In this article, you'll learn how to increase the Magic Formula strategy by adding just one more ratio, like Price Momentum or Price to Book. It explains how each added ratio works, why it enhances your stock selection, and provides back-tested results showing you that it worked.

You'll also get a step-by-step guide to apply these ratios to your own portfolio using a stock screener. This simple tweak could make your Magic Formula strategy even more effective and profitable.

Estimated Reading Time: 6 minutes

If you found this article you may already be using the Magic Formula investment strategy, but did you know you can make it even better? By adding just one ratio to your process, you could increase your returns significantly.

In this article, we show you how combining the Magic Formula with additional ratios like Price Momentum and Price to Book can help you find even better investment ideas.

You will also see back-tested data that prove these combinations work. Plus, we will show you exactly how to apply these ratios in your portfolio.

Click here to start finding your own Magic Formula ideas NOW!

Why Combine Other Ratios with the Magic Formula?

The Magic Formula is great for finding quality companies at bargain prices. It looks at two key ratios: Return on Invested Capital (ROIC) and Earnings Yield. These help you spot companies that earn good returns and are undervalued.

But adding one more ratio to the mix can give you even better ideas.

The Magic Formula alone might miss a great company because it doesn’t account for everything. By using other ratios, you can spot companies with an upward moving stock price or are trading below their true value.

Key Ratios to Add

Here are three ratios that can improve your results when combined with the Magic Formula:

- Six Months Momentum: This ratio lets you select the Magic Formula companies that have increased the most over the past six months.

- Twelve Months Momentum: This ratio lets you select the Magic Formula companies that have increased the most over the past twelve months.

- Price to Book (P/B): This shows how cheap a company is compared to its assets. A low P/B ratio can help you find companies that are trading below their book value.

These ratios work well with the Magic Formula because they help you focus on stocks that are not only good and undervalued but also moving up in price or cheap in terms of book value.

Back Tested Success: Combining Ratios with the Magic Formula

The Test Period: Europe, 1999-2011

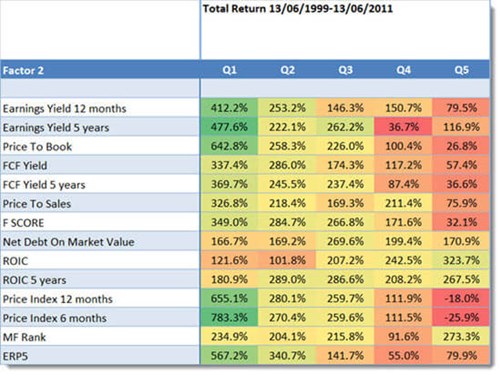

Let’s look at some real numbers. Over a 12-year period from June 1999 to June 2011, we tested the Magic Formula in Europe. We tested it with a further 13 ratios to see if they can improve the already good returns.

The back test universe included about 1500 companies in 17 Eurozone countries, giving us a good sample size.

Results from Specific Combinations

Here’s what we found:

- Magic Formula + Six Months Momentum:

- Performance: This combination led to returns of 783% over 12 years, a 600.5% improvement over the Magic Formula returns.

- Why It Worked: Adding Six Months Momentum helped you find companies that were already moving up in price, you just had to get on this upward moving stock price.

- Magic Formula + Twelve Months Momentum:

- Performance: Returns improved to 655% when you added Twelve Months Momentum a 472.3% improvement over the Magic Formula only returns.

- Why It Worked: the same as above, when adding Twelve Months Momentum it let you find companies that were already moving up in price, you just had to get on this upward moving stock price.

- Magic Formula + Price to Book:

- Performance: This combination delivered returns of 642.8% a 460% improvement.

- Why It Worked: Price to Book let you select companies trading at a low price compared to their book value. This result surprised us as Price to Book has proven to be a less effective valuation ratios in this time of technology companies that do not really have any hard assets. Perhaps this was because we tested the strategy in Europe with more industrial type companies.

All The Ratios We Tested with The Magic Formula

The following table shows all the ratios we tested with the Magic Formula.

As you can see, the returns of the Magic Formula (+182.8%) can be substantially improved.

Magic Formula returns when combined with a third ratio in Europe from June 1999 to June 2011.

Source: Quantitative Value Investing in Europe: What works for achieving alpha

In all cases we first selected the 20% best Magic Formula companies and then selected only those companies that were best rated with the ratios in the column called Factor 2.

Click here to start finding your own Magic Formula ideas NOW!

How to Use a Stock Screener to Implement These Strategies

Now that you know these combinations can improve your results, let’s walk through how you can use a stock screener to apply them in your own portfolio.

You can use any stock screener that has all the ratios you need. In the example below we will show you how to do this using the Quant Investing stock screener. It is built for this type of analysis.

Step-by-Step Guide for Using the Quant Investing Screener

Step 1: Choose the Magic Formula Screen

First, log in to your stock screener. Start by selecting the already saved for you Magic Formula screen, which automatically filters for ROIC and Earnings Yield.

Step 2: Add a Secondary Ratio

Once you have your Magic Formula list, you can add an additional ratio. Here’s how:

- Six Months Momentum: Use the filter options to select Price Index 6m and set it to find companies with the highest value (usually the top 20-30% of companies).

- Twelve Months Momentum: If you want to focus on companies with the best 12-month momentum add Price Index 12m strong cash flow, to your screen.

- Add Price to Book: Use the filter options to select Price to Book and set it to find companies with the lowest P/B ratios (usually the top 20-30% of companies).

Step 3: Refine by Market

Next, customize your screen to focus on specific markets. You can choose to look at companies in Europe, the U.S., or globally depending on your investment preferences.

Step 4: Build and Manage Your Portfolio

Finally, use your results to build a portfolio of at least 20-30 stocks. Spread your investments across different sectors and markets to keep your portfolio diversified.

Remember to rebalance your portfolio once a year by replacing stocks that no longer meet your criteria with new ones that do. You can also do this every six month but, because of trading costs, we do not recommend that you do this.

Psychological and Technical Considerations for Combining Ratios

Avoiding the Pitfall of Over-Optimization

While it’s tempting to add a lot of filters, try not to overcomplicate things. The Magic Formula works well on its own and adding one ratio can make a big difference. But adding too many ratios or filters can lead to analysis paralysis, where you spend more time tweaking your strategy than investing.

Emotional Discipline

It’s important to stick to your strategy, especially when the market is volatile and when your portfolio underperforms the market. All strategies do this from time to time.

Back-tested data shows that these combinations work well over time, but you need to be patient. Avoid the temptation to chase short-term trends or react emotionally to market dips. Trust the strategy and stick to your long-term plan.

Also think about implementing a trailing stop loss strategy to keep your losses low. This will make sure you stick to the strategy in the long run as it will lower your emotional stress.

Final Tips and Takeaways

Key Takeaways

By adding ratios like Six- and Twelve-Months Momentum or Price to Book to the Magic Formula, you can improve your investment results. These additional ratios help you find companies that are not only undervalued but also moving up in price and am trading below book value.

Actionable Advice

Start by experimenting with these combinations using the Quant Investing screener. See how adding one or two extra ratios affects your portfolio, and don’t be afraid to adjust your strategy based on what you learn.

Remember to keep your portfolio diversified and rebalance it once a year to stay on track.

Final Thought:

The Magic Formula is a powerful strategy but adding a few key ratios can take it to the next level. Stick to your strategy, trust the data, keep your losses low and watch your returns grow over time.

Frequently Asked Questions

Why should I add more ratios to the Magic Formula?

Adding ratios like Price Momentum or Price to Book can help you find stocks that are not only undervalued but are also gaining in price or trading below their true asset value. This can improve your chances of higher returns without making your strategy too complex.

What is Price Momentum, and how does it work?

Price Momentum measures how much a stock’s price has increased over a period, like 6 or 12 months. Choosing stocks with strong momentum means picking companies that are already moving up, making it more likely they’ll keep rising.

What is the Price to Book (P/B) ratio, and why use it?

The Price to Book ratio compares a stock’s price to its assets. A low P/B ratio could mean the stock is undervalued, letting you buy companies at prices below their worth. This ratio is handy for finding “cheap” stocks that others might overlook.

How do I combine the Magic Formula with the Six-Month Momentum ratio?

First, use a stock screener to apply the Magic Formula to filter for high ROIC and earnings yield. Then, add a secondary filter for Six-Month Momentum. This will help you pick companies with both strong fundamentals and positive recent price movement.

How effective is adding Twelve-Month Momentum to the Magic Formula?

Back tests showed adding Twelve-Month Momentum improved returns by over 472%. This combination focuses on stocks with both solid fundamentals and longer-term price gains, which often points to continued growth.

How can I add Price to Book as a filter with the Magic Formula?

In your screener, apply the Magic Formula first, then add Price to Book as a filter to find the lowest P/B stocks among those that pass the Magic Formula. This helps you pick undervalued stocks.

Can I use too many ratios?

Yes, adding too many ratios can overcomplicate your strategy. This may lead to “analysis paralysis,” where it’s hard to decide on any stock. The Magic Formula works best with one or two added ratios for a focused, effective approach.

How often should I rebalance my portfolio with these strategies?

Yes, adding too many ratios can overcomplicate your strategy. This may lead to “analysis paralysis,” where it’s hard to decide on any stock. The Magic Formula works best with one or two added ratios for a focused, effective approach.

How can I stick to this investment strategy when the market is volatile?

Volatility can make sticking to your plan tough, but trusting the data and keeping a long-term view helps. Set up a trailing stop-loss at around 15-20% to limit losses, so you’re less tempted to abandon your strategy during downturns.

Click here to start finding your own Magic Formula ideas NOW!