Do you only invest in the in the country where you live? This is called home bias and if you do you are not alone but it’s a BIG mistake as it limits your investment opportunities and gives you lower returns.

You are simply fishing in a pond that’s too small.

Why do we all do this?

In theory I am sure you agree that increasing the number of companies (including more countries) in your investment universe can only help your returns.

But it’s not easy to do.

We all think that where we live its safe, we think we know the companies better and it feels comfortable.

But is this true?

Every country has problems

Be honest, every country has had its problems in terms of accounting fraud and other scams. If you don’t believe me take a look at all the investment frauds and scams in your country over the past five year.

It will be a sobering experience as I found here in Germany.

That is why you should spread your investments over as many companies, industries and countries.

If its 50% cheaper

Also, as long as a country is not a complete banana republic, and you can buy a company there for 50% or even cheaper than in your home country you are definitely paid well for taking on the risk of PERHAPS somewhat more relaxed accounting rules, if at all.

You are not alone

If you mainly invest at home you are not alone.

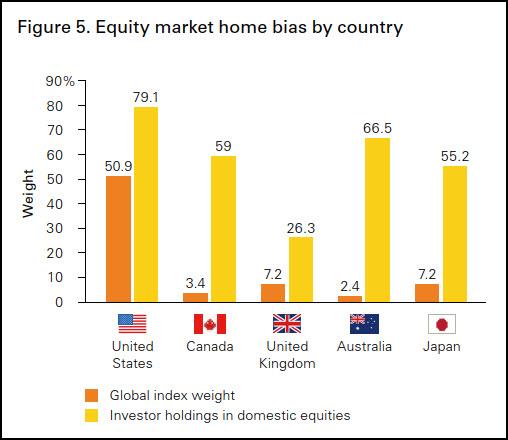

The 2016 research paper The buck stops here: The global case for strategic asset allocation and an examination of home bias by the fund manager Vanguard contained this chart:

Source: The buck stops here: The global case for strategic asset allocation and an examination of home bias - Vanguard – July 2016

Investors in the USA don’t look too bad. BUT this is only because they have the largest stock market.

Investors in Canada don’t seem to trust their US neighbours much but the Australians look by far the worse in terms of home bias.

Germany was not listed, probably because it hasn’t got much of an equity culture, but I am sure it would be just as bad.

What the worst thing that can happen? You can lose everything

What can happen if you don’t diversify across countries, you may be thinking.

You can get wiped out.

Yes you can get wiped out as happened to stock and bond investors in Germany and Russia around the 1920’s. I admit it’s an extreme example and is relatively unlikely.

But even if it is the fact remains that the bond and stock markets of countries perform very differently.

Think of the US market outperforming most markets over the 10 years after the financial crisis. This is great but is unlikely to do so over the next 10 years because the market has become overvalued.

No one knows what world market will perform best so spreading your investments world-wide is the best strategy.

Does investing worldwide work?

But does investing worldwide work? Isn’t it risky?

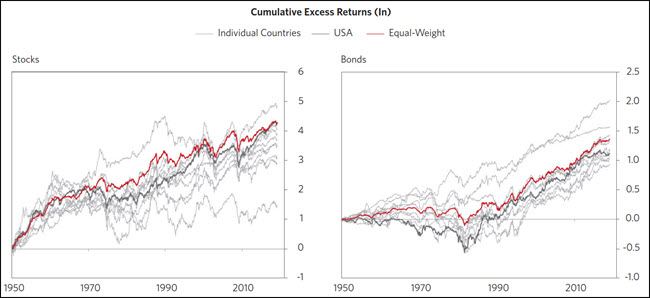

It works very well as a proven in a 2019 research paper by the investment firm Bridgewater Associates ($124.7 billion assets under management) called Geographic Diversification Can Be a Lifesaver, Yet Most Portfolios Are Highly Geographically Concentrated .

The following charts show the stock and bond market returns of various countries including an equal country weight portfolio.

Source: Bridgewater Associates - Geographic Diversification Can Be a Lifesaver, Yet Most Portfolios Are Highly Geographically Concentrated

Red line = Equal weight portfolio

Dark Grey line = USA

Light Grey lines = Individual countries

The reason the equal weight portfolio (Red line) does so well because it has lower drawdowns. This gives you more consistent returns which lead to faster compounding of your money.

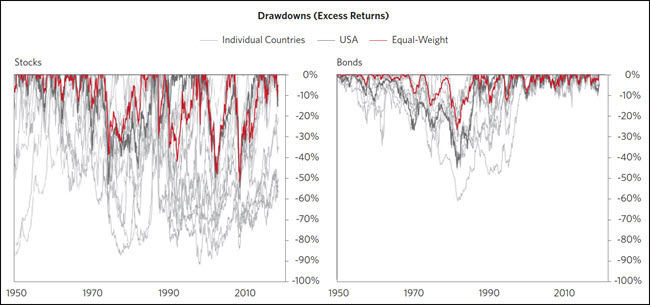

This following chart clearly shows the lower drawdowns of the world-wide equal weight portfolio (Red line):

Source: Bridgewater Associates - Geographic Diversification Can Be a Lifesaver, Yet Most Portfolios Are Highly Geographically Concentrated

Red line = Equal weight portfolio

Dark Grey line = USA

Light Grey lines = Individual countries

Another research report

Here is a second research report that proves investing world-wide gives you higher returns.

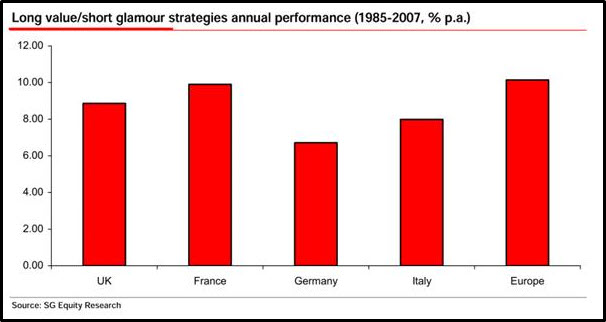

It’s a research paper written by James Montier called Going global: value investing without boundaries and was published on 16 September 2008 when James was working for the French bank Societe Generale in London.

Does global value investing work?

James wrote the paper after he was asked if he has ever seen any research that proves that value investing works at the global level.

With the paper he wanted to prove his idea that an investor should be allowed to invest anywhere in the world where the most attractive investment opportunities can be found.

Great fund managers have shown it works

This is of course not a new idea as several great value investors such as Sir John Templeton and Jean-Marie Eveillard have shown that value investing works very well if done on a global basis.

As Sir John said:

It seems to be common sense that if you are going to search for these unusually good bargains, you wouldn’t just search in Canada.

If you search just in Canada, you will find some, or if you search just in the United States, you will find some. But why not search everywhere? That’s what we’ve been doing for forty years; we search anywhere in the world” (speaking in 1979).

The European evidence

The chart below shows that investing across Europe would have given you higher returns (look at the last bar) and proves that expanding your boundaries across Europe can improve your returns.

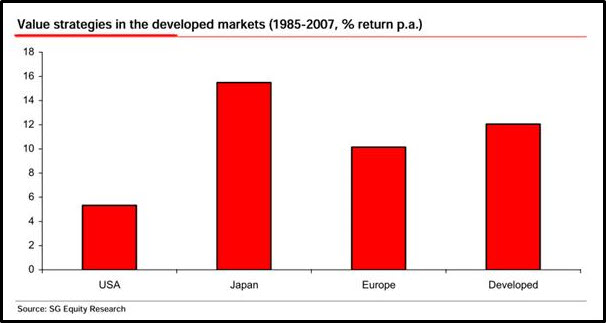

All developed markets evidence

Across three developed markets (Europe, the US and Japan) you can see that investing in ALL developed countries would have given you the highest returns (look at the last bar) apart from Japan.

Conclusion, global investing works

So as you have seen global investing works.

This means it’s definitely a great idea to look for the companies that best fit you investment strategy irrespective of where in the world they are.

If you do this your portfolio will not look like most of your friends or any of the investment funds your friends are invested in. But you shouldn’t care (I definitely don’t) because as you can see your returns will be a lot higher and your drawdowns lower.

Best of all its easy to implement, just widen your investment universe and start investing worldwide.

You don't have to go all out immediately

You don’t have to go all out and do it immediately, start with a few investments and go from there as you feel comfortable.

If you are very worried start with smaller positions.

How to overcome your home country bias

Larry Swedroe in a great 5 December 2019 article called Global Impact of Investor Home Country Bias had a great suggestion on how you can overcome your home country bias.

He wrote (bold comments are mine):

Finally, I add this note of caution, one that might help you avoid home country bias.

If a belief in relatively high market efficiency has led you to conclude that you should be a passive investor—accepting market prices as the best estimate of the right prices—you should also accept the idea that all risky assets have similar risk-adjusted returns.

If that were not the case, capital would flow from assets with lower expected risk-adjusted returns to the assets with higher expected risk-adjusted returns until equilibrium was reached.

If all risky assets have similar risk-adjusted returns, there is no reason to have a home country bias—other than perhaps a small bias to take into account that investing in U.S. stocks is a bit cheaper than investing in international stocks.

On the other hand, if you are still employed, it is likely your labor capital is more exposed to the economic cycle risks of the U.S. than to foreign market risks.

If that is the case, once you include your labor capital as part of your portfolio, you should consider overweighting foreign markets to offset your labor capital risk.

PS To implement a worldwide investment strategy in your portfolio sign up for the Quant Investing stock screener by clicking here .

PPS It is so easy to forget and put things off why don’t you sign up right now?