Estimated Reading Time: 8 minutes

Looking for high Free Cash Flow Yield stock picks for 2025?

In this article we show you the best Free Cash Flow Yield stock ideas world-wide, including North America, Europe, and Asia. Plus, we will show you how to enhance the strategy and seamlessly integrate it into your portfolio.

If you're eager to jump straight to the stock suggestions, feel free to skip ahead.

WHY FREE CASH FLOW YIELD IS A GREAT INVESTMENT STRATEGY

There’s a "truth-teller" in the world of investing—an unassuming metric that cuts through financial noise and reveals what truly matters: Free Cash Flow Yield (Free Cash Flow /Enterprise Value).

Investors who understand its transformative power have unlocked an edge that sets them apart. It is not just another ratio; it’s the foundation of an investment strategy that has stood the test of time, markets, and economic turmoil.

If you start using it you will never look at stock selection the same way again. This is because it focuses on finding companies that are not just undervalued but also have strong cash generation relative to their market value and debt.

It goes beyond accounting tricks, beyond flashy revenue numbers, and beyond marketing spin. It tells the story of how much cash a company truly generates after paying for its expenses and investments. You know cash is the lifeblood of a business and is nearly impossible to fake. Unlike earnings, which can be adjusted or manipulated, cash is cash.

Cash flow is also hard to manipulate. After all cash in the beginning of the year plus or minus cash generated must be equal to cash in the bank on year end.

So why don’t more investors use Free Cash Flow Yield? Perhaps because the best-kept secrets in investing are often hidden in plain sight. To those in the know, Free Cash Flow Yield isn’t just a strategy—it’s a time-tested compass for investing in any market, any period.

Let’s explore how Free Cash Flow Yield works, why it's considered a robust metric for valuing companies, and its practical application in your portfolio.

Click here to get the tools you need to implement a high FCF yield strategy in your portfolio

DOES FREE CASH FLOW YIELD INVESTING WORK IN THE USA?

First let’s find out if free cash flow yield works in the USA.

Free Cash Flow Yield might sound too good to be true. But rigorous backtests by Alpha Architect reveal that it’s one of the most powerful valuation ratios in the investing world. Their 40-year study of valuation ratios wasn’t just a performance test—it was a quest to find the Holy Grail of investing metrics. Free Cash Flow Yield emerged as one of the champions, second only to EBITDA/EV.

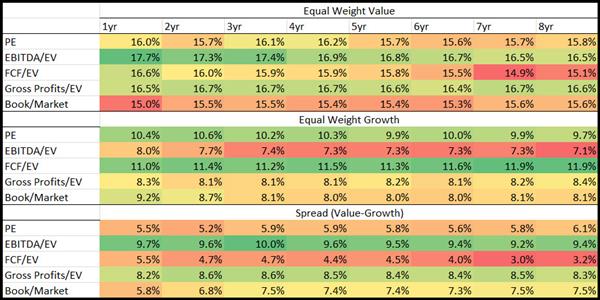

5 strategies tested over 40 years

They tested 5 ratios over the 40 year period from 1 July 1971 to 31 December 2010 to find the best valuation ratio. They also tested normalized (average) ratios to see if they increase returns.

What ratios did they test?

- Earnings to Market Value (E/M) – You can also call the ratio Earnings to Price – the inverse of the PE ratio

- Earnings before interest and taxes and depreciation and amortization to total enterprise value (EBITDA/TEV)

- Free cash flow to total enterprise value (FCF/TEV) – FCF was defined as Net Income + Depreciation and Amortization - Working Capital Change - Capital Expenditures

- Gross profits to total enterprise value (GP/TEV)

- Book to market(B/M) – the inverse of Price to Book

Companies included and how they tested

- This back test excluded financial companies and utilities, and the smallest 10% of market value companies listed on the NYSE.

- Portfolios were put together on 30 June each year when all the companies were sorted into five quintiles – 20% groups of companies.

- They only included companies for which 8 years of data was available.

- Portfolios were re-balanced on a yearly basis.

How the ratios were calculated

For the one year (1yr) ratios companies were selected based on current numerator (top value) and current denominator (bottom value) for each measure.

For all the normalized ratios (2 years – 8 years) they used the average of the numerator over the past 2 to 8 years, and divided this average by the current denominator.

For example, the 8 year FCF/EV ratio was calculated using the average of the past 8 years FCF for each company (including the current year), and dividing this by the company’s current total enterprise value (EV).

This is what they found:

Click image to enlarge

Source: Analyzing Valuation Measures: A Performance Horse-Race over the past 40 Years.

The Equal Weight Value part of the table shows the equal-weighted returns of the most undervalued (cheap) 20% of companies based on each valuation ration.

The Equal Weight Growth part of the table shows the equal-weighted returns of the most overvalued (expensive) 20% of companies based on each valuation ration.

The Spread (Value-Growth) part of the table shows the difference between the Equal Weight Value and Equal Weight Growth returns of the two above tables.

What they found

As you can see (look at the dark green areas of the table) they did not find that using normalized ratios can add to your returns. Only normalized book to market (inverse of price to book) would have given you slightly higher returns compared to the one year ratio.

The best valuation ratio they found was trailing 12 month EBITDA to EV with an average return of 17.7% over the 40 year test period.

EBITDA to EV was also the ratio the highest spread (Value – Growth) returns which is a further indicator that it is the best ratio to use.

What about free cash flow yield? - Second best ratio

As you can see free cash flow yield was the second best ratio they tested, at 16.6% (look at 1 year equal weight) it was 1.1% per year lower than EBITDA/EV.

Still a great return!

Click here to get the tools you need to implement a high FCF yield strategy in your portfolio

IS FREE CASH FLOW YIELD A UNIVERSAL TRUTH?

We didn’t just test it in one market; we tested it in Europe, a different market, with different rules. What we found is extraordinary: no matter where you look, high Free Cash Flow Yield companies consistently outshine the competition.

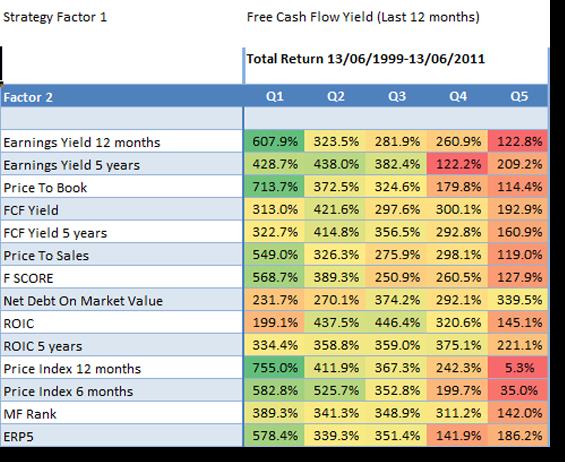

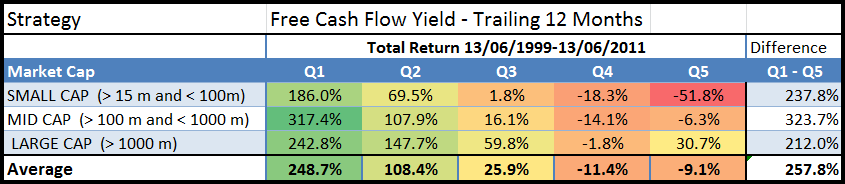

In our book Quantitative Value Investing in Europe: What Works for Achieving Alpha we tested 168 investment strategies in Europe over the 12 year period from June 1999 to June 2011 we also tested 12 months Free Cash Flow yield and 5 year average free cash flow yield.

Free cash flow yield vs Normalized free cash flow yield

In the back test free cash flow yield was defined cash flow from operations minus capital expenditure, divided by enterprise value.

This is what we found:

Free Cash Flow Yield Trailing 12 months returns (Source: Quantitative Value Investing in Europe: What Works for Achieving Alpha)

Q1 (Quintile 1) represents the cheapest 20% of companies and Q5 (quintile 5) the most expensive.

As you can see buying the most undervalued FCF yield companies (Q1) gave you by far the best performance, for small mid and large companies.

Substantial market outperformance

Just in case you were wondering - market outperformance was substantial, over the 12-year period of the study, the market portfolio generated a return of only 30.5 % or 2.25% pa, dividends included.

HOW TO IMPROVE THE RETURNS OF A HIGH FREE CASH FLOW YIELD INVESTMENT STRATEGY

In the above research report we not only tested single valuation ratios, we also tested if you can improve returns further by combining free cash flow yield with other ratios.

Improve your free cash flow yield returns

The following table shows you the returns you could have achieved if you can combined high 12 month free cash flow yield companies with other ratios and indicators.

Source: Quantitative Value Investing in Europe: What works for achieving alpha

Look at column Q1

Look at the returns in column Q1, it shows the returns generated by first selecting the 20% best free cash flow yield companies combined with the ratios in the column called Factor 2.

Best combination +755% was Momentum (506.3% improvement)

What if Free Cash Flow Yield wasn’t just a strategy but part of a legendary duo? When combined with Price Index Momentum (12 months), it works even better, delivering greatly improved returns. +755% total return, more than double what Free Cash Flow Yield alone achieved. It’s as if combining these two metrics unlocks a hidden formula for investment greatness.

Price index 12 months is calculated as the current share price / share price 12 months ago.

This means if you invested only in the 20% of high free cash flow yield companies that also had the top 20% 12 months price index you could have increased your return by 506.3% (755.0% - 248.7%) compared to if you only invested in companies with the highest free cash flow yield.

That is an improvement of just over 2 times the original return!

Click here to get the tools you need to implement a high FCF yield strategy in your portfolio

BEST HIGH FREE CASH FLOW YIELD INVESTMENT IDEAS WORLD-WIDE FOR 2025

Stand alone Free Cash Flow Yield investment ideas

This is what the screen looked like:

- All countries world-wide included

- Top 20% Free Cash Flow Yield companies

- Minimum daily trading volume of $100,000

- Minimum company market value of $100 million

- Financial statements updated in the last 6 months

- Results sorted by Free Cash Flow Yield from undervalued to expensive

There were some wild numbers (most likely outliers) that ranked best so I went down the list a bit to show you companies with more realistic Free cash flow yields.

| Name | Country | FCF Yield |

|---|---|---|

| SITE Centers Corp. | USA | 178.1% |

| CTT - Correios De Portugal, S.A. | Portugal | 110.6% |

| Shinko Shoji Co., Ltd. | Japan | 80.7% |

| BAIC Motor Corporation Limited | China | 79.2% |

| SNT Motiv Co., Ltd. | South Korea | 78.1% |

| HANDSOME Corporation | South Korea | 69.2% |

| Rakuten Group, Inc. | Japan | 65.6% |

| DoubleDown Interactive Co., Ltd. | South Korea | 63.0% |

| Eversendai Corporation Berhad | Malaysia | 57.4% |

| Shinnihon Corporation | Japan | 57.1% |

| Hyundai Bng Steel Co., Ltd. | South Korea | 55.7% |

| FinVolution Group | China | 55.3% |

| Chiyoda Corporation | Japan | 53.1% |

| HD Hyundai Energy Solutions Co.,Ltd. | South Korea | 50.8% |

| Grupa Azoty S.A. | Poland | 50.6% |

| HyVision System. Inc | South Korea | 50.5% |

| FutureFuel Corp. | USA | 50.2% |

| StealthGas Inc. | Greece | 49.3% |

| BB Biotech AG | Switzerland | 48.4% |

| Teekay Corporation Ltd. | USA | 44.8% |

Source: Quant Investing Stock Screener

Free Cash Flow Yield combined with Price Index 6 month

This is what the screen looked like:

- All countries world-wide included

- Top 20% Free Cash Flow Yield companies

- Minimum daily trading volume of $100,000

- Minimum company market value of $100 million

- Financial statements updated in the last 6 months

- Results sorted by Price Index 6 months (Momentum) from best to worse

| Name | Country | FCF Yield | Price Index 6m |

|---|---|---|---|

| FreightCar America, Inc. | USA | 19.5% | 3.2 |

| Boyaa Interactive International Limited | China | 7.4% | 3.0 |

| Dave Inc. | USA | 9.1% | 2.5 |

| MDA Space Ltd. | Canada | 6.7% | 2.2 |

| Argan, Inc. | USA | 6.7% | 2.2 |

| HKBN Ltd. | Hong Kong | 9.3% | 2.2 |

| SG Co.,Ltd | South Korea | 6.7% | 2.1 |

| Enerflex Ltd. | Canada | 14.3% | 2.1 |

| Frequency Electronics, Inc. | USA | 6.9% | 2.1 |

| El Al Israel Airlines Ltd. | Israel | 41.0% | 1.9 |

| Ashot Ashkelon Industries Ltd. | Israel | 7.7% | 1.9 |

| NETGEAR, Inc. | USA | 33.4% | 1.9 |

| PAL GROUP Holdings CO., LTD. | Japan | 8.2% | 1.9 |

| Wolverine World Wide, Inc. | USA | 7.6% | 1.8 |

| JBM (Healthcare) Limited | Hong Kong | 15.9% | 1.8 |

| Serabi Gold plc | Great Britain | 6.9% | 1.8 |

| XAVi Technologies Corporation | Taiwan | 7.0% | 1.8 |

| ATON Inc. | South Korea | 9.3% | 1.8 |

| Toumei Co.,Ltd. | Japan | 8.3% | 1.8 |

| Hanesbrands Inc. | USA | 6.6% | 1.8 |

Source: Quant Investing Stock Screener

BEST HIGH FREE CASH FLOW YIELD INVESTMENT IDEAS IN NORTH AMERICA FOR 2025

Stand alone Free Cash Flow Yield investment ideas

This is what the screen looked like:

- USA and Canada selected

- Top 20% Free Cash Flow Yield companies

- Minimum daily trading volume of $100,000

- Minimum company market value of $100 million

- Financial statements updated in the last 6 months

- Results sorted by Free Cash Flow Yield from undervalued to expensive

| Name | Country | FCF Yield |

|---|---|---|

| Offerpad Solutions Inc. | USA | 126.89% |

| Opendoor Technologies Inc. | USA | 105.77% |

| Teekay Corporation | USA | 40.75% |

| The Andersons, Inc. | USA | 40.25% |

| Fortitude Gold Corporation | USA | 36.49% |

| PetroTal Corp. | USA | 33.09% |

| Cross Country Healthcare, Inc. | USA | 32.45% |

| Zymeworks Inc. | Canada | 30.83% |

| Teekay Tankers Ltd. | USA | 30.81% |

| CarParts.com, Inc. | USA | 30.52% |

| Dundee Precious Metals Inc. | Canada | 30.03% |

| Westlake Chemical Partners LP | USA | 29.31% |

| Hamilton Beach Brands Holding Company | USA | 28.95% |

| BlueLinx Holdings Inc. | USA | 28.42% |

| Cricut, Inc. | USA | 28.14% |

| Medifast, Inc. | USA | 27.97% |

| Neo Performance Materials Inc. | Canada | 27.92% |

| Spartan Delta Corp. | Canada | 27.89% |

| G-III Apparel Group, Ltd. | USA | 26.26% |

| Amplify Energy Corp. | USA | 25.96% |

Source: Quant Investing Stock Screener

Free Cash Flow Yield combined with Price Index 6 month

This is what the screen looked like:

- USA and Canada selected

- Top 20% Free Cash Flow Yield companies

- Minimum daily trading volume of $100,000

- Minimum company market value of $100 million

- Financial statements updated in the last 6 months

- Results sorted by Price Index 6 months (Momentum) from best to worse

| Name | Country | FCF Yield | Price Index 6m |

|---|---|---|---|

| TSS, Inc. | USA | 6.3% | 4.1 |

| FreightCar America, Inc. | USA | 19.5% | 3.2 |

| Dave Inc. | USA | 9.1% | 2.5 |

| Latham Group, Inc. | USA | 6.3% | 2.4 |

| MDA Space Ltd. | Canada | 6.7% | 2.2 |

| Argan, Inc. | USA | 6.7% | 2.2 |

| Enerflex Ltd. | Canada | 14.3% | 2.1 |

| Frequency Electronics, Inc. | USA | 6.9% | 2.1 |

| CompoSecure, Inc. | USA | 6.5% | 2.0 |

| Pediatrix Medical Group, Inc. | USA | 6.5% | 1.9 |

| NETGEAR, Inc. | USA | 33.4% | 1.9 |

| Wolverine World Wide, Inc. | USA | 7.6% | 1.8 |

| Build-A-Bear Workshop, Inc. | USA | 6.5% | 1.8 |

| Hanesbrands Inc. | USA | 6.6% | 1.8 |

| Gambling.com Group Limited | USA | 7.1% | 1.8 |

| Viant Technology Inc. | USA | 12.8% | 1.7 |

| Expensify, Inc. | USA | 5.7% | 1.7 |

| Liquidity Services, Inc. | USA | 5.8% | 1.7 |

| Cal-Maine Foods, Inc. | USA | 10.8% | 1.7 |

| Virtu Financial, Inc. | USA | 6.1% | 1.7 |

Source: Quant Investing Stock Screener

BEST HIGH FREE CASH FLOW YIELD INVESTMENT IDEAS IN EUROPE FOR 2025

Stand-alone Free Cash Flow Yield investment ideas

This is what the screen looked like:

- EU countries, Scandinavia and the UK selected

- Top 20% Free Cash Flow Yield companies

- Minimum daily trading volume of $100,000

- Minimum company market value of $100 million

- Financial statements updated in the last 6 months

- Results sorted by Free Cash Flow Yield from undervalued to expensive

| Name | Country | FCF Yield |

|---|---|---|

| CTT - Correios De Portugal, S.A. | Portugal | 110.6% |

| Grupa Azoty S.A. | Poland | 50.6% |

| StealthGas Inc. | Greece | 49.3% |

| BB Biotech AG | Switzerland | 48.4% |

| OKEA ASA | Norway | 44.8% |

| B.P. Marsh & Partners PLC | Great Britain | 41.6% |

| Unieuro S.p.A. | Italy | 35.5% |

| d'Amico International Shipping S.A. | Luxembourg | 31.3% |

| Halfords Group plc | Great Britain | 31.1% |

| Wise plc | Great Britain | 30.7% |

| ProSiebenSat.1 Media SE | Germany | 29.8% |

| MFE-Mediaforeurope N.V. | Italy | 28.3% |

| Global Ship Lease, Inc. | Greece | 27.0% |

| INDUS Holding AG | Germany | 25.7% |

| Dampskibsselskabet Norden A/S | Denmark | 25.4% |

| Viridien Société anonyme | France | 25.2% |

| Norwegian Air Shuttle ASA | Norway | 24.4% |

| Wallenius Wilhelmsen ASA | Norway | 24.2% |

| Hafnia Limited | Norway | 24.0% |

| Ten Square Games S.A. | Poland | 23.6% |

Source: Quant Investing Stock Screener

Free Cash Flow Yield combined with Price Index 6 month

This is what the screen looked like:

- EU countries, Scandinavia and the UK selected

- Top 20% Free Cash Flow Yield companies

- Minimum daily trading volume of $100,000

- Minimum company market value of $100 million

- Financial statements updated in the last 6 months

- Results sorted by Price Index 6 months (Momentum) from best to worse

| Name | Country | FCF Yield | Price Index 6m |

|---|---|---|---|

| VEON Ltd. | The Netherlands | 9.2% | 1.7 |

| Wise plc | Great Britain | 30.7% | 1.5 |

| Sats ASA | Norway | 14.1% | 1.5 |

| Dynagas LNG Partners LP | Greece | 11.7% | 1.4 |

| B.P. Marsh & Partners PLC | Great Britain | 41.6% | 1.4 |

| Unieuro S.p.A. | Italy | 35.5% | 1.4 |

| Telefonaktiebolaget LM Ericsson (publ) | Sweden | 11.7% | 1.4 |

| Tenaris S.A. | Luxembourg | 13.8% | 1.4 |

| Obrascón Huarte Lain, S.A. | Spain | 11.3% | 1.3 |

| Zalando SE | Germany | 9.7% | 1.3 |

| Clas Ohlson AB (publ) | Sweden | 8.9% | 1.3 |

| AlzChem Group AG | Germany | 15.7% | 1.3 |

| Imperial Brands PLC | Great Britain | 9.2% | 1.3 |

| AcadeMedia AB (publ) | Sweden | 15.7% | 1.3 |

| Verve Group SE | Sweden | 12.0% | 1.3 |

| Sanoma Oyj | Finland | 10.2% | 1.3 |

| OVS S.p.A. | Italy | 8.9% | 1.3 |

| Per Aarsleff Holding A/S | Denmark | 10.5% | 1.3 |

| CTT - Correios De Portugal, S.A. | Portugal | 110.6% | 1.3 |

| Terveystalo Oyj | Finland | 8.8% | 1.3 |

Source: Quant Investing Stock Screener

BEST HIGH FREE CASH FLOW YIELD INVESTMENT IDEAS IN ASIA FOR 2025

Stand alone Free Cash Flow Yield investment ideas

This is what the screen looked like:

- Australia, China, Hong Kong, Japan, South Korea, New Zealand and Singapore selected

- Top 20% Free Cash Flow Yield companies

- Minimum daily trading volume of $100,000

- Minimum company market value of $100 million

- Financial statements updated in the last 6 months

- Results sorted by Free Cash Flow Yield from undervalued to expensive

| Name | Country | FCF Yield |

|---|---|---|

| Shinko Shoji Co., Ltd. | Japan | 80.7% |

| BAIC Motor Corporation Limited | China | 79.2% |

| SNT Motiv Co., Ltd. | South Korea | 78.1% |

| HANDSOME Corporation | South Korea | 69.2% |

| Rakuten Group, Inc. | Japan | 65.6% |

| DoubleDown Interactive Co., Ltd. | South Korea | 63.0% |

| Shinnihon Corporation | Japan | 57.1% |

| Hyundai Bng Steel Co., Ltd. | South Korea | 55.7% |

| FinVolution Group | China | 55.3% |

| Chiyoda Corporation | Japan | 53.1% |

| HD Hyundai Energy Solutions Co.,Ltd. | South Korea | 50.8% |

| HyVision System. Inc | South Korea | 50.5% |

| Sinopec Shanghai Petrochemical Company Limited | China | 39.4% |

| Hy-Lok Corporation | South Korea | 39.0% |

| Seohee Construction Co., Ltd. | South Korea | 38.9% |

| Doshisha Co.,Ltd. | Japan | 38.1% |

| Hosiden Corporation | Japan | 36.0% |

| Japan Securities Finance Co., Ltd. | Japan | 32.8% |

| NEOWIZ | South Korea | 32.7% |

| DoubleUGames Co., Ltd. | South Korea | 31.7% |

Source: Quant Investing Stock Screener

Free Cash Flow Yield combined with Price Index 6 month

This is what the screen looked like:

- Australia, China, Hong Kong, Japan, South Korea, New Zealand and Singapore selected

- Top 20% Free Cash Flow Yield companies

- Minimum daily trading volume of $100,000

- Minimum company market value of $100 million

- Financial statements updated in the last 6 months

- Results sorted by Price Index 6 months (Momentum) from best to worse

| Name | Country | FCF Yield | Price Index 6m |

|---|---|---|---|

| Boyaa Interactive International Limited | China | 7.4% | 3.0 |

| HKBN Ltd. | Hong Kong | 9.3% | 2.2 |

| PAL GROUP Holdings CO., LTD. | Japan | 8.2% | 1.9 |

| JBM (Healthcare) Limited | Hong Kong | 15.9% | 1.8 |

| ATON Inc. | South Korea | 9.3% | 1.8 |

| Toumei Co.,Ltd. | Japan | 8.3% | 1.8 |

| Valeura Energy Inc. | Singapore | 13.4% | 1.8 |

| Dingdong (Cayman) Limited | China | 9.4% | 1.8 |

| Junjin Construction and Robot Co.,Ltd. | South Korea | 7.2% | 1.7 |

| Pangrim Co., Ltd. | South Korea | 15.0% | 1.7 |

| Jacobson Pharma Corporation Limited | Hong Kong | 13.3% | 1.6 |

| NetEase, Inc. | China | 9.4% | 1.5 |

| Myer Holdings Limited | Australia | 7.4% | 1.5 |

| EXEDY Corporation | Japan | 15.6% | 1.5 |

| Nihon Dengi Co., Ltd. | Japan | 9.4% | 1.5 |

| Digital Garage, Inc. | Japan | 8.0% | 1.5 |

| Happinet Corporation | Japan | 11.2% | 1.4 |

| Nojima Corporation | Japan | 10.4% | 1.4 |

| ZERO Co., Ltd. | Japan | 14.2% | 1.4 |

| Yamato Corporation | Japan | 14.1% | 1.4 |

Source: Quant Investing Stock Screener

HOW TO FIND HIGH FREE CASH FLOW YIELD INVESTMENT IDEAS

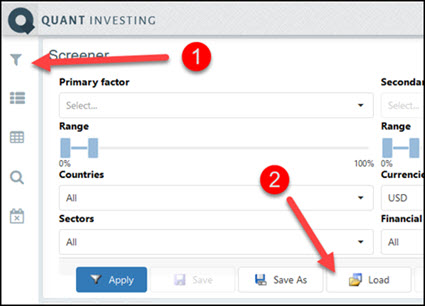

Now for the interesting part where you can see exactly how to find free cash flow yield investment ideas for your portfolio.

We have saved a free cash flow yield screen for you so all you have to do is load it.

Here is how you do it:

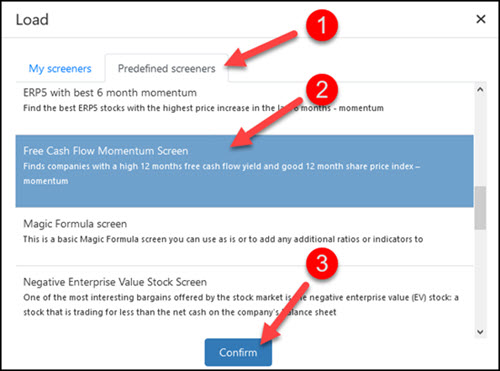

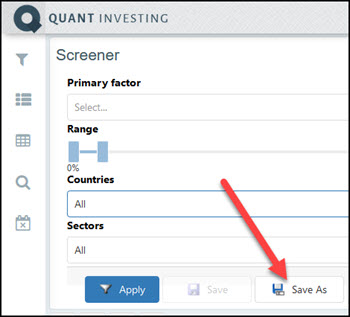

After logging into the screener click

- The Screener funnel icon

- Then click the Load button

- Then click on the Predefined screeners tab, scroll down then

- Click on the Free Cash Flow Momentum Screen

- Click the Confirm button

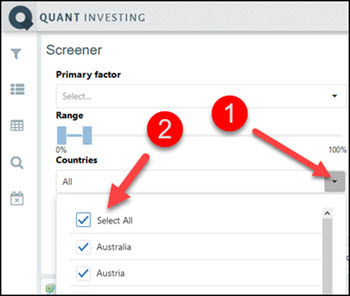

Select your countries

You then have to select the countries where you would like to search for investment ideas.

To do this:

- Click the drop down list item below Countries and then

- Check all the countries you would like to select

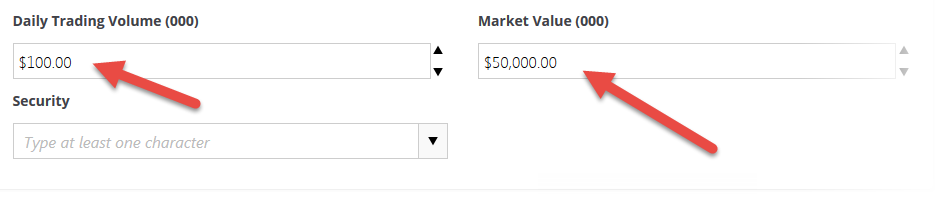

Select value and volume

Next you have to enter the minimum daily trading volume and the minimum market value of the companies you want to screen for.

Important: The numbers you enter are in thousands, this means if you enter $100 it is equal to $100,000.

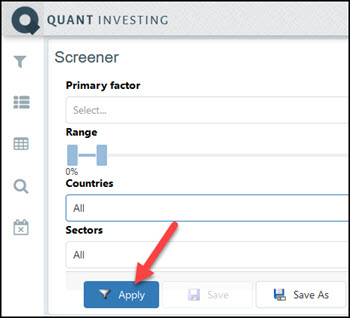

That is all you have to do.

When you are done click the Apply button to get your investment ideas.

That is all there is to do

You now hold the key to one of investing’s most powerful secrets. Free Cash Flow Yield has the potential to change the way you invest. It helps you uncover undervalued companies with real, sustainable cash flow. Don’t let this opportunity slip away. Start your journey to becoming the kind of investor who sees what others miss.

Click here to get the tools you need to implement a high FCF yield strategy in your portfolio

You can save all your screens

Once you have changed the basic free cash flow yield screen to fit your investment style you can save it so that you can call it up at any time with a few simple mouse clicks.

You can save as many screens as you like.

To save your screen click the Screener funnel icon, then the Save As button to save your screen.

All this costs less than a lunch for two

How much does a tool like this cost, you may be thinking?

To make it affordable, and give you a great return on your investment, even if your portfolio is still small, we have made the price of the screener surprisingly low.

It costs less than an inexpensive lunch for two each month (Click here to sign up RIGHT NOW!).

Don’t hesitate, you have nothing to lose. If you are not 100% satisfied you get your money back – no questions asked!

PS: Why not sign up right now, while this is fresh in your mind?

FREQUENTLY ASKED QUESTIONS

1. What is free cash flow yield?

It's the cash a company has left after paying for its operations and investments, divided by its total market value (including debt and cash). It shows how much cash a company generates compared to its total value.

2. Why is Free Cash Flow Yield your ultimate valuation ratio?

Free cash flow is hard to fake. It tells you if a company is truly making money, which is crucial for long-term investing.

3. Is free cash flow yield better than other ratios?

It's one of the best because it focuses on real cash. Some studies even show it's almost as good as the best metric, EBIT/EV.

4. Does the power of Free Cash Flow Yield work everywhere?

Yes! Whether in the USA, Europe, or Asia, high free cash flow yield stocks have shown to perform well.

5. How do I find stocks with high free cash flow yield?

You can use stock screeners that sort companies by their free cash flow yield. Look for those in the top 20%.

6. What other metrics should I combine with free cash flow yield?

Combining it with momentum (how much a stock’s price has increased over the past year) can boost returns even more.

7. Are there risks with free cash flow yield investing?

Like all investments, it has risks. Sometimes, high yields can be due to temporary issues or wild working capital movements. Always do your own research.

8. How often should I review my free cash flow yield stocks?

Annually rebalancing your portfolio is a good practice. This ensures you keep up with changes in the companies you invest in.

9. What are the best regions for free cash flow yield stocks?

Good opportunities exist worldwide, look at regions where you're comfortable investing.

10. Should I buy only high free cash flow yield stocks?

It’s a good strategy, but diversify with other metrics or different types of stocks to manage risk.

Click here to get the tools you need to implement a high FCF yield strategy in your portfolio