If I have not yet convinced you that the Piotroski F-Score can improve your investment returns I am not sure what more I can do.

Improve your returns by 200% over 12 years

For example, in this article I showed you how the Piotroski F-Score improved the average returns of 13 completely different investment strategies by an average of over 200% over 12 years.

That’s a great improvement you can get by doing one simple thing - buying companies with a healthy F-Score.

You can read the whole article here: Can the Piotroski F-Score also improve your investment strategy?

Click here to get the Piotroski F-Score working in your portfolio NOW!

Companies with a good AND improving F-Score

To help you select good investments we recently added a new report that helps you find undervalued companies with an already good BUT also improving Piotroski F-Score.

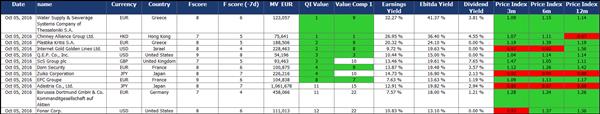

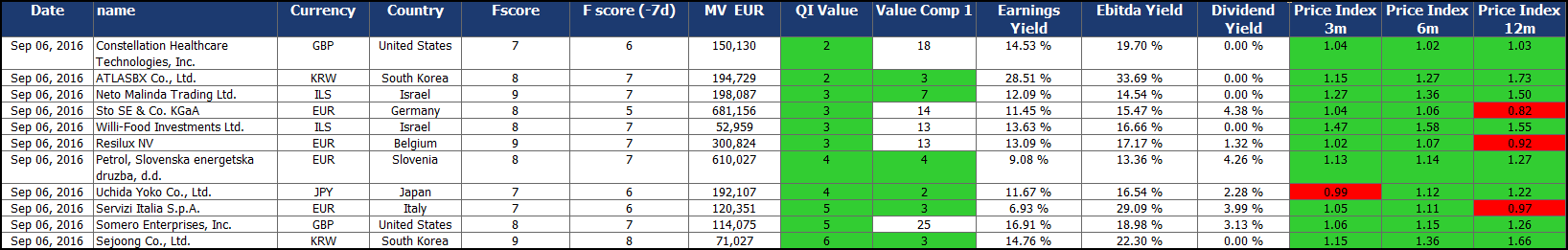

This is what it looks like:

What do all the columns mean?

The following is an explanation of the columns:

- Fscore shows you the current F-Score;

- F score (-7d) the old or previous F-Score;

- MV EUR gives you the current market value of the company in thousands of Euro

QI Value (value the list is sorted by) is our own developed rating system to help you find undervalued companies based on four of the best performing ratios we have tested. You can read more about the Qi Value ranking in this article: This outperforms all other valuation ratios (14 year back test result); - Value Comp 1 (Value Composite One) is an indicator that uses five ratios to help you identify undervalued companies. You can read more about Value Composite One here: This combined valuation ranking gives you higher returns - Value Composite One;

- Earnings Yield is the current Earnings Yield (EBIT/Enterprise Value) of the company;

Dividend Yield shows you what the current dividend yield of the company is; - Price Index 3m shows you the three month share price momentum (current share price / share price 3 months ago) of the company;

- Price Index 6m shows you the six month share price momentum (current share price / share price 6 months ago) of the company;

- Price Index 12m shows you the one year share price momentum (current share price / share price 1 year ago) of the company;

As you can see the report gives you a lot of useful information.

Click here to get the Piotroski F-Score working in your portfolio NOW!

This F-Score report is updated daily

You can find a weekly updated improving Piotroski F-Score report on the website.

Here is how you can get hold of it.

We add the report to the Dashboard page on the website.

After you have logged in, scroll down the page and under the heading Tactical asset allocation Dashboard click on the Go to Dashboard button.

Scroll down on the next page to the bottom of the page and click on the file called “Improved_F-Score”

What are in all the other files?

Along with the improved F-Score report you will see a lot of other files.

To find out how you can profit from the information in these files take a look at the following article: These new tools will give you even more good investment ideas

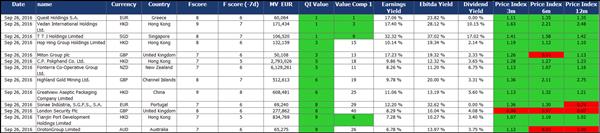

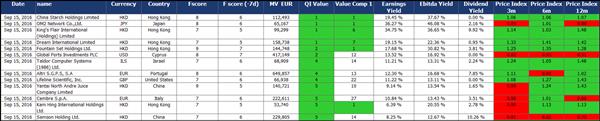

Undervalued companies with an improving F-Score over the past month

To give you a few more investment ideas here are the lists of the undervalued companies with improving F-Score’s over the past month.

Click image to enlarge

PS To get unlimited access to the Improved F-Score report as well as over 110 ratios and indicators to find market beating investment ideas sign up for the screener, it costs less than an inexpensive lunch for two.

PPS Why not sign up now? Simply click the following link: Screener join today

Click here to get the Piotroski F-Score working in your portfolio NOW!