Estimated Reading Time: 5 minutes

By reading this post, you'll learn why the book-to-market ratio is a smarter choice than the price-to-book ratio for finding undervalued stocks. The post explains how book-to-market avoids the pitfalls of negative book values. This insight will improve your stock screening and lead to better investment ideas, giving you a clearer path to identifying real value in the market.

Why do you think we recommend that you use the book to market ratio, and NOT price to book when screening for undervalued companies?

A question we get a lot

If you don’t know you are not alone, it is a question asked by a lot of our stock screener subscribers.

The simple answer - book to market gives you better investment ideas results.

That is why, I am sure, you also noticed that all academic research studies use the book to market ratio and not price to book.

Let me explain.

How it’s calculated

The price to book ratio is calculated as - Market value / Book value (or the stock price / Book value per share).

The book to market ratio is calculated as - Book value / Market value (or Book value per share / Stock price).

As you see the ratios are very similar, the one is simply the inverse (the opposite) of the other.

But why does the book to market value give you better results?

Negative book value

The answer - negative book value.

If you use the price to book ratio, the lower the ratio the more undervalued the company is.

But if the company's book value is negative it will make the price to book value negative.

Now if you look for companies with the lowest price to book value (most undervalued companies) those with a negative price to book value will be the first on your list.

Not what you are looking for

This may not be the companies you are looking for.

The book to market ratio works just the other way around. The higher the book to market value the more undervalued the company is.

Negative book value does not matter

With the book to market ratio it does not matter if a company has a negative book value.

Because, to find undervalued companies, you are looking for companies with the highest book to market value.

If the book value of the company's negative it will have a negative book to market value and the company will not show up in your results of the most undervalued companies.

This is what you are looking for!

Why negative book value?

Why do companies have a negative book value?

One reason is because they wrote off a large amount of goodwill and the loss wiped out the book value. Or the total losses so far is more than its equity.

I'm sure you can think of a few other reasons.

To get the book to market ratio working in your portfolio now - Click here

How to screen with book to market

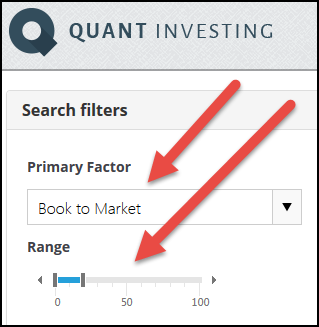

In the Quant Investing stock screener when looking for companies that are undervalued in terms of price to book value use the book to market value ratio instead as your primary factor.

If you set the slider from 0 to 20% (as shown above) we have already programmed it for you so that it will give you a list the most undervalued book to market companies.

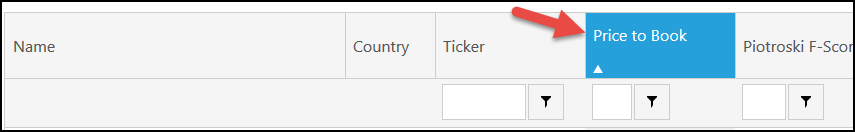

If you prefer price to book

If you prefer to see your results as price to book value simply select price to book as one of your output columns.

You can then sort this column from low (the most undervalued companies) to high.

Give the book to market ratio a try, it will give you better screening results and better investment ideas.

Frequently Asked Questions

1. Why is Book-to-Market better than Price-to-Book for finding undervalued stocks?

Book-to-Market helps avoid misleading results from negative book values, making it more reliable for identifying truly undervalued companies.

2. How is Book-to-Market calculated?

It’s the book value divided by the market value, which is the reverse of Price-to-Book.

3. What happens if a company has a negative book value?

With Price-to-Book, a negative book value can show the company as undervalued incorrectly. Book-to-Market avoids this problem.

4. Should I always prefer Book-to-Market over Price-to-Book?

Yes, especially if you want a more accurate picture of undervalued stocks, as Book-to-Market doesn’t get distorted by negative values.

5. Why do companies have negative book values?

This can happen due to significant goodwill write-offs or ongoing losses that exceed the company’s equity.

6. Can I still use Price-to-Book if I prefer it?

Yes, but be cautious of negative book values skewing your results. Book-to-Market might give you better insights.

7. What type of companies might have misleading Price-to-Book ratios?

Companies with significant losses or write-offs could appear undervalued when they’re not.

8. How can I use Book-to-Market in my screening?

Set your screener to focus on the top 20% of companies with the highest Book-to-Market ratios.

9. Will using Book-to-Market improve my investment returns?

It could, by helping you find genuinely undervalued companies and avoiding those that only seem cheap.

10. Is there a quick way to start using Book-to-Market in my portfolio?

Yes, many stock screeners allow you to easily switch to using Book-to-Market as a primary factor.

PS To get the book to market ratio working in your portfolio today sign up here

PPS Why not sign up right now while it's still fresh in your mind

To get the book to market ratio working in your portfolio now - Click here