This article walks you through how to use Joel Greenblatt's Magic Formula investment strategy to find undervalued, high-quality stocks. You’ll see real-world results, including performance data from the U.S. and international markets, that show why this approach is so powerful.

Learn how combining this formula with additional factors, like momentum, can increase your returns even more. Plus, get practical tips to easily implement the Magic Formula yourself and protect your portfolio from big losses.

Estimated Reading Time: 6 minutes

Looking for a simple, proven way to pick stocks that beat the market? That’s exactly what the Magic Formula investing strategy was designed to do. Created by Joel Greenblatt, this formula helps you find undervalued, high-quality stocks easily, giving you a serious advantage as an individual investor.

First a bit of background information.

How Magic Formula Investing Works

The Magic Formula ranks stocks using two ratios: Earnings Yield and Return on Invested Capital (ROIC).

- The first, Earnings Yield, measures how cheap a stock is. It helps you get the most for your money because it considers the company's earnings against its value, including debt.

- ROIC, on the other hand, measures the company’s quality, looking at how efficiently a company uses its money to generate profits.

In short, these ratios help you find stocks that are both "on sale" and well-run.

Once the stocks are ranked on each factor, the formula adds up these rankings and identifies the best companies overall. It is an easy way for you to use one ranking for quality stocks at good prices.

It is not hard to do the calculations if you have all the data, it just takes a lot of time. That is why we recommend using a stock screener that does the ranking for you.

Historical Results of Magic Formula Investing

So, how has the Magic Formula performed over time?

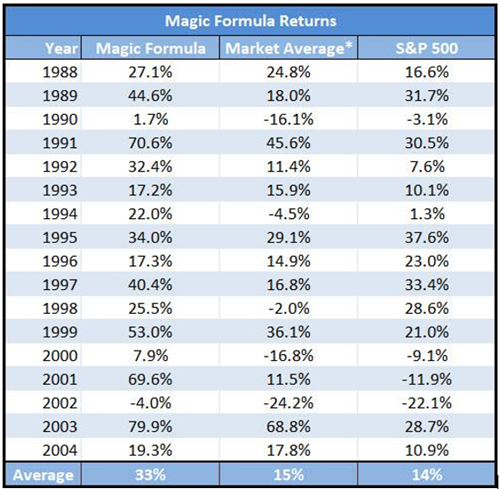

According to Joel Greenblatt’s research, in the 16 years from 1988 to 2004, Magic Formula stocks returned an average of 33% per year, compared to the market’s 12%. These results, published in Greenblatt’s book, show that investing in undervalued, high-quality companies can give you a significant edge over time.

Here are Joel’s results from his book:

Source: The Little Book That Still Beats the Market 2006

*Market Average return was the return of an equally weighted index of the 3,500-stock universe Joel used when testing the Magic Formula

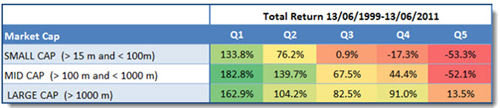

But the Magic Formula also works outside the U.S. For instance, back-tests in Europe from 1999 to 2011 showed Magic Formula stocks outperformed the market by an impressive 152.3%.

Here are the results:

Magic Formula returns in Europe from June 1999 to June 2011 by company size.

Source: Quantitative Value Investing in Europe: What works for achieving alpha

As you can see companies with the best Magic Formula rank, quintile 1 (Q1) in the above table, did a lot better than companies with the worse Magic Formula rank (Q5), and did this for small, medium and large companies.

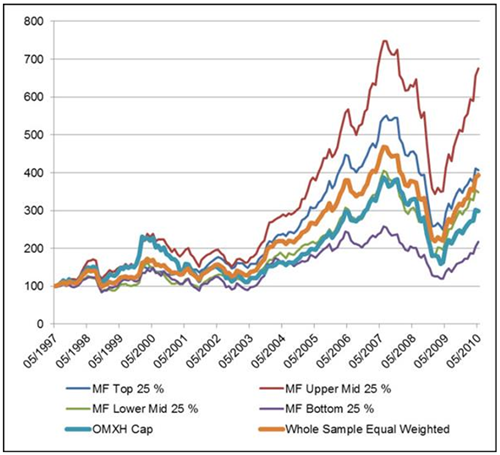

Even in smaller markets, like Finland, studies found Magic Formula investing beat the market by choosing quality stocks.

Here are the results:

As you can see the Magic Formula could have helped you outperform the market.

Click the following links to see more Magic Formula results and back tests.

Click here to start finding your own Magic Formula ideas NOW!

Improving Magic Formula Results with Additional Factors

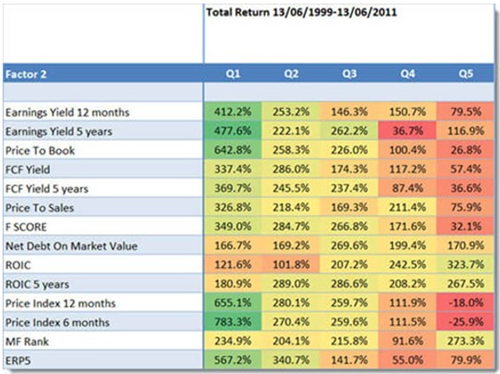

Now, what if you could make the Magic Formula even better? Research shows that adding a single extra ratio—like momentum—can improve returns substantially.

For example, by adding six-month price momentum, the return jumped from 183% to 783% over a 12-year period in European markets. This simple addition allows you to capture stocks that are both cheap, high-quality, and on an upward price trend.

Here are the detailed results:

Magic Formula returns when combined with a third ratio in Europe from June 1999 to June 2011.

Source: Quantitative Value Investing in Europe: What works for achieving alpha

In all cases we first selected the 20% best Magic Formula companies and then selected only those companies that were best rated with the ratios in the column called Factor 2. The table shows the results for the Magic Formula when combined with different ratios would be a great way to visualize these enhancements.

Why Magic Formula Still Works Today

One of the best things about the Magic Formula is its resilience. Unlike some strategies that work only in certain economic conditions, the Magic Formula has proven effective in various markets and across decades.

This happened because it focuses on two fundamental aspects of good investing: buying quality stocks and getting them at good prices.

By following these principles, the Magic Formula helps you avoid the risk of “shiny object” investing—chasing trends that might not last.

It’s also worth mentioning that you don’t need to limit yourself to U.S. stocks.

With more companies worldwide, you increase your chances of finding the best high-quality bargains the Magic Formula was designed to identify. Also using the strategy across borders helps you avoid the risk of home country bias we all have.

Practical Steps to Implement Magic Formula Investing

Implementing the Magic Formula is easier than you might think. First, use a stock screener to find companies with high earnings yields and returns on invested capital.

Quant Investing’s screener does all this for you, and it covers global markets, so you don’t have to do the calculations yourself. Just load the Magic Formula screen (already saved for you), select the regions or markets you prefer, and set filters for daily trading volume and market size. And click a button.

Once you have your list, build your portfolio of about 30-50 stocks, each with an equal amount invested. This balance helps you avoid putting too much on any single company. Hold each stock for a year, then replace and rebalance.

Keeping your process simple and sticking to your rules is key to making this strategy work. By using a systematic approach, you’ll have a better chance of seeing consistent returns over time.

Click here to start finding your own Magic Formula ideas NOW!

Keep Your Losses Low with a Smart Stop-Loss Strategy

What you may want to consider is using a well-designed stop-loss strategy to protect your portfolio when using the Magic Formula.

Stock prices are unpredictable, and while some investments soar, others can take unexpected dives. Setting a trailing stop loss lets you limit your downside by automatically triggering a sale if a stock falls too far. This lets you lock in profits and minimizing large losses.

To implement a trailing stop loss effectively, set it to sell if the stock price drops by a certain percentage from its highest price since you bought it. For the Magic Formula strategy, consider a 15% to 20% trailing stop loss. Here’s how it works:

- Track from the All-Time High: Calculate the stop loss based on the highest price reached since you purchased the stock. If a stock hits $100 and you set a 20% stop loss, it will trigger a sell order if the stock price falls to $80.

- Review Monthly, Not Daily: Resist checking stop losses every day, as daily volatility can cause unnecessary selling. Instead, review your stop-loss levels weekly or rather monthly. This approach reduces trading costs and prevents emotional reactions to market swings.

- Account for Dividends: Dividends can impact stop-loss calculations, especially for high-yield stocks. When a stock goes ex-dividend, its price typically drops by the dividend amount. Failing to adjust your stop-loss level for dividends may lead to premature selling. Use this formula to factor in dividends: Trailing Stop Loss = Current Price − Highest Price + Dividend per Share

- Sell and Reinvest: When a stock hits your stop-loss level, sell it and reinvest the cash into a new idea from your Magic Formula picks. This keeps your capital in stocks that have the best prospects rather than in lagging investments.

Applying a trailing stop loss with these adjustments will make it a lot easier to follow the Magic Formula with discipline and confidence. This is because you will know you’re your profits are protected and your losses limited.

It is a lot easier to buy a stock if you have a clear plan on how you will get out if things do not go according to your plan.

Conclusion

The Magic Formula has shown great results throughout the world and can give you an edge in the market.

By focusing on quality stocks at reasonable prices, it simplifies your stock picking and as you have seen it has a strong track record of outperformance. With evidence from both U.S. and international markets, you can feel more confident using this strategy no matter where you invest.

Ready to try the Magic Formula yourself?

Start with a stock screener, set up your portfolio, and remember to keep things simple. The best investment strategies are the ones you stick with over the long term, and the Magic Formula is a great strategy you can use to help you reach your investment goals.

Click here to start finding your own Magic Formula ideas NOW!

Magic Formula Investing Strategy Results Frequently Asked Questions

What is the Magic Formula, and how does it help me as an investor?

The Magic Formula is an investment strategy developed by the great hedge fund manager Joel Greenblatt. It helps you find undervalued, high-quality stocks by focusing on two factors: Earnings Yield (EBIT to Enterprise Value) and Return on Invested Capital. This gives you a simple way to identify stocks likely to perform well.

Why are Earnings Yield and Return on Invested Capital important?

Earnings Yield shows how cheap a stock is, while Return on Invested Capital shows how well a company uses its money or capital. Together, they help you find companies that are both affordable and well-run, a powerful combination for investing success.

Does the Magic Formula really work in different markets?

Yes, studies show it works not only in the U.S. but also in markets like Europe and Finland. The Magic Formula has outperformed the market average in various places, proving its effectiveness across different economic environments.

Can I use the Magic Formula even if I’m new to investing?

Absolutely! The Magic Formula is straightforward, especially if you use a stock screener. This way, you don’t need advanced skills, just a screener to calculate the rankings for you based on Earnings Yield and ROIC.

How has the Magic Formula performed historically?

In the USA between 1988 and 2004, Magic Formula stocks averaged 33% returns, compared to the market’s 12%. This track record shows its potential to beat the market over the long term by focusing on quality and value.

How often should I check or adjust my Magic Formula investments?

The strategy works best when you hold each stock for one year. After that, replace underperformers and rebalance your portfolio. This disciplined approach keeps you from frequent, costly trading and helps capture long-term returns.

What’s a stop-loss strategy, and should I use it with the Magic Formula?

A stop-loss automatically sells a stock if it falls a set amount below its high. For the Magic Formula, a 15–20% stop-loss can help protect you from big losses while letting winning stocks grow.

Can adding other factors improve the Magic Formula’s results?

Yes, adding factors like momentum can improve returns. For example, using six-month momentum with the Magic Formula in Europe increased returns significantly, helping capture both quality and price growth.

Do I need to limit my Magic Formula investing to U.S. stocks?

No, the Magic Formula works internationally. Screening stocks from different countries can help you find more opportunities and spread risk. Many screeners include global markets, making this easier.

Is the Magic Formula still effective today?

Yes, the Magic Formula has remained reliable across different markets and times. It does of course not always work best, but no investment strategy does. By sticking to fundamental principles—quality and value—it helps you avoid hype-driven decisions and focus on solid stocks.

Click here to start finding your own Magic Formula ideas NOW!

Please note: This website is not associated with Joel Greenblatt and MagicFormulaInvesting.com in any way. Neither Mr Greenblatt nor MagicFormulaInvesting.com has endorsed this website's investment advice, strategy, or products. Investments recommendations on this website are not chosen by Mr. Greenblatt, nor are they based on Mr Greenblatt's proprietary investment model, and are not chosen by MagicFormulaInvesting.com. Magic Formula® is a registered trademark of MagicFormulaInvesting.com, which has no connection to this website.