I am sure you already know that the Piotroski F-Score can improve your investment returns.

For example, in the article Can the Piotroski F-Score also improve your investment strategy? I showed you how the Piotroski F-Score improved the average returns of 13 different investment strategies by over 200% over 12 years.

That’s a big improvement you can get by only buying companies with a high F-Score, I am sure you will agree.

Investment ideas below

Keep reading as further down I give you a list of investment ideas of undervalued companies with a good and improving Piotroski F-Score.

Value companies with a good AND improving F-Score

To help you get even better investment ideas we publish a weekly report that shows you undervalued companies with an already good BUT also improving F-Score.

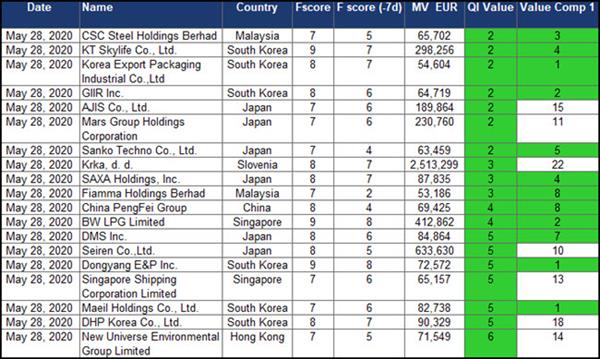

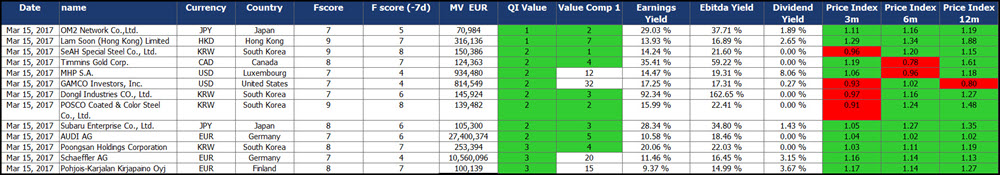

This is what it looks like:

Click image to enlarge

Click here to find undervalued companies with an improving F-Score

What do all the columns mean?

The following is an explanation of the columns:

- Fscore shows you the current F-Score;

- F score (-7d) the old or pervious F-Score;

- MV EUR gives you the current market value of the company in thousands of Euro

- QI Value (value the list is sorted by) is our own developed rating system to help you find undervalued companies based on four of the best performing ratios we have tested. You can read more about the Qi Value ranking in this article: This outperforms all other valuation ratios (14 year back test result);

- Value Comp 1 (Value Composite One) is an indicator that uses five ratios to help you identify undervalued companies. You can read more about Value Composite One here: This combined valuation ranking gives you higher returns - Value Composite One;

- Earnings Yield is the current Earnings Yield (EBIT/Enterprise Value) of the company;

- Dividend Yield shows you what the current dividend yield of the company is;

- Price Index 3m shows you the three month share price momentum (current share price / share price 3 months ago) of the company;

- Price Index 6m shows you the six month share price momentum (current share price / share price 6 months ago) of the company;

- Price Index 12m shows you the one year share price momentum (current share price / share price 1 year ago) of the company;

This F-Score report is updated weekly

You can find the weekly updated improving F-Score report on the website.

Here is how you can get hold of it.

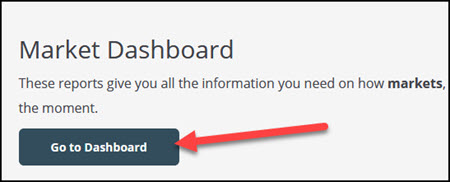

After you have logged in, scroll down the page and under the heading Market Dashboard click on the Go to Dashboard button.

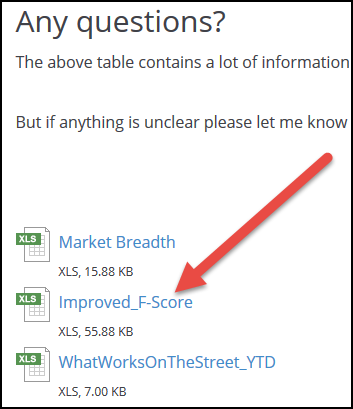

Then click on the file called “Improved_F-Score”

What are in all the other files?

Along with the improved F-Score report you will see a lot of other files.

To find out how you can profit from the information in these files take a look at this article: These new tools will give you even more good investment ideas

Here are the investment ideas as promised

Current investment ideas

Here is an extract of the lists of the undervalued companies with improving F-Score:

It costs less than an inexpensive lunch for two each month!

PPS Why not sign up now? Simply click the following link: Screener join today

Click here to find undervalued companies with an improving F-Score