After the market crash I thought you would like to know if there are any interesting net-net investment ideas you can make use of.

But before we get to the investment ideas, and how you can find them using the screener, some background information.

What is a net-net investment?

The net-net investment strategy was developed by Benjamin Graham (father of value investing) with the basic idea to find companies trading for less than their liquidation value. Companies trading at such a low price that you could buy the whole company, sell off all the assets, pay off all liabilities and still make a profit.

You thus want to find companies with a market value less than its net net working capital (this is where the name net-net investment strategy comes from).

Net-net working capital is defined as: (Cash and short-term investments + (75% of accounts receivable) + (50% of inventory) - All Liabilities)

Very conservative

As you can see the net-net formula is very conservative as it assumes the full value of inventory and accounts receivables will not be collected when they are sold or collected.

You must buy a basket

As you can imagine there is a good reason why companies get this undervalued. If you look at the list of investment ideas the net-net screen comes up with you will see that these are companies that have BIG problems.

This is why Benjamin Graham said you should lower your by investing in a number of net-net investments, he suggested that you invest in basket of 30 such ideas to lower the risk of any one company (or a few) going bankrupt.

The idea is that other companies in the basket will do so well, more than compensating for the few companies that go bankrupt.

Net-nets in the screener

In the Quant Investing stock screener we define Net Current Asset Value (NCAV) as:

Net Current Assets Value (NCAV) = (Current assets (cash, inventories and accounts receivable) – All possible Liabilities) / Market value

With all possible liabilities calculated as (Total Assets - Common Shareholders Equity)

Margin of safety

As you can see in the above ratio calculation nothing is done to lower the value of inventory or accounts receivable as Benjamin Graham suggested.

NCAV > 1.5

To make up for this you can make sure that the companies the screen selects has a net current asset value ratio of more than 1.5.

This means that all the companies the screener selects have net assets (after all liabilities have been deducted) worth at least 1.5 the current market value of the company.

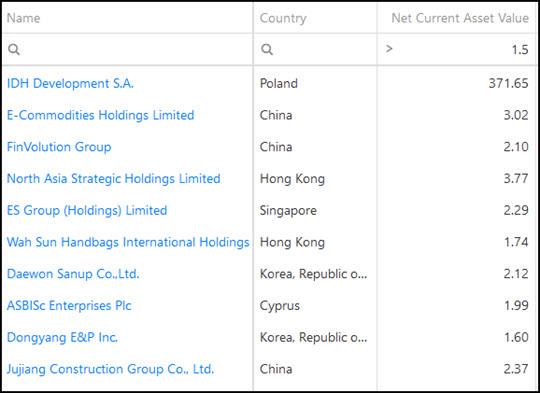

First 10 net-net investment ideas

Below is a list of first 10 net-net ideas sorted by net current asset value (NCAV):

Remove low quality Net-nets

As I mentioned a net-net company is usually a low quality business. You can however improve the quality of your net-net ideas by using the Piotroski F-Score.

You can find more information on the Piotroski F-Score here: This academic can help you make better investment decisions – Piotroski F-Score

If you use the above list but remove all companies with a Piotroski F-Score of less than 5 (Piotroski F-Score values go from 0 to 9) the list of investment ideas look like this:

Net-net with positive free cash flow

If you want to screen out companies that are burning cash (this decreased NCAV over time) you can do this by selecting net-nets with a cash flow to capital expenditure ratio greater than 1. (Cash flow to Capex = Cash from Operations / Capex)

This will make sure the company has been able to meet all its capital expenditure with cash flow generated by the business, or you can say the company has positive free cash flow.

If you do this 159 companies remain on the net-net list. Here are the top 10 from high to low by Net Current Asset Value:

Your research required

Fortunately there are a lot net-net ideas around at the moment, enough to give you a basket of companies to invest in, I am afraid.

Please remember, as with all screens, the names the screener comes up with should just be the start of your research process.

And because net-nets are high risk investment ideas further detailed research of the company’s financial statements is very important.

And remember - buy at least a basket of 30 companies!

How to find net-net investment ideas with the screener

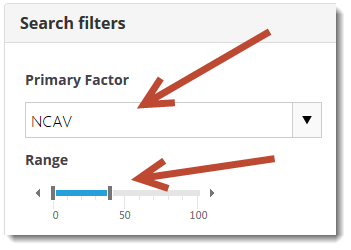

Step 1 – Use NCAV in the Primary slider

Select the cheapest companies in terms of NCAV

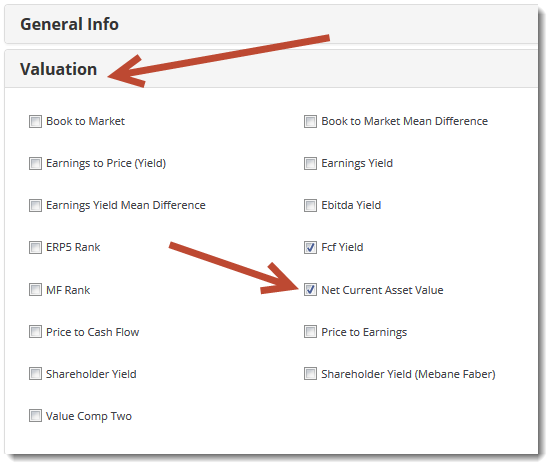

Step 2 – Add Net Current Asset Value as a column to show

Click image to enlarge

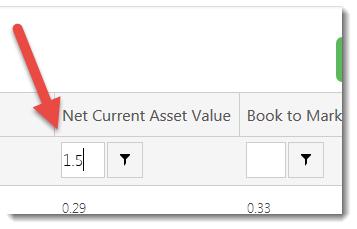

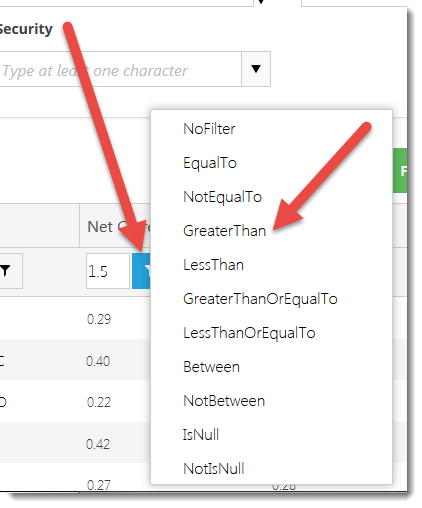

Step 3 – Filter for companies with a Net Current Asset Value of greater than 1.5

This gives you a complete list of net-net investment ideas.

You can then refine this list with the more than 110 other ratios and indicators in the screener - you can see all definitions here: Quant Investing stock screener Glossary

PS All the tools you need to implement a net-net investment strategy in your portfolio can be found right here: Screener join now

PPS Why not sign up right now while its still fresh in your mind?