund manager at GMO, in the October 2024 article DON’T MISS OUT - A Historic Opportunity in Deep Value Stocks says these stocks are trading at valuations among the cheapest in history.

Globally, deep value stocks are in the bottom 10% of their historical valuation range. In contrast, many growth stocks are trading at the top.

Why is this important?

When deep value stocks are this cheap, they have historically delivered outsized returns. Markets eventually revert to the mean, and undervalued stocks tend to outperform when this happens.

Deep value investing fits with our mission to empower you with research-backed strategies to find hidden opportunities in undervalued stocks.

Click here to start finding Deep Value companies for your portfolio NOW!

Compelling Fundamentals

Deep value investing isn’t just about picking the cheapest stocks. It’s about finding high-quality businesses that are priced like junk.

That’s why we use the Quant Value Composite valuation metric. It combines five valuation ratios to find a stock’s true worth. Unlike basic valuation ratios like price-to-book, this composite approach filters out "value traps"—companies that are cheap for a reason, like poor quality or unsustainable profits.

The Quant Value Composite is a composite indicator that takes and ranks the entire screener universe from best to worst based on the following five ratios:

- Price to Sales: The lower, the better,

- Price to Earnings (PE): The lower, the better,

- EBITDA Yield or EBITDA to EV: The higher, the better,

- FCF Yield (FCF to EV): The higher, the better,

- Shareholder Yield: The higher, the better.

Avoiding Common Pitfalls

Passive value investing often disappoints. Value ETFs typically rely on outdated metrics like Price to Book value, which don’t account for modern balance sheets. For example, tech companies often show low book values due to heavy investment in intangible assets like R&D.

Better deep value investing approaches like using the Quant Value Composite avoid this trap by using different valuation metrics not based on book value.

How to Implement a Deep Value Strategy

Screening for Deep Value

To build a deep value portfolio, start with a stock screener that helps you filter for undervalued opportunities. The Quant Investing Screener is ideal for this, offering over 110 ratios to refine your search.

Here’s a simple screen to get started:

- Region: Include global markets for diversification.

- Market Cap: Focus on companies with a minimum market cap of $250 million to ensure stability.

- Trading Volume: Look for stocks trading at least $100,000 daily to avoid illiquidity.

- Valuation: Use the Quant Value Composite to rank companies based on a mix of valuation factors.

Practical Example: Screening Criteria

Let’s say you’re screening for deep value stocks in developed markets like the U.S., Europe, and Asia. You set your screener to find the most undervalued 20% companies using the Quant Value Composite.

You then add quality filters like a Piotroski F-Score greater than 6 to weed out low-quality businesses.

For example, your screen might reveal a Japanese industrial company trading at a Quant Value Composite undervalued rank in the top 10%. The company has a strong balance sheet, a Piotroski F-Score of 8, and a trailing 12-month earnings yield of 12%. This stock could be a prime candidate for your portfolio.

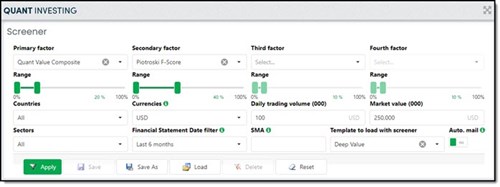

This is what your final screen looks like:

- All developed markets (countries)

- Financial results updated in the past six months

- Minimum trading value $100,000 per day.

- Minimum market value $250 million.

- 20% of companies most undervalued based on Quant Value Composite

- Piotroski F-Score greater than 6

- Sorted the output by Quant Value Composite

This is what the screen looks like:

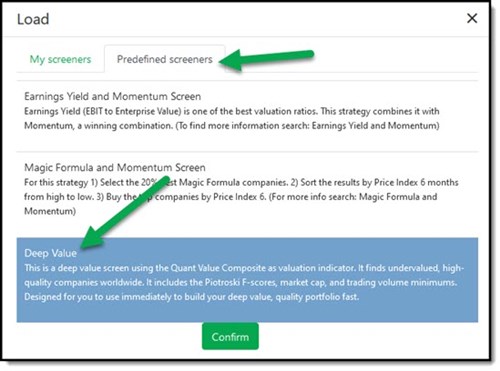

Saved Screen You Can Use Immediately

We have saved a deep value screen you can start using with a few mouse clicks. All you need to do to load is click on “Predefined screeners” scroll down, click on “Deep Value” then click “Confirm”

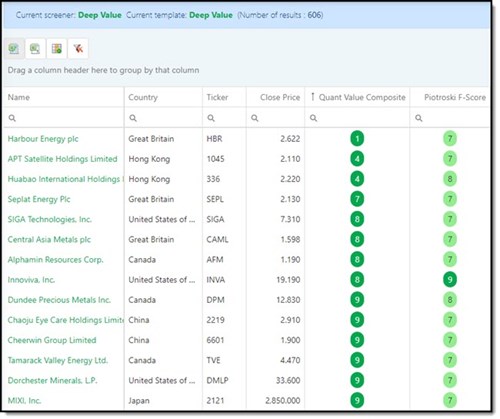

This is what the result from running the Deep Value screen looks like:

Saved the Output Columns You need

We also created an output template with all the ratios and information you need.

The following columns were included:

- Country

- Ticker

- Close Price

- Quant Value Composite

- Piotroski F-Score

- Debt to Equity

- ROIC

- Price Index 6m

- Adj. Slope 125/250d

Click here to start finding Deep Value companies for your portfolio NOW!

Building Your Portfolio

Once you have a list of potential investments, build a diversified portfolio of 30 to 50 stocks. This keeps your individual company risk low and increases your chance of capturing significant gains of this deep value opportunity.

Allocate your investments evenly, and hold each stock for at least a year, but also up to five years, to allow the value thesis to play out.

You of course do not have to go all in on just deep value. You may just want to add a few deep value names to balance your portfolio away from the tech heavy US market or to just bring the average valuation of your portfolio down.

Remember it is not just about numbers. There is no “100% right” answer here. As with everything in investing it is about doing what you feel comfortable with and aligning your investments with ideas that have worked for decades.

Managing Risks and Maximizing Returns

Avoiding Value Traps

Value traps—stocks that look cheap but are actually poor investments—are a common pitfall. Here is how the screen avoids them:

Quality Metrics: You saw we used the Piotroski F-Score which works great to find quality companies. If you want to look for even better quality companies you can screen out the worst 40% of companies by return on invested capital (ROIC).

Balance Sheet: We did not add a screen for debt to equity as the valuation ratios already include debt in the Enterprise Value calculation. If you want to you can add a debt-to-equity ratio filter to remove the 40% of companies with the highest debt levels.

Adding a Stop-Loss System

Even in deep value investing, you need a plan to limit losses. We recommend you use a trailing stop-loss, set at 20%. This will help you cut your losses early while letting your winners run.

Alternatively, use a fundamental stop-loss system. For example, sell a stock if its Piotroski F-Score drops below 5.

It is important to think of how you will limit your risk in advance because by managing risks, you can invest with confidence and focus on long-term results.

Patience is Key

Deep value stocks often underperform in the short term. But patience pays off. Historically, these stocks deliver their best returns over 3–5 years as the market re-rates their value.

Why a Deep Value Approach Works

Deep value investing works because it lets you profit from market inefficiencies. The market is often driven by emotions—fear, greed, and herd mentality. As a result, good companies become overlooked and undervalued. By systematically identifying these opportunities, you position yourself for long-term success.

Deep value investing aligns perfectly with the core idea of Quantitative Investing: Markets are inefficient in predictable ways. By using quantitative tools like the Quant Value Composite, you can exploit these inefficiencies while removing emotion from your decisions.

Start Small and Invest From There

Ready to take the first step?

Here’s how to start:

- Sign Up for a Screener: Use the Quant Investing Screener to identify deep value opportunities.

- Run Your First Screen: Follow the criteria outlined above to find undervalued, high-quality stocks.

- Start Small: Build a portfolio with a few stocks and gradually expand as you gain confidence.

Deep value investing isn’t about chasing trends. It’s about patience, discipline, and letting the numbers guide you. Start building your deep value portfolio today—and take control of your financial future.

Join Quant Investing today. We’ll help you turn market mistakes into your advantage and achieve your financial goals.

Click here to start finding Deep Value companies for your portfolio NOW!

Frequently Asked Questions and Answers for Deep Value Investors

What is deep value investing, and why should I care?

Deep value investing is about buying stocks priced far below their true value. These opportunities arise when the market misprices quality companies. By holding these stocks, you profit when the market corrects its mistakes. It’s a reliable way to build wealth over the long term.

How do I know if a stock is truly undervalued and not a "value trap"?

Use the Quant Value Composite, which combines five valuation metrics like Price-to-Earnings and Shareholder Yield. Adding a quality filter like the Piotroski F-Score ensures you avoid low-quality companies that seem cheap but aren’t worth investing in.

What makes now a good time for deep value investing?

Deep value stocks are currently trading at some of the cheapest levels in history. Historically, stocks bought at these valuation levels have delivered great returns when the market reverts to normal valuation levels.

How can I start building a deep value portfolio?

Use a stock screener to find undervalued stocks based on the Quant Value Composite. Start small with part of your portfolio or invest in 30–50 stocks, diversify globally, and hold for 1–3 years to allow the value to materialize.

What tools do I need to succeed in deep value investing?

A good stock screener is essential. It lets you apply filters like market cap, trading volume, and valuation metrics to identify the best opportunities. The Quant Investing Screener is a great choice with over 110 ratios to refine your search.

How do I manage risks in deep value investing?

Avoid value traps by screening for quality metrics like high Piotroski F-Scores. Add a stop-loss system to limit your downside, such as selling a stock if its F-Score drops below a certain threshold, 5 for example, and using a 20% trailing stop-loss.

Do I need to commit entirely to deep value investing?

Not at all. You can start by adding a few deep value stocks to your portfolio. This approach helps reduce overall valuation and balances portfolios heavy in high-growth sectors like tech.

Gradually increase your deep value holdings as you gain confidence. Remember to always diversify with either a basket of 30 to 50 deep value stocks or small positions of no more than 3% per company in your portfolio.

Deep Value

Click here to start finding Deep Value companies for your portfolio NOW!