Have you also asked yourself What is the best investment strategy in retirement?

It is a question we get often and one I have asked myself, at I am also not that far away from retirement.

Retirement investment strategy requirements

What requirements do you think an ideal retirement investment strategy must have?

Here are the main ones we have come up with:

- Beat the market – if not you can just buy an ETF

- Less volatile than the market

- Pay you an income – to either reinvest, buy a nice car, or a great vacation

- Be easy to implement

- Only take up a small amount of time

- Can be implemented in a tax-free account

- Allows tax planning – tax loss harvesting

Let me know if you come up with anything else you would like to add.

It is a strategy you may have heard about

With these requirements in mind, we gave the idea a lot of thought and realised that there is a strategy, we have looked at, that is a perfect fit.

It is also one we, and a lot of other great investors, have researched and tested thoroughly. You may even have received an e-mail where we told you about it.

How we found the perfect retirement strategy

This is how we found it.

In the first quarter of 2022 we started looking for a market beating large cap investment strategy.

We did this to complement our Quant Value investment newsletter which recommends small quality undervalued companies world-wide. Subscribers had problems buying the small companies, so we set out to find a large cap strategy.

In other words, companies you can buy easily, also in a tax-free account.

We stumbled onto a strategy that will also work great as a retirement investment strategy.

What we found really surprised us.

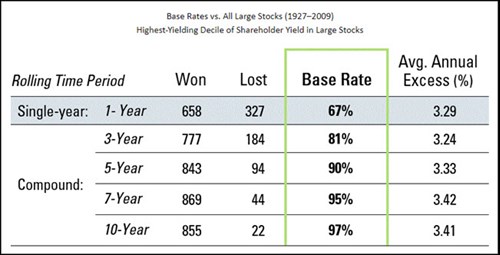

The table below showy you the returns of simply buying the 10% of large stocks that fits the investment strategy over an 80-year back test period:

Source: 7 Traits for Investing Greatness

It beat the market over 95% of the time

If you look at the green highlighted column you will see that over five years, the strategy beat the market 90% of the time and if you go out to seven and ten years the strategy nearly always beat the market - or at least over 95% of the time!

If you look at the column Avg. Annual Excess (%) you will see that it beat the market by over 3% per year. That is outstanding.

The Shareholder Yield investment strategy

What investment strategy are we talking about, you may have asked.

It is the Shareholder Yield investment strategy.

How is Shareholder Yield calculated?

Shareholder Yield is calculated as the sum of: Dividend yield + Percentage of Shares Repurchased

For example, if a company trading at €50 and pays an annual dividend of €1, its dividend yield (DY) is 2%. If same company had 1,000,000 shares outstanding at beginning of year and 900,000 at end of year, the company's share buyback yield is 10% ((1,000,000 – 900,000)/1,000,000).

If you add the two together, you get its Shareholder yield of 12%.

Shareholder Yield is thus all the cash the company returned to shareholders over the past year.

Want to use the Shareholder Yield strategy in your portfolio NOW! - Click here for more info

How to make the strategy even better

When we found the strategy, we immediately thought of a way we can make it even better.

As we have subscribers all over the world, we wanted to include companies in all developed markets worldwide.

It fishes in a great pond

We thought of a great group of companies in which to look for investment ideas.

We got the idea from the great book What Works on Wall Street where James O'Shaughnessy tested an investment strategy of only investing in market leading companies which resulted in market beating performance.

James defined Market Leaders as non-utility companies with larger than average:

- Market value

- Number of shares outstanding

- Free Cash flow and

- Sales above 1.5 times the average of the universe

James used US companies and foreign companies listed in the USA, when he tested his strategy. We wanted to make this universe larger, so we decided to use market leader companies in all developed markets worldwide.

Back test of the best investment strategy

We of course tested the strategy to make sure it can give you great return and beats the market.

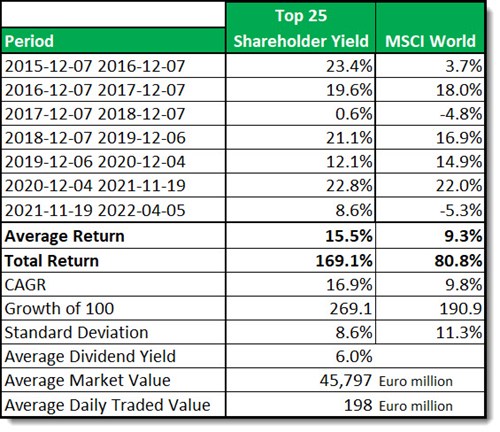

It performed a LOT better than the market on average and on a compound average growth rate basis!

The up and down movements, also called volatility, of returns of the strategy was also lower than the market. This was because of the high average 6% dividend yield of the strategy.

Source: Historical screener at www.quant-investing.com

What makes it a great strategy

No negative years - As you can see the strategy had no negative years whereas the index had two.

High dividend yield of 6% - The average dividend yield of the strategy 6%, so it is also an incredibly good income strategy, for your retirement.

Average market value €45.8 billion or $50 billion - The average company size is massive, over €45 billion ($50 billion). This makes the companies extremely easy to buy also with your current broker and your tax-free account.

Average traded value €200 million or $210 million - The daily traded value is also huge, over $200m per day. This means easy, fast order execution with a low bid-offer spread. No more limit adjustments as the price runs away or expensive orders executed over days.

More detailed back test information

We described the above back test in more detail in the article Best large cap investment strategy ever – Shareholder Yield keeps beating the market.

Want to use the Shareholder Yield strategy in your portfolio NOW! - Click here for more info

A great strategy for your retirement

Let us see how well it meets all the requirements we determined for a great retirement investment strategy.

- It beats the market – by over 3% per year on average

- Back tests showed it paid a dividend of over 6% - enough for a car? Or a great vacation? This depends on the size of your portfolio

- Average company size was €45bn so yes, it is easy to implement

- A few companies to buy and sell per month or quarter – Yes, it is easy to do

- Can be implemented in a tax-free account - Average company size was €45bn so yes, most tax-free accounts should offer trading in these companies

- Allow tax planning – Yes buying individual companies allows you to easy harvest tax losses

How to implement the best retirement strategy in your portfolio

Now comes the most important part, how you can implement it in your portfolio.

You can use any stock screener that has can give you a market leader investment universe and that calculates the Shareholder Yield.

In the following example we have used the Quant Investing stock screener. Ass everything you need is available it is very easy to implement the strategy.

How to set up your screen

After logging in this is how you set up your stock screen.

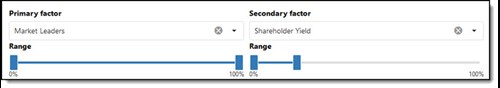

Select Market Leaders as Primary Factor and set the sliders from 0% to 100% to select all Market Leaders companies.

Want to use the Shareholder Yield strategy in your portfolio NOW! - Click here for more info

Then do the following:

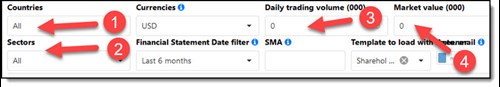

- Select all the countries you want to include. We included China in the back test, you may choose to leave it out.

- Select the industry sectors you would like to include. All sectors were included in the back test.

- In the back test we did not include a minimum daily trade value as the Market Leaders universe already has only large cap companies

- We also did not include a minimum market value as the Market Leaders universe already has only large cap companies

Then click the Apply button to run your screen.

Add Shareholder yield as output column

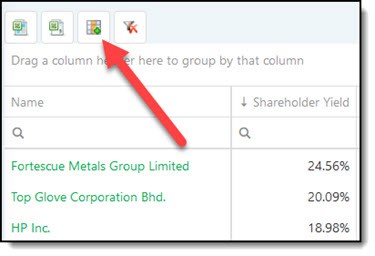

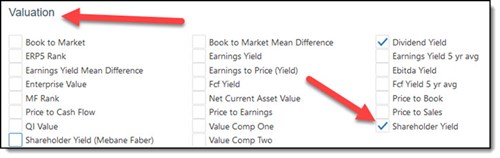

To add Shareholder Yield as an output column, click the Add/Remove Columns icon.

Then click the Valuation tab and tick the box next to Shareholder Yield. The same way you can select all the columns you would like to see.

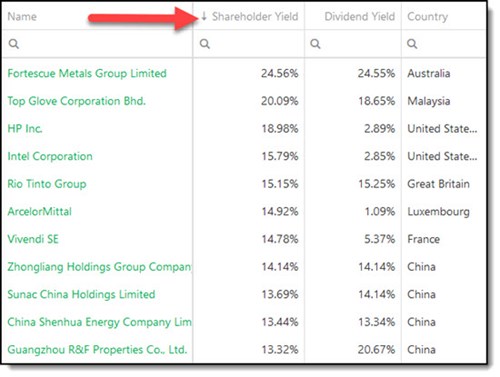

Sort by Shareholder Yield

Click the Shareholder Yield column heading twice to sort it from high to low.

Buy the top 25 companies

In this back test we bought the top 25 Shareholder Yield companies each year.

Save your screen

You can also save your screen to load it with a few mouse clicks whenever you want to re-balance your portfolio.

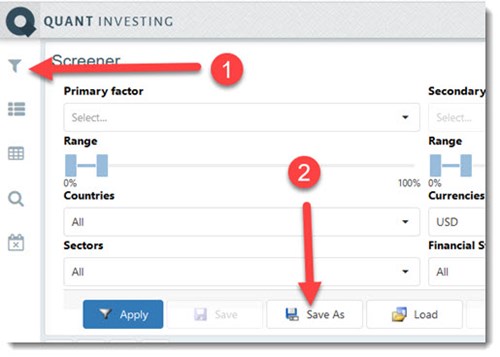

To do this:

- Click the screener small funnel icon

- Click on the Save As button

- Give your screen a name and a description

- Click the Confirm button to save your screen

That is all you have to implement the best retirement investment strategy we have tested in your portfolio.

Wishing you profitable retirement investing!

PS To get the Shareholder Yield investment strategy working in your portfolio today sign up right here .

PPS It is so easy to put things off and forget so why not sign up right now .

Want to use the Shareholder Yield strategy in your portfolio NOW! - Click here for more info