This the editorial of our monthly Shareholder Yield Letter published on 2023-11-14. Sign up here to get it in your inbox the first Tuesday of every month.

More information about the newsletter can be found here: The best large cap investment strategy ever

This month you can read about a BIG investment mistake we all make. It is easy to fix with a bit of courage. If you do it will give you higher, more consistent returns.

But first the portfolio changes.

Portfolio Changes

Buy Four – Sell One

Four new recommendations this month as the MSCI World index is above its 200-day simple moving average.

The first is a US-based company that produces and markets tobacco, cigarettes, and related products with a shareholder yield of 11.1%, share buybacks of 1.4%, and it pays a dividend of 9.6%.

The second is a Germany-based chemicals producer with a shareholder yield of 8.6%, share buybacks of 0.8%, and a dividend yield of 7.8%.

The third is a French-based financial services company with a shareholder yield of 9.6%, share buybacks of 1.6%, and a dividend yield of 8.0%.

The fourth and last recommendation is a United Kingdom-based retailer with a shareholder yield of 8.8%, share buybacks of 4.8%, and a dividend yield of 4.0%.

Stop Loss – Sell One

Sell ArcelorMittal S.A. at a loss of 15.6%.

The big investment mistake we all make

Have you so far only bought recommended companies in your home market or one other market you feel comfortable with. The USA for example?

If you do you are not alone but it’s a BIG mistake as it limits your investment opportunities and gives you lower returns.

Why do we do this?

I am sure you agree that increasing the number of companies (including more countries) in your investment universe can help your returns. This is because it helps you find ideas that better fit your investment strategy.

But it’s not easy to do.

We all think that where we live is safe, we think we know the companies better and it feels comfortable. I see this all the time with subscribers for example only buying US or European ideas.

But is this true?

Every country has problems

Be honest, every country has had its problems in terms of accounting fraud and other scams. If you don’t believe me, look at all the investment frauds and scams in your country over the past five year.

It will be a sobering experience as I found here in Germany – think Wirecard and the Dieselgate scandal.

As you can see fraud, or a scam can hit you anywhere.

If its 50% cheaper

If a country is not a complete banana republic and you can buy a company there for 50% or even cheaper than your home country you are paid well for taking the risk of PERHAPS somewhat more relaxed accounting rules, if at all.

You are not alone

If you mainly invest at home, you are not alone.

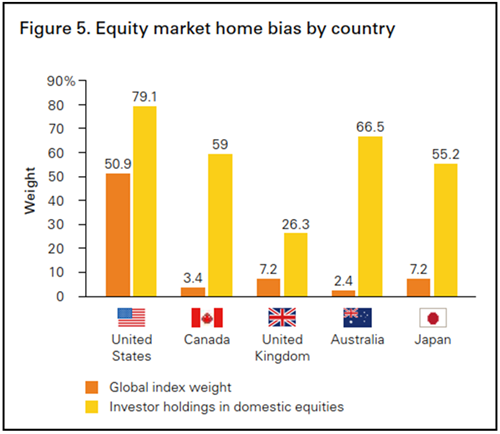

The 2016 research paper The buck stops here: The global case for strategic asset allocation and an examination of home bias by the fund manager Vanguard contained this chart:

Source: The buck stops here: The global case for strategic asset allocation and an examination of home bias - Vanguard – July 2016

The chart shows that US investors don’t look bad in terms of home bias – the difference between the orange and yellow bars. BUT this is most likely only because they have the largest stock market.

Investors in Canada don’t seem to trust even their US neighbours much, but the Australians look by far the worse in terms of home bias.

Germany was not listed, probably because it has not got much of an equity culture, but I am sure it would also be bad.

What the worst thing that can happen? You can lose everything

What can happen if you don’t diversify across countries, you may be thinking.

You can get wiped out.

Yes, you can get wiped out as happened to stock and bond investors in Germany and Russia around the 1920’s (in Russia again in 2022 perhaps). I admit it’s an extreme example and is relatively unlikely.

But even if it is, the fact remains that the bond and stock markets of countries perform very differently.

Think of the US market outperforming most markets over the past 10 years. This is great but is unlikely to do so over the next 10 years because the market has become overvalued.

No one knows what market will perform best so spreading your investments world-wide is a great strategy for consistent long-term returns.

Does investing worldwide work?

But does investing worldwide work? Isn’t it risky?

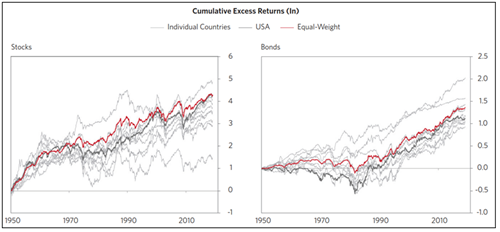

It works great as proven in a 2019 research paper by the investment firm Bridgewater Associates ($124.7 billion assets under management) called Geographic Diversification Can Be a Lifesaver, Yet Most Portfolios Are Highly Geographically Concentrated.

The following charts show the stock and bond market returns of the USA (dark grey line) other countries (light grey lines), and an equal country weight portfolio (red line).

Source: Bridgewater Associates - Geographic Diversification Can Be a Lifesaver, Yet Most Portfolios Are Highly Geographically Concentrated

Red line = Equal weight portfolio, Dark Grey line = USA, Light Grey lines = Individual countries

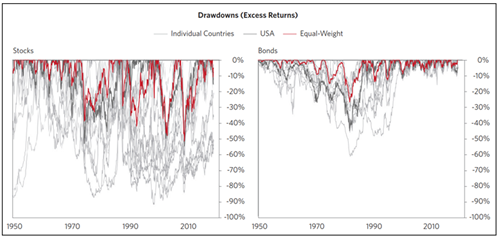

The reason the equal weight portfolio (Red line) does so well because it has lower drawdowns. This gives you more consistent returns which lead to faster compounding of your money.

This following chart clearly shows the lower drawdowns of the world-wide equal weight portfolio (Red line):

Source: Bridgewater Associates - Geographic Diversification Can Be a Lifesaver, Yet Most Portfolios Are Highly Geographically Concentrated

Red line = Equal weight portfolio, Dark Grey line = USA, Light Grey lines = Individual countries

Another report confirming investing world-wide is a great idea

In a 2008 paper called Going global: value investing without boundaries James Montier proved that investing world-wide gives you higher returns.

Does global value investing work?

James wrote the paper after he was asked if he has ever seen any research that proves that value investing works at the global level.

With the paper he wanted to prove his idea that an investor should be allowed to invest anywhere in the world where the most attractive investment opportunities can be found.

Great fund managers have shown it works

This is of course not a new idea as several great value investors such as Sir John Templeton and Jean-Marie Eveillard have shown that value investing works very well if done on a global basis.

As Sir John said:

It seems to be common sense that if you are going to search for these unusually good bargains, you wouldn’t just search in Canada.

If you search just in Canada, you will find some, or if you search just in the United States, you will find some. But why not search everywhere? That’s what we’ve been doing for forty years; we search anywhere in the world” (speaking in 1979).

The European evidence

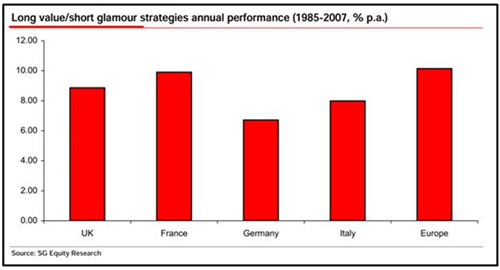

The chart below shows that investing across Europe would have given you higher returns (look at the last bar) and proves that expanding your boundaries across Europe can improve your returns.

Source: Going global: value investing without boundaries by James Montier

All developed markets evidence

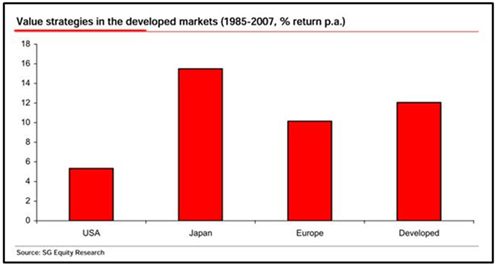

Across three developed markets (Europe, the US and Japan) you can see that investing in ALL developed countries would have given you the highest returns (look at the last bar) apart from Japan.

Source: Going global: value investing without boundaries by James Montier

How to overcome your home country bias

Larry Swedroe in a great 5 December 2019 article called Global Impact of Investor Home Country Bias added another reason why you should overcome your home country bias and invest world-wide.

He wrote (bold comments are mine):

Finally, I add this note of caution, one that might help you avoid home country bias.

If a belief in relatively high market efficiency has led you to conclude that you should be a passive investor—accepting market prices as the best estimate of the right prices—you should also accept the idea that all risky assets have similar risk-adjusted returns.

If that were not the case, capital would flow from assets with lower expected risk-adjusted returns to the assets with higher expected risk-adjusted returns until equilibrium was reached.

If all risky assets have similar risk-adjusted returns, there is no reason to have a home country bias—other than perhaps a small bias to take into account that investing in U.S. stocks is a bit cheaper than investing in international stocks.

On the other hand, if you are still employed, it is likely your labor capital is more exposed to the economic cycle risks of the U.S. than to foreign market risks.

If that is the case, once you include your labor capital as part of your portfolio, you should consider overweighting foreign markets to offset your labor capital risk.

Conclusion, global investing works

So, as you have seen investing world-wide is a great idea, that works! This means it’s a great idea to look for the companies that best fit your investment strategy irrespective of where in the world they are.

This is what we do for you in the newsletter.

Best of all its easy to implement, just widen your investment universe and start investing in more countries. You do not have to go all out and do it immediately, start with a few investments and go from there when you feel comfortable.

If you are very worried, start with smaller positions.