This article, with a back test, proves the Piotroski F-Score can increase your investment returns. It’s a simple, easy to use tool that evaluates a company’s financial health using nine key metrics.

You’ll learn how the F-Score works internationally, including in emerging markets, and see its proven performance in predicting stock returns over nearly two decades.

Plus, you’ll understand why focusing on financially strong companies can add up to 10% or more to your annual returns. This article gives you practical steps to incorporate the F-Score into your strategy, helping you confidently pick better stocks.

Estimated Reading Time: 8 minutes

We have written a lot and really like the Piotroski F-Score (F-Score) as an indicator you can use to improve your returns. It is a simple and easy to use indicator that lets you quickly assess a company’s financial health. The F-Score uses nine financial measures to help you find companies with good financial health or good financial momentum.

It was originally developed and tested in 2000 on U.S. stocks to improve the return of a low price to book investment strategy. This means it has been a reliable tool for over two decades.

We already tested the F-Score in Europe and wrote about it in this article: Can the Piotroski F-Score also improve your investment strategy? In this article we look at a recent 2020 Piotroski F-Score research report called: Piotroski’s F-Score: international evidence.

It is a great research paper that proves that the Piotroski F-Score works on international stocks outside the U.S. across various global markets, including emerging markets.

Before you get to that first a bit of background information.

How is the Piotroski F-Score Calculated?

The Piotroski F-Score is a 9-point checklist that determines a company's financial strength. It is broken down into three categories: Profitability, Financial Health, and Efficiency.

Profitability

1. Return on assets (ROA)

Net income before extraordinary items for the year divided by total assets at the beginning of the year.

Score 1 if positive, 0 if negative

2. Cash flow return on assets (CFROA)

Net cash flow from operating activities (operating cash flow) divided by total assets at the beginning of the year.

Score 1 if positive, 0 if negative

3. Change in return on assets

Compare this year’s return on assets (1) to last year’s return on assets.

Score 1 if it’s higher, 0 if it’s lower

4. Quality of earnings (accrual)

Compare Cash flow return on assets (2) to return on assets (1)

Score 1 if CFROA>ROA, 0 if CFROA<ROA

Funding

5. Change in gearing or leverage

Compare this year’s gearing (long-term debt divided by average total assets) to last year’s gearing.

Score 1 if gearing is lower, 0 if it’s higher.

6. Change in working capital (liquidity)

Compare this year’s current ratio (current assets divided by current liabilities) to last year’s current ratio.

Score 1 if this year’s current ratio is higher, 0 if it’s lower

7. Change in shares in issue

Compare the number of shares in issue this year, to the number in issue last year.

Score 1 if there is the same number of shares in issue this year, or fewer. Score 0 if there are more shares in issue.

Efficiency

8. Change in gross margin

Compare this year’s gross margin (gross profit divided by sales) to last year’s.

Score 1 if this year’s gross margin is higher, 0 if it’s lower

9. Change in asset turnover

Compare this year’s asset turnover (total sales divided by total assets at the beginning of the year) to last year’s asset turnover ratio.

Score 1 if this year’s asset turnover ratio is higher, 0 if it’s lower

Piotroski or F-Score = 1 + 2 + 3 + 4 + 5 + 6 + 7 + 8 + 9

Good or high score = 8 or 9

Bad or low score = 0 or 1

How You Can Best Use the Piotroski F-Score

The F-Score acts like a financial quality filter—helping you avoid weak companies and focus on those getting stronger.

Now back to the back test.

What Was Tested

The main goal of the study was to test whether the Piotroski F-Score could improve stock returns across various international markets. Specifically, the researchers wanted to see if companies with higher F-Score performed better than those with lower F-Score.

What Is a Good and Bad F-Score

But what exactly counts as a "high" or good F-Score?

In this study, companies with an F-Score of 7 to 9 were considered high-F-Score companies. These companies were financially healthier, showing positive trends in profitability, leverage, liquidity, and operating efficiency.

On the other hand, companies with an F-Score of 0 to 3 were considered low-F-Score companies. These firms were generally weaker, with signs of financial trouble such as declining profits, increasing debt, or poor liquidity.

Companies with F-Score in the middle range (4 to 6) were treated as neutral in the analysis.

Key points:

- The study tested if F-Score could predict stock performance in global markets.

- High-F-Score companies had scores between 7 and 9, indicating strong financials.

- Low-F-Score companies had scores between 0 and 3, signalling weaker financials.

Markets Included and Excluded

The study covered 20 developed markets including the UK, Japan, and Germany, and 15 emerging markets such as China, India, and Brazil. The wide variety of markets is good because it tests if the results are relevant to both developed and emerging economies.

U.S. stocks and financial companies were excluded. Also, financial firms, like banks, were excluded because their accounting structures are different, making them hard or impossible to analyse using the F-Score nine ratios.

Key points:

- The Research Covered 20 developed and 15 emerging markets.

- Excluded U.S. stocks and financial firms.

Time Period Analysed

The research looked at data from 2000 to 2018, covering 18 years. This time frame is important because it includes periods of economic growth as well as downturns. By looking at different market conditions, the researchers could see how well the F-Score worked in good and bad times.

Key points:

- The study spanned 18 years, from 2000 to 2018.

- F-Score worked well in both up and down markets.

Click here to start finding High F-Score companies for your portfolio NOW!

How Were Biases Avoided

One of your major concerns with any investment study must be to make sure whether the results are influenced by biases, as they can distort the findings and lead to incorrect conclusions. To ensure accuracy, the researchers took several steps to avoid common biases that could affect the F-Score research results.

Look Ahead Bias

One key technique was how and when they selected companies to avoid "look-ahead bias."

To avoid look-ahead bias, the study used a lagged selection process. This means that companies were selected after their financial statements were publicly available. Specifically, the financial data for a company was only considered from July of the following year after the fiscal year-end. For example, if a company’s fiscal year ended in December 2000, its F-Score was calculated and applied starting from July 2001.

This six-month delay ensured that investors had ample time to review the financial statements, which mimicked real-world conditions. Without this delay, there would be a risk of using information that wasn’t available to the public at the time, leading to inflated performance results.

Small Company Bias

Additionally, to prevent small, volatile companies from skewing the results, the study excluded the smallest 5% of companies by market value in each market.

These tiny stocks often have limited liquidity, making their stock prices more volatile and can potentially skew results of the research. By focusing on larger, more stable companies, the study’s findings became more applicable to everyday investors like us.

Controlled for Investment Factors

The researchers also controlled for other known factors that affect stock returns. These included company size, book-to-market ratios (value), and momentum. By adjusting for the return of these factors, the researchers could make sure that the results were only due to the F-Score's effect.

Key points:

- The study used a six-month delay when calculating the F-Score to avoid look-ahead bias.

- The smallest 5% of companies were excluded to reduce volatility and improve reliability.

- The study controlled for factors like size, book-to-market ratios, and momentum to isolate the F-Score's predictive power.

These bias avoidance techniques give you confidence that the results reflect real-world conditions.

Company Selection Criteria

To ensure the F-Score was calculated correctly, the study included companies that had reliable financial data. The researchers used data from trusted sources like Worldscope.

They excluded companies with negative book value, which could indicate financial trouble. Banks and insurance companies have financial reports that are structured differently, making it difficult to use the F-Score to evaluate them.

Key points:

- Only companies with reliable financial data were included.

- Firms with negative equity and financial companies were excluded.

Portfolio Rebalancing Period

The study rebalanced portfolios once a year in July. New portfolios were formed based on the companies’ F-Scores from the previous year to avoid look ahead bias.

Results of the Study

The results showed that high-F-Score companies outperformed low-F-Score companies by about 10% per year. This was true across both developed and emerging markets, making the F-Score a powerful tool for global investing.

The F-Score also worked well for companies of all sizes—small, mid, and large. So, whether you like investing in small or large-cap’s, the F-Score can increase your returns.

Key points:

- High-F-Score companies outperformed low-F-Score ones by about 10% annually.

- The F-Score worked well for small, mid, and large companies.

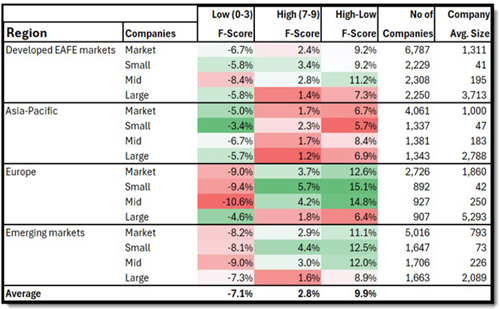

Here are the detailed results of the research paper:

Returns shown are the average annualised monthly size adjusted returns. This means returns higher or lower than all the same size companies in a market. The study spanned 18 years, from 2000 to 2018.

Average company size is shown in millions of US Dollars.

Source: Piotroski’s F-Score: international evidence.

The F-Score Worked!

As you can clearly see the F-Score worked great! High F-Score companies outperformed low F-Score companies by between 5.7% up to 15.1% per year on average.

And it worked across various regions and company sizes worldwide.

This just shows you that focusing your investments on companies with strong fundamentals (indicated by high F-Scores) leads to higher returns.

You can also see that low F-Score companies performed a lot worse than the market(-7.1% on average) compared to the outperformance of good F-Score companies (+2.8% on average). So, like we said in a previous article: Avoid bad F-Score companies like the plague.

Surprising Finding – F-Score Can Predict Future Profitability

A surprising finding of the research study is that the F-Score gives you valuable information about a company’s future profitability (return on assets) in the short and long term.

And provides useful insights beyond just current profits and firm size. The study shows that firms with high F-Scores have an average profitability advantage of 2.3% to 3.1% over low-F-Score companies over one year, and 1.3% in the long term.

While it is commonly believed that current profits are the main factor in a company’s future success, the F-Score adds important information that helps you predict future profitability.

Key points:

- The F-Score also gives you important information about the future profitability of a company.

Conclusion - F-Score Still Works Great

In summary, Piotroski’s F-Score isn’t just for U.S. or value investors or something that only worked in the past. It’s a financial health indicator you can use that works across different markets and types of stocks.

Whether you invest in developed or emerging markets, or whether you prefer growth or value stocks, the F-Score can help you identify financially strong companies.

If you’re looking for a simple way to improve your stock-picking process, consider using the F-Score. Start using it today to take your investing strategy to the next level.

If you want an easy way to apply this, check out the Quant Investing Screener to find high F-Score companies quickly and easily.

Key points:

- F-Score is a versatile tool for global stock picking.

- Start using F-Score today to improve your investment strategy.

Click here to start finding High F-Score companies for your portfolio NOW!

Frequently Asked Questions and Answers About The Piotroski F-Score

1. What is the Piotroski F-Score and how can it help me as an investor?

The Piotroski F-Score is a simple tool that evaluates a company’s financial health using nine criteria related to profitability, leverage, liquidity, and efficiency. Companies with a high F-Score (7-9) are financially strong, while those with a low F-Score (0-3) often signal trouble. By focusing on high F-Score companies, you can increase your chances of finding stocks with solid fundamentals and better future returns.

2. How do I calculate a company’s F-Score?

The F-Score is based on nine questions answered with a "yes" (1 point) or "no" (0 points). These include profitability (like positive net income), leverage (like decreasing debt levels), and operating efficiency (like increasing gross margins). A score of 9 is the highest, indicating strong financial health. You can calculate it manually using financial statements or with tools like the Quant Investing Stock Screener, which simplifies the process.

3. Can the F-Score be used internationally, or is it only for U.S. stocks?

Yes, the F-Score works globally. Research has shown its effectiveness in developed and emerging markets alike, including regions like Europe, Asia, and South America. Whether you're looking at small or large companies, it can improve your decision-making by identifying financial strength.

4. What types of companies are excluded from F-Score analysis, and why?

The F-Score isn’t reliable for financial firms like banks and insurance companies because their financial structures don’t align with the F-Score criteria. Additionally, companies with negative book value or extremely small market caps (bottom 5%) are excluded to avoid volatile or unreliable data.

5. How does the F-Score improve my investment returns?

High F-Score companies outperform low F-Score companies by an average of 10% annually, according to long-term studies. Investing in these companies means aligning your portfolio with strong, improving fundamentals, which historically leads to better stock performance.

6. Can the F-Score predict a company’s future profitability?

Surprisingly, yes. High F-Score companies tend to have better future profitability, often 2-3% higher in the short term and 1% higher in the long term compared to low F-Score companies. This makes it a valuable tool for long-term investors.

7. How can I start using the F-Score in my portfolio today?

Start by screening for companies with F-Scores of 7-9 using a stock screener like Quant Investing. Look for opportunities in different markets and sectors to diversify. Avoid low F-Score companies as they often underperform and carry higher risks. If you're short on time, subscribing to a newsletter like Quant Value can provide pre-screened ideas tailored to your strategy.

Click here to start finding High F-Score companies for your portfolio NOW!