Estimated Reading Time: 5 minutes

In this blog post, you'll discover how to use the Golden Cross and Death Cross indicators to improve your stock market returns. You'll learn when to buy or sell stocks by understanding these simple moving average signals, making your investment decisions more precise. The post also covers how these indicators work best for larger companies and how to apply them using a stock screener. By the end, you'll feel more confident in timing your trades for better outcomes.

Knowing exactly when to buy or sell is not easy BUT here is a indicator you can use to help – it is called the golden cross and the death cross - and it can help if you are a trader or a long term investor.

What is the Golden Cross?

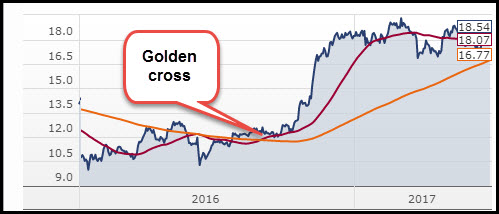

A golden cross is a buy signal and occurs when a short term moving average (50 days for example) moves up and crosses over a longer moving average (200 days for example).

This indicates an increasing stock price and often results in higher trading volumes.

Golden cross (Buy signal) occurs when the short term moving average (red line) moves up through the long term moving average (orange line)

Opposite is the Death Cross

The opposite can of course also happen, when a short term moving average moves down and crosses over a longer term moving average.

This pattern is called a death cross, and is a sell signal as it shows the stock price is falling and may continue to do so.

Death cross (Sell signal) occurs when the short term moving average (red line) moves down through the long term moving average (orange line)

To understand exactly how the golden cross or death cross can help you, it is important that you know what a moving average is.

Click here to start using the Golden Cross in your portfolio NOW!

What is a moving average?

A moving average is an indicator that reduces the noise of daily stock price movements.

It is simply the average closing price of a stock measured over a number of trading days, typically 50 days, 100 days and 200 days.

For example, to calculate the 50 day moving average you simply average the closing price of the stock over the past 50 trading days into a single value or data point.

Moving average lags the stock price

Moving averages thus lag behind the current share price since it is based on past data. The longer the time period used to calculate a moving average, the greater the lag.

Thus, a longer term moving average (such as for 200 trading days) is used to measure long term price movements, while short term moving averages (such as for 50 days or shorter) is used as a short term indicator.

It shows you the trend

So when the short term average moves up and passes over the longer term moving average (golden cross), it shows you that there is an upward moving trend in the share price.

This is because the shorter moving average is more sensitive than a longer moving average. It reacts faster to more recent price changes.

How to use the golden cross

1. The golden cross is a good buy indicator

The golden cross is a great indicator to help you decide when to buy. Once you have done your research and decided to buy a company you can use a golden cross to help time your purchase.

The golden cross draws the attention of other investors and thus give you and higher trading volume, and possibly a fast profit, as other investors are also buying.

2. Better for large companies

Research has shown that the golden cross is best used for larger and more stable companies and does not work as well for smaller (more volatile) companies.

3. Longer period moving averages are better

For individual stocks longer period moving averages, for example 50 day and 200 day, provide a better signal than a moving average for a shorter period.

Indicators available in the stock screener

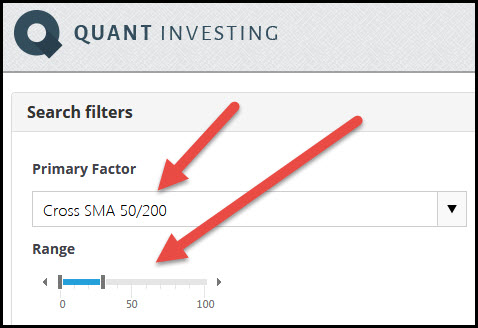

There are a couple of indicators available in the screener which allow you to use the golden and death cross to buy and sell at the right time.

For individual companies, the typical golden and death cross of 50 day and 200 day moving averages is available.

How is it calculated?

In the Quant Investing stock screener the golden cross it is called Cross SMA 50/200 (SMA = Simple Moving Average) and is calculated as follows:

Cross SMA 50/200 = 50 day moving average / 200day moving average

What do the values mean?

If the Cross SMA 50/200 value is greater than 1, it shows you that the 50 day moving average is above the 200 day moving average (golden cross), a buy signal because of an moving share price.

If the Cross SMA 50/200 value is less than 1, this shows that the 50 day moving average is below the 200 day moving average (a death cross), is a sell signal as the stock prices has fallen and may continue to drop.

Click here to start using the Golden Cross in your portfolio NOW!

This is what it looks like

This is how you can use one of the four funnels to select companies golden cross companies using the screener:

How to select golden cross companies

How to select golden cross companies

To select companies where the 50 day moving average is higher than 200 day moving average position the sliders from 0% to 30%.

To select companies where the 50 day moving average is below the 200 day moving average set the sliders from 70% to 100%.

To find companies where a golden or death cross has just taken place (the 50 day moving average has just crossed the 200 day moving average) set the sliders from 30% to 70%.

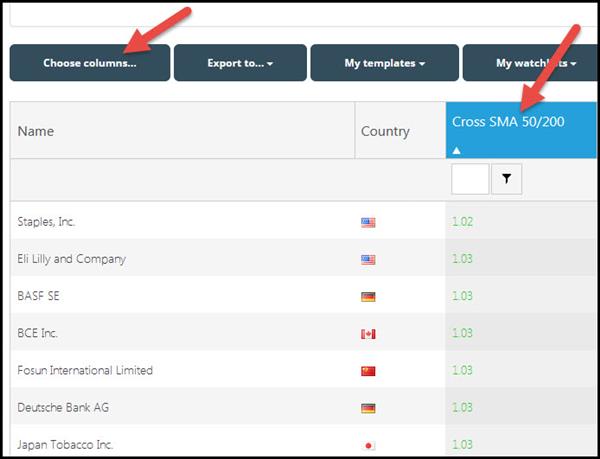

See the golden cross values

You can of course also see the golden cross values of the companies in your screen.

To do this click on the Choose columns button and select Cross SMA 50/200 as one of your output columns.

Show the golden cross values of all the companies in your screen

How to sort the column

Clicking on the column heading (Cross SMA 50/200 in this case) sorts the values in the column. If you click once it sorts from low to high, when you click the second time it sorts the column from high to low.

Golden cross also available for world markets and ETFs

As a subscriber you also have access to golden cross indicators applied to 42 world stock markets and 43 ETF’s.

These two reports allow you to quickly see what the major market and market sectors are doing.

Here is an extract of both reports (updated weekly):

ETF momentum dashboard including golden cross indicators

Click image to enlarge

World market momentum dashboard including golden cross indicators

Click image to enlarge

Click here to start using the Golden Cross in your portfolio NOW!

Summary and conclusion

The golden cross and death cross are simple and easy to use indicators to help you time your buy and sell decisions – especially if you are more of a trader.

That said it can also help you if you are a long term investors as it can help you time your buy and sell decisions better.

For example, buy an already researched investment idea on a golden cross and wait for the price to turn up again after a death cross before buying.

PS To get the golden cross and more than 110 other ratios and indicators to help you make better investment decisions sign up here.

Why not do it now while it is still fresh in your mind.

Frequently Asked Questions

1. What is a Golden Cross, and why should I care?

The Golden Cross happens when a short-term moving average (like 50 days) crosses above a long-term moving average (like 200 days). It's a strong sign that a stock's price might keep rising, so it's a good time to consider buying.

2. Can the Golden Cross really help me make better investment decisions?

Yes, it can. While no indicator is perfect, the Golden Cross is well-known for signalling potential upward trends, which can help you time your buys more effectively.

3. How do I know when a Golden Cross is happening?

You can track it using stock charting tools or screeners that highlight when the 50-day moving average crosses above the 200-day moving average.

4. Should I use the Golden Cross for all my investments?

It's most effective with larger, stable companies. It might not work as well with smaller, more volatile stocks.

5. What’s the difference between a Golden Cross and a Death Cross?

A Golden Cross signals a potential upward trend (buy signal), while a Death Cross signals a potential downward trend (sell signal).

6. How does the Golden Cross compare to other indicators?

It's simple and widely used, but it’s best combined with other research and indicators to confirm buy or sell decisions.

7. Can the Golden Cross help me avoid bad investments?

It can help you avoid buying into a stock that’s on a downward trend. If you see a Death Cross forming, it might be a signal to wait or sell.

8. Is the Golden Cross a good strategy for long-term investors?

Yes, even long-term investors can use it to time their entry points, potentially buying stocks when a new upward trend begins.

9. What should I do if the stock I own forms a Death Cross?

Consider selling or holding off on additional purchases until the trend reverses. It could signal further price drops.

10. Can I automate trading using the Golden Cross?

Many trading platforms allow you to set up automated alerts or trades when a Golden Cross occurs, making it easier to act quickly on these signals.

Click here to start using the Golden Cross in your portfolio NOW!