In 2016 I stumbled onto the hedge fund manager of the decade while searching for a cure for back pain.

Soon thereafter I downloaded his great eBook The Retarded Hedge Fund Manager and I have been following him since then.

He recently launched an investment course that looked very interesting, so I asked for more information. After a few interesting emails I asked him if I could introduce him to you in the form of an interview.

Mike graciously agreed but before we get to the interview here is a bit of background information.

Mike Syding Bio

Karl-Mikael Syding was born in January 1972 in the eternal night of Jukkasjärvi, above the polar circle in Northern Sweden.

After finishing his masters in finance at Stockholm School of Economics he worked first as an IT analyst during the IT boom years of 1994-2000, and then as a hedge fund manager between 2000-2015 and 2020-2023.

During his voluntary retirement from 2015 to 2020 he published several hundred podcast episodes, wrote about his investment philosophy on his blog.

Together with his podcast and business partner Ludvig Sunström he also created an online course in value-oriented investing, originally it was available only in Swedish, but he recently adapted it for an English-speaking audience. The translation followed a request for a 14-hour lecture series for finance students at London Business School.

Now on to the interview:

Transition from Hedge Fund to Personal Investing

After years as a hedge fund manager, how has your approach to investing evolved now that you're focusing solely on managing your own money?

My professional portfolio as a hedge fund manager has always been market neutral, with as many short positions as long positions. In addition, the focus has been on large cap companies and the largest sectors, like technology and banks.

My private portfolio now and before is much riskier, and always long only (except for a short period when I was short the OMX index as a hedge against my portfolio of unlisted assets).

Currently my portfolio of listed stocks consists of just five junior mining stocks, so a small sector, small companies, pre-revenue start-ups really, and long-only, no short positions.

My main investments are in unlisted start-ups and private equity in all kinds of industries: software, services, fintech, crowd monitoring, precious metals, e-commerce, crypto, manufacturing/services. I have less than 5% of my net worth in listed stocks.

Analysing Equities

What key lessons from your hedge fund experience do you apply most frequently when analysing equities for your personal portfolio?

Positive trends tend to continue longer than I would consider logical or warranted. There are procyclical forces that attract capital and customers to certain sectors and companies in a positive feedback loop of Fundamentals/Valuations/Capital.

Consequently, it is “safe” to latch on to and ride trends, even if you feel a little late to the game or valuations are daunting.

Likewise, cheap value stocks typically continue to mine ever lower valuations than warranted for much longer than one would normally guess. You thus have plenty of time to do your research thoroughly.

Tip: buy falling value stocks in small increments, make sure you save enough dry powder and liquidity to buy the most in the “despondency” phase, not early on at just fair or slightly cheap valuations.

It is exactly because expensive stocks get even more expensive and cheap stocks become super cheap that value investing works.

If everything was fairly valued

all the time

then a value investor

would never

get any great investment opportunities.

It’s one example of Coincidence of Opposites. In this case it means that “Because value investing doesn’t work short to mid-term, it works extremely well long-term”.

The other side of that coin is valid for momentum investing: “Because momentum works short term, buying leads to more buying until the stock is way too expensive. Eventually the trend breaks at a point when the stock is extremely expensive, i.e. in the end momentum investing suddenly leads to catastrophic results (see every asset bubble in history)”

Idea Generation

Can you describe the process or tools you use to generate investment ideas now, compared to when you were at Futuris?

My idea generation process changed a lot during both my time as a sell-side analyst and during my time at Futuris and Antiloop, not to mention as a private investor both in public and private equity.

The market changes, the type of opportunities vary, and I change too.

The main difference is that my private investments are much more long term and in much smaller companies than my hedge fund bets are. In addition, I’ve relied progressively less on detailed financial models over time, and instead more on the big picture.

Before, the next few quarters were much more important, but now it’s the potential news flow, revenues and profits some 5 years from now that drive my investments.

At Futuris I built large financial models myself for the companies I invested in or covered, but still much smaller than as a sell side analyst at Swedbank. At Futuris I read a lot of sell-side research from our 20-30 broker counterparties. I also went to conferences and met with sell-side analysts all the time, trying to gauge the sentiment and ACTUAL consensus expectations for the stocks I covered. So, I travelled a lot, met with a lot of bankers, and read their research (not to mention partied with them). I also had my own Bloomberg terminal at Futuris.

At Antiloop I used free online tools like KoyFin for screening purposes. And my financial models, if I had any at all, were as condensed as possible.

My main idea generation process was:

- Reading news in general,

- Reading news on the largest companies in S&P 500,

- Reading news about the sectors I was particularly interested in now.

- Thinking about big picture economic, stock market and geopolitical developments, to guess which sectors would respectively outperform/underperform the coming quarter(s) or year.

- Then I identified a few stocks that could express those views, e.g. buy Facebook and Spotify when bullish on technology and advertising, or Occidental petroleum when I had a positive view on the economy and oil.

Risk Management

How do you approach risk management differently in your personal portfolio compared to your time managing a hedge fund?

At Futuris I aimed to find the best and the worst companies possible, making absolute profits on both longs and shorts. At Antiloop I instead focused on tracking only about the largest 100 companies, buying shares representative of sectors in the right trend for the coming year and selling shares representative of sectors I thought would fall out of favour over the coming year. If I could make a good enough spread between my longs and my shorts, I was happy with that, no matter if either leg lost value or not.

In my personal portfolio I aim for 10-100x returns on risky small cap long only bets, while being completely ready for about half going to zero. I have experienced about 10 total losses, and three 100x positions.

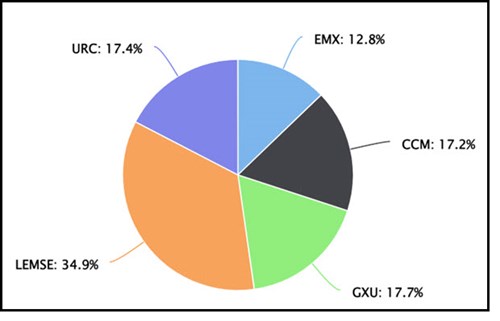

I currently own 5 listed stocks: URC, GXU, EMX, Lemse, CCM. They are in order: uranium royalty, uranium junior mine prospecting company, gold/copper/battery metals royalty generator, junior mine prospecting company, and a super junior gold property.

With uranium at $150-300 and gold at $3000-5000, and the rest of the minerals around current levels + 10-15% annual price increases, then given the required permits, all five stocks should increase by 10-100x over about 5-7 years’ time.

Annual doublings take 5 years to 32x, with 2 years doubling periods, 32x takes 10 years. I expect some kind of average of that: approximately 30x for the portfolio in 7.5 years if things work out according to plan. => Eight years to increase by 100% five times over is a lot, but it’s not quite a rocket taking off. And I’m only aiming for end-valuations of 5-10 times profits.

Ten Times in Ten Years

However, stocks never do as you expect..., but I’m still happy with 10x returns after dilution over 10 years. To get there the companies need to get the right permits, the right financing, build the mines, start producing at the right cost level, sell at the required higher commodity prices

Investment Philosophy Influenced by Douglas Adams

How has your investment philosophy been influenced by your admiration for Douglas Adams and the significance of the number 42?

Apart from retiring within a week from my 42nd birthday, as well as keeping the number of stocks in Antiloop at around 42 stocks, the magical number hasn’t affected my actual research or investments. I do become a little excited though whenever the number turns up, but it doesn’t govern my investment decisions.

Teaching Investment Strategies

In your upcoming investing course, what core strategies or principles from your professional experience are you most excited to teach?

- Keep an investment diary and use it to keep evaluating your investments and updating your strategy and investment note taking processes.

- Be patient and consistent. Have a strategy that is logical and stick to it.

- Don’t trade when you’re emotional. Take a walk, cool off, never invest in a state of FOMO or hurry

- Investing is about being systematic, not excited; it’s about constant evaluation and adaptation, not a finished perfect system (since the marketplace keeps evolving).

- Don’t invest in more stocks than you can keep track of and that add significant value to your portfolio. Around 10 stocks are a good benchmark. Stock nr 11 is the one you would know the least about and would constitute maximum 4% of the portfolio, thus making very little difference to your returns.

- Sell your winners and buy more of your losers if your analysis still holds. Optimize your portfolio with dynamic rebalancing (regularly update portfolio weights to reflect the current risk/reward ratios for your holdings).

- Don’t invest in just equities. There Is aN Alternative: TINA. Use 10% gold, for example, as a complementary asset.

- Make sure you understand the negative aspects of your investments. You should be able to convincingly pitch for the opposing side.

- Never go all in on a single stock. Don’t give bad luck the opportunity to ruin you. Keep dry powder to make sure you always get to keep playing (investing)

- Invert! For example: The US economy might be dependent on Taiwanese semiconductors (and thus on China), but China is dependent on US and global consumer demand.

Sector or Industry Focus

Do you focus on specific sectors or industries for your personal investments, and if so, how do you select these areas?

I want long term growth, secular trends, or very low valuations or new credible disruptors in other more stagnant sectors. Robotics, automation, electrical transition, AI, health, security, entertainment, transport, energy, money. gold, crypto.

I try to think in terms of “What makes the world turn and people tick?”. Maslow’s hierarchy of needs and basic infrastructural necessities govern my thinking: Energy and money form the base layer, including commodities like oil, battery metals, fintech and crypto. Then there is food, shelter, transportation, entertainment, infrastructure. And various technological support sectors: software, semis, AI.

In the end everything fit my criteria one way or the other. It all boils down to the individual company valuation. I want it to be easy to see when I will get my money back - with a significant compensation on top for waiting, for lending my money.

Portfolio Rebalancing

How do you approach rebalancing your personal portfolio? Is there a specific frequency or set of conditions you look for?

At least once a year is a good benchmark to check one’s portfolio weights.

But a more productive tactic is to sell winners and buy losers if certain asset pairs move apart by one or two annual return requirements in a short time span for no reason.

Behavioural Investment Aspects

As someone who has managed large sums, how do you deal with the behavioural aspects of investing, such as emotional bias or overconfidence?

In my book The Retarded Hedge Fund Manager I noticed that I oscillated between hubris and depression every few years. No matter what I do, I tend to get overconfident after a wave of hard work and subsequent success.

And that overconfidence typically leads to losses and having to scale back and get back to basics.

I see no easy way to get around the process.

I try to be as systematic as possible, doing my research, being patient, controlling my risk level, not going after the big wins, but in the end, I go there anyway.

As a manager I have certain risk limits that I adhere to, but as a private investor I only answer to myself and thus can and do take much higher and concentrated risks.

Market Adaptation

Given the market's evolution over the years, how have you adapted your investment strategy for your personal portfolio?

It’s the same as always, I still focus on long term value.

Maybe I’ve become a bit more tolerant to high near to mid-term multiples and to high long term profit forecasts. But in general, the principles and the focus are the same.

I do consider however that central banks and politicians have become increasingly focused on the financial markets, consequently making for shorter downturns, more and earlier stimulus and generally higher valuations.

More valuation-agnostic index and algo funds also make higher valuations, not least for the largest companies, more likely and kind of sustainable.

Incorporating Technology in Investing

How do you incorporate modern technology and tools in managing your personal investments?

I can’t say I do.

- I just use free online screening tools and back of the envelope calculations of what a typical P/E or P/S valuation would mean for the stock price about 4-5 years from now.

- I don’t use algos

- I don’t use sophisticated screening methods, trying to sift through a higher number of alternatives or using more complicated search combinations.

I think in very big picture terms, trying to imagine what the world and the market might look like 5-10 years from now: what sectors or countries should be in favour (Mining? AI?), which fell out of favour (fast fashion?). How have revenues and profits developed for the companies I’m interested in. What valuation multiples are likely to be common in that context: P/E 5, PE 10, PE 15? P/S?

Most Important Economic Indicators

What economic indicators do you consider most crucial when assessing the potential of an investment for your personal portfolio?

The overall market valuation level in terms of cyclically adjusted earnings multiples. If the overall market is expensive, I consider that a headwind for all stocks, since the market might start trending downward, or even crash. I don’t use short term timing data series like PMIs, interest rates, inflation data, GDP growth numbers, job market data, national debt levels etc.

Long-Term vs Short-Term

Do you prefer long-term holdings or short-term trades for your personal investments, and what factors influence this decision?

I only invest long-term. I only buy stocks that if their valuation multiples evolve in a normal fashion, I should make at least 20% per year on average if I hold them for 5-10 years. But I typically aim much higher than 20% per year.

Investing Milestones

Can you share a couple of milestones or significant achievements in your personal investing journey post-retirement?

My investment in Creditsafe has increased about 100x, as did my investment in Wkit (but that was before I retired).

Since I retired, my investment in Vinter Capital, a crypto index company, is or was up by some 10-20x before the VC winter. If there’s another crypto summer in 2024-25 that should be the floor valuation, and I might get lucky and make 100x on Vinter before there is a liquidity event (takeover, IPO or similar).

Apstec is hard to say anything about right now. I think it could end up being a 10x, once it goes public or is sold to a larger company within the coming 2 years. Right now, however, it’s only valued slightly higher than my entry price in the most recent cap raise round. Those cap raises are made at deliberately low levels for the benefit of existing shareholders though, they don’t say anything about the true value.

Polskenet, my currently largest investment in established value, is up by about 100% so far, but that’s at a quite conservative valuation, and I expect another quick doubling when we add some leverage and potentially go public as well. There is a planned liquidity event in the spring of 2024 and another in 2025, so I’ll soon get confirmation of the actual value.

Advice for Aspiring Investors

What advice would you give to knowledgeable personal investors who wish to manage their own portfolios effectively, drawing from your extensive experience?

- Around ten stocks

- stay focused, don’t jump from ship to ship, to anything that seems shiny, first accumulate experience and information on very few promising companies, then slowly add one company at a time.

- Don’t trade too much, set a few price alerts, rebalance yearly or when large unwarranted relative moves in valuation/prospective annual returns

- Focus on the big picture and large margin of safety, not fancy models, and detailed calculations

- never buy stocks that promise just 10-15% annual returns if you’re right. Just buy an index fund in that case

- Focus on what you don’t know, try to estimate your weak points and level of uncertainty

- Don’t get greedy in a single stock unless you positively know what you’re doing – you rarely don’t

- take that stop loss on a falling stock unless you’re certain you know the market is wrong

Investment Course Launch

You mentioned you are launching your investment course in English soon. Can you tell me a bit more about the course. How it came about, your target audience and what is included?

I’ve thought about what it means to value a company at least since 1990, when I commenced my finance studies at the Stockholm School of Economics. When I started my first job as an analyst in 1994, I was shocked to see that professional broker firms used P/E ratios as the basis for their investment recommendations, when I had learned at SSE that “DCF is the only correct way”.

As a sell-side analyst, I found my own pragmatic way of predicting accounting data from company research & extrapolation; and finding a balance between an estimate of a theoretically warranted equity value and the likely market valuation in a certain economic context. When I later moved to the Buy Side in the form of the hedge-fund Futuris things changed again. With actual money on the line my perspective shifted to being more cautious and aware of risks and share price downside. I became more focused on the likely stock price trajectory and endpoint than some theoretically correct price based on my annual average returns were I to hold the asset forever.

After my first voluntary retirement from the industry in 2014, I invested heavily in start-ups. There I learned more about the time and risk aspects. Start-ups tend to fail no matter how much you think you know. I’ve been hit by both fraud/theft, bad luck, and legislation, but also poor product/market fit, and just incompetent or lazy founders.

The Investing Course (TIC) is the distillation of all my investment knowledge accumulated from 1990 to 2023 as a financial economics student, a sell-side analyst, a hedge fund manager at two different hedge funds, and as a business angel / venture capitalist with investments in some 20 start-ups in various sectors.

My podcast partner Ludvig Sunström came up with the idea of a course in finance some five years ago. We started with creating a 12-week course in Swedish that we’ve run for 8 classes by now, and #9 starting early 2024.

Based on feedback from the Swedish version the English TIC version has been scaled back to six weeks without taking anything essential out from the course material. In addition, there is much more audio and video material, not least 14 hours of video lectures from my series at London Business School.

TIC is the result. It aims to teach the best practices in valuation and investing to the average investor.

The course holds a lot of value for those who already work in finance or have invested their own money for several years, but it’s mainly aimed at slightly advanced or interested beginners, that want to eliminate guesswork and blindly following recommendations from their investment process.

If you have at least 10 000 USD to invest in stocks then The Investing Course is for you, given that you want to understand the companies you are investing and their value, rather than just try to analyse stock charts and do blind momentum investing.

Valuation when you buy

The valuation you buy at determines your annual returns if you hold forever. If you don’t know what valuation you’re buying at, you risk baking a lot of loss into your investment cake.

Our clients don’t need to know finance or economics before starting the course. If you’re interested, have about average IQ, and are ready to spend about five hours per week for six weeks passing the course exam should pose no obstacle at all.

Investing isn’t complicated or needs esoteric accounting knowledge. But it is complex, with potentially confusing feedback loops everywhere. TIC shows how to break that complexity down to manageable parts that can be analysed and extrapolated and then built right back up again to your own effective and robust ever adapting and improving investment strategy

TIC teaches how to Find, Analyse (value), Invest and Manage a portfolio of stocks. It’s an online course with all my best investment practices boiled down to six practical weeks of text, audio, video, summaries, and case studies – one focus theme per week. The first cohort gets to buy the course at a discounted price, including free access to all future updates.

Thank you for your time Mike!

More Information on The Investment Course

Mike where can we find more information on the course?

You can find all the information here:

The Investing Course - A 6 Week Online Course in Stock Investing