How do you select investment ideas for the Quant Value newsletter? is a question we get a lot and we thought the answer would also interest you.

After all, you are (or are thinking about) investing your hard earned money in these ideas.

Are markets moving up - the newsletter does not invest in falling markets

Before we even start looking for ideas we make sure the markets aren't falling.

You know when markets fall they all fall together – in more technical terms – they become correlated.

This means, when markets are falling and we keep on recommending investment ideas they will soon be sold because of the strict trailing stop loss system the newsletter follows.

This is definitely not what you want!

Stop buying when the market is falling

To solve this problem we follow a simple rule (based on a LOT of solid research) - No new ideas are recommended when the markets are falling.

This means we will only recommend new ideas if the moving average of the respective market is above its 200 day simple moving average (SMA).

This is how it works

For example, if the S&P500 index is above its 200 day SMA (and we can find good undervalued companies) we will recommend investment ideas in North America. If the S&P500 index is below its 200 day moving average no North American companies will be recommended because it means the market is falling.

Now for more information on how investment ideas are found and selected.

Click here to get the Quant Value newsletter's investment ideas NOW!

Ideas from the investment model

The first step is to get a list of companies that fit the newsletter’s investment model.

The investment model is built from the best investment strategies in the 54 page research paper I wrote with my friend Philip Vanstraceele Quantitative Value Investing in Europe: What Works for Achieving Alpha as well as all the latest research we have done on ideas we come across all the time.

We use the Quant Investing stock screener to get investment ideas, using the following ratios and indicators:

- Qi Value – finds cheap companies

- Piotroski F-Score – finds quality companies

- Six months share price momentum – finds companies with an increasing share price over the past six months

- Daily traded value of more than $100,000 – makes sure you can easily buy and sell the ideas

- Market value of more than $50m – this also makes sure you can easily buy and sell the ideas

The screen looks like this:

When we have a list of companies

Once we have a list of companies, we build an analysis spreadsheet with five years of historical financial results on each of the companies.

Make sure a company is correctly included

The spreadsheet helps us make sure the company is not wrongly included in the screener because of data errors or unusual numbers, a large once-off profit for example.

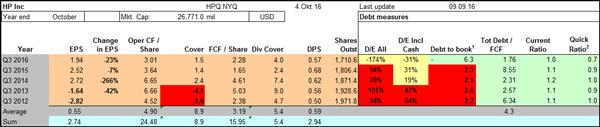

This is what the spreadsheet looks like:

We then work through this 24 point checklist

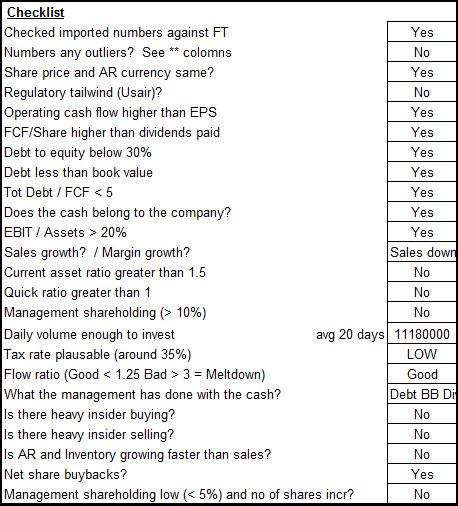

To make 100% sure that the company fits in the newsletter’s investment model, we work through a 24-point checklist that looks like this:

If anything in the checklist looks unusual we do more research or just move on to the next idea.

A company does not have to pass a certain number of checklist items before it is researched further. The checklist questions are there to help us think of all the important items that we need to look at.

Click here to get the Quant Value newsletter's ideas NOW!

Check the latest news

If a company has made it through the above process and we have not found anything unusual we visit the investment relations website of the company and look at all the latest company news.

We specifically look at the latest financial results (half yearly or quarterly), as well as all the financial press releases to make sure the company has not done anything that may have changed its financial situation or its business.

Has the business changed?

We look for actions that can or have substantially changed the business or structure of the company.

Remember, the stock screener selects companies based on past results and you need to make sure the company has not changed since the publication of its last financial results.

Examples of what to look for:

- Spin-offs - After a spin-off a company may look completely different from the company that was selected by the screener based on information before the spin-off.

- Special dividends - These may change the valuation as well as financial position of the company.

- Large acquisitions - May change the company’s business and or its financial situation, for example a lot of new debt.

No second guessing

During this whole process we try (this is a lot more difficult than it sounds) not to second guess the ideas the investment model comes up with. For example, excluding companies because we do not like the business or the industry.

This is important because a lot of research has shown that second guessing a high performance, time tested, investment strategy leads to lower returns.

Because the investment model may recommend companies with a lot of negative news it makes this hard. But it is something we have learned to live with.

Only then is a company included

Only if a company passes all the above tests is it recommended in the newsletter.

Click here to see the Quant Value newsletter's ideas NOW!

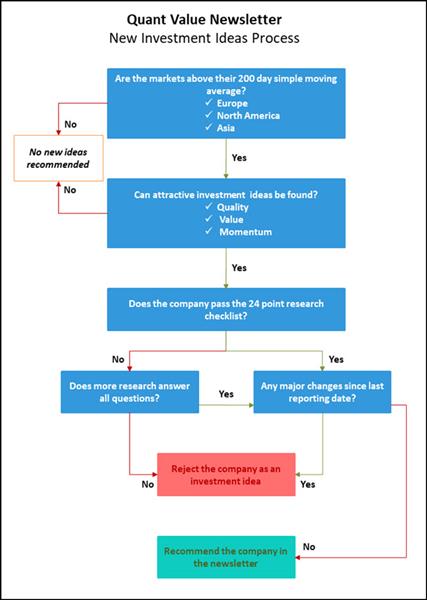

These flow charts show you the process

Here is the whole process in the form of a flow chart - to give you a better overview of the process.

Click image to enlarge

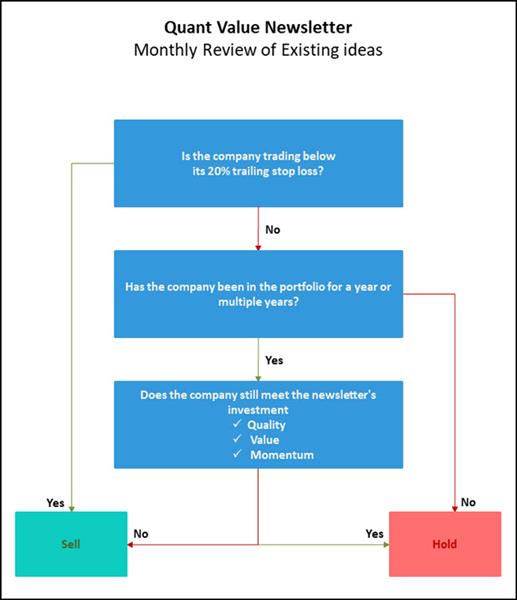

And this is what happens to all the existing ideas in the newsletter each month:

Click image to enlarge

As you can see, it is a solid process, with a lot of research and analysis.

Frequently Asked Questions (FAQs) about the Quant Value Investment Newsletter

Why does the Quant Value newsletter avoid investing in falling markets?

The newsletter follows a rule to only recommend new ideas if the market is above its 200-day simple moving average (SMA). This is because, during falling markets, stocks tend to move together, increasing the risk of triggering stop-losses and incurring losses.

By investing only when markets are moving up, the strategy aims to provide more stable and reliable investment opportunities.

How does the Quant Value investment model find companies?

The model uses a combination of proven investment strategies and the latest research. It screens for companies using the following criteria:

- Qi Value: Identifies undervalued companies.

- Piotroski F-Score: Finds quality companies.

- Six Months Price Momentum: Identifies companies with increasing share prices over the past six months.

- Daily Traded Value: Ensures liquidity with a minimum of $100,000.

- Market Value: Focuses on companies with a market value over $50 million.

What steps are taken to ensure a company is a good investment after screening?

Once companies are identified through screening, the following steps are taken:

- An analysis spreadsheet is built with five years of historical financial results.

- A 24-point checklist is used to verify the accuracy and quality of the company’s inclusion.

- Latest news and financial updates are reviewed to ensure no significant changes in the company’s business or financial situation.

Why is it important to review the latest news and financial updates of selected companies?

Reviewing the latest news ensures that the company's financial situation or business structure hasn't changed significantly since the screening process. Events like spin-offs, special dividends, or large acquisitions can alter a company's financial health and future prospects.

This additional check helps confirm that the company remains a good investment based on the most current information.

What is the significance of the 24-point checklist in the selection process?

The 24-point checklist helps ensure that each company meets the high standards required by the investment model. It serves as a comprehensive guide to evaluate all critical aspects of a company, including financial health, operational performance, and potential risks.

If any red flags are identified, further research is conducted or the company is excluded from the recommendations.

How does the newsletter handle companies with a lot of negative news?

The investment model may recommend companies with negative news, but we avoid second-guessing the model. This means sticking to the high-performance, time-tested strategy without bias. Research shows that second-guessing often leads to lower returns.

The focus remains on the objective criteria set by the model, ensuring disciplined and consistent investment decisions.

Why is the subscriber limit set at 400, and how does it benefit me?

The Quant Value newsletter limits its subscribers to 400 to ensure that each member can act on the recommendations without significantly moving the price of the recommended stocks.

This limit helps maintain the integrity and effectiveness of the investment strategy, ensuring that all subscribers have an equal opportunity to benefit from the carefully selected investment ideas.

What should I look for in a company’s recent actions that might affect its suitability as an investment?

Key actions to watch for include:

- Spin-offs: Can significantly change the company’s structure.

- Special Dividends: Can impact the company’s valuation and financial position.

- Large Acquisitions: May alter the company’s business model and increase debt levels.

These factors are crucial because they change the reason the company was selected and a second look then becomes important.

PS To sign up for the newsletter, for less than an inexpensive lunch for two, click here: Join today

PPS Why not sign up now while it is still fresh in your mind. You can cancel at any time for a FULL refund if you are not happy. Sign up here.