Do you only invest in the in the country where you live?

If you do it’s a BIG mistake as it limits your investment opportunities and returns. You are fishing in a pond that is just too small.

Don’t take my word for it

But don’t take my word for it as I found an interesting research paper that proves investing world-wide works by James Montier, currently a member of the asset allocation team at GMO.

(Be sure to read to the end of the article where I show you how you can find the exact same investments James used in his research)

The paper James wrote is called Going global: value investing without boundaries and was published on 16 September 2008 when James was still working for the French bank Societe Generale in London.

Does global value investing work?

James wrote the paper after he was asked if he has ever seen any research that proves that value investing works at the global level.

With the paper he wanted to prove his idea that an investor should be allowed to invest anywhere in the world where the most attractive investment opportunities can be found.

Great fund managers have shown it works

Of course, several very good value investors such as Sir John Templeton and Jean-Marie Eveillard have shown that in practice value investing can be done on a global basis.

As Sir John said:

It seems to be common sense that if you are going to search for these unusually good bargains, you wouldn’t just search in Canada. If you search just in Canada, you will find some, or if you search just in the United States, you will find some. But why not search everywhere? That’s what we’ve been doing for forty years; we search anywhere in the world (speaking in 1979).

In theory it sounds good and should work

In theory, I am sure you will agree that increasing the number of companies in your investment universe can only help your returns.

But international investing also has problems, such as different accounting standards.

Certainly in the days before Enron and other large bankruptcies, one of the most heard comment from US based investors was concerns over the quality of the accounting.

Every country has problems

Let’s be honest, every country has had its problems in terms of accounting fraud and other scams.

That is why you should spread your investments over a lot of different companies, industries and countries.

If its 50% cheaper

Also as long as the country is not a complete banana republic, and you can buy a company there for 50% or even cheaper than your home country you are definitely paid well for taking on the risk of PERHAPS somewhat more relaxed accounting rules.

This is how he tested

James set up his stock screen as follows:

- He used an investment universe of all developed and emerging markets over the 22 year time period 1985 to 2007.

- To avoid any small company effects, he set a minimum market value of $250m.

- All returns were measured US dollars.

- James used a combination of five ratios to find undervalued investments Price to earnings, Price to book, Price to Cash flow, Price to sales and EBIT to EV. This is nearly the same ratios as James O’Shaughnessy uses in his Value Composite One indicator.

- Each of these ratios was ranked across the universe. These ranks were then added together for each company, and this combined score was ranked to give a value factor.

- Value was defined as the cheapest 20% of the investment universe based on this multi-value factor.

- Glamour was defined as the most expensive 20% of companies in the investment universe based on the multi-value factor.

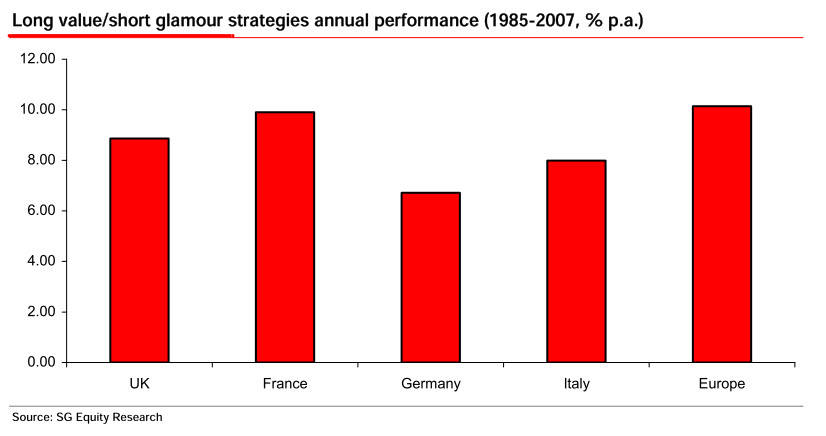

The European evidence

The chart below shows the value outperformance relative to glamour (long value short glamour) in a number of large European countries.

Look at the individual country returns compared to the average of all countries. This provides the first proof that expanding your boundaries across Europe can improve your returns.

Click image to enlarge

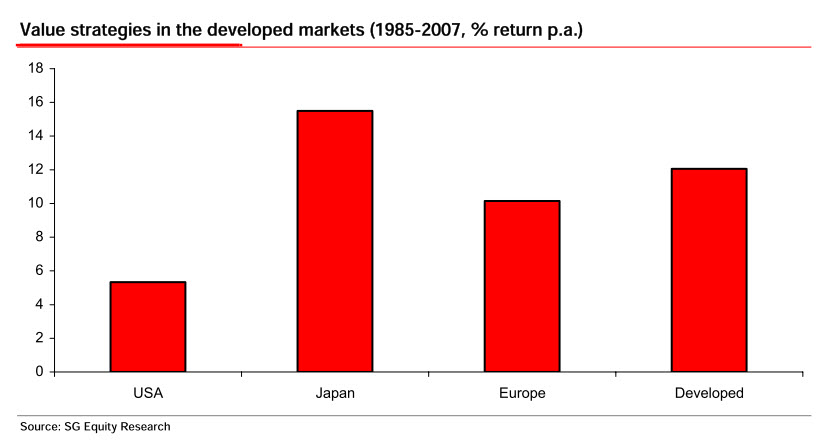

All developed markets

Across six major developed markets (Europe, the US and Japan), value outperformed glamour by an average of around 9% per year. However, across all the developed markets, value outperformed glamour by over 12% per year.

This means if you invested across all developed markets you would have had higher overall returns. Only returns in Japan were higher.

Click image to enlarge

But you have to be patient

But James also found you must be patient, referring to Benjamin Graham who said:

Undervaluations caused by neglect or prejudice may persist for an inconveniently long time. Whenever a value position is established one can never be sure which potential return pathway will be taken.

Effectively, any value position falls into one of three categories.

- Those that enjoy a re-rating as the market more generally recognises that a miss-pricing has occurred

- Those that generate a higher return via dividend yield, but are not immediately re-rated

- Those that simply don’t recover, the value traps.

So patience is a requirement for value investors as long as you are dealing with the first two types of undervalued companies, and a problem when it comes to the third type of company.

Global value investing needs patience

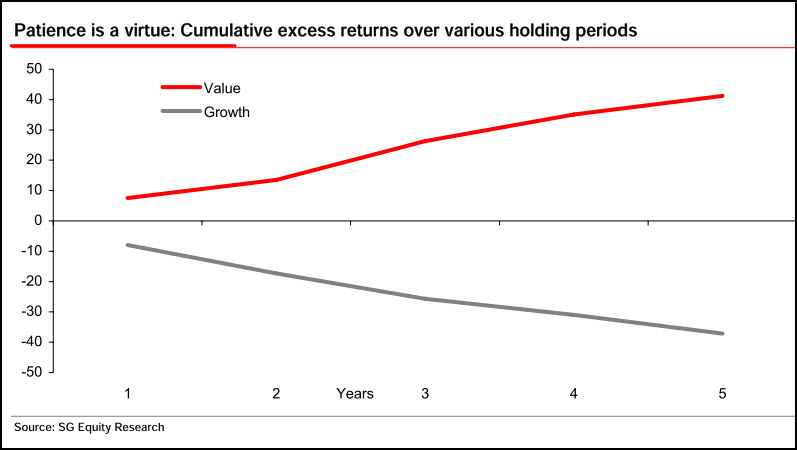

The chart below shows the need for patience when it comes global value investing.

The value strategy outperformed the market by around 7% in the first year. If you held for another 12 months, an additional 6% was added to the return.

But, holding for longer period really helped your returns. In the third year an amazing 12% outperformance of the market was recorded, followed by another 8% in the fourth year.

Click image to enlarge

This long holding period is also reflected in the average holding period of long-term successful value fund managers with their average holding period of around 5 years.

A concentrated portfolio

If you are a value investor the above results will not have surprised you. However, one thing you have probably thought of already is how do you invest in so many companies?

What buy 1,800 companies?

In the above mentioned strategy because the investment universe is so large (developed and emerging markets), if you invest in the most undervalued 20% of companies you would have to buy a lot of companies.

For example there were 1,800 companies in the most undervalued 20% of the investment universe at the end of 2007.

What if you only bought 30 companies?

James also looked at what would have happened if you ran a concentrated portfolio, and only bought the most undervalued 30 companies.

The simple answer is you would have done even better.

You would have generated an average return of nearly 25% per year over the 22 year test period.

This is an average yearly outperformance over the investment universe of nearly 15% per year!

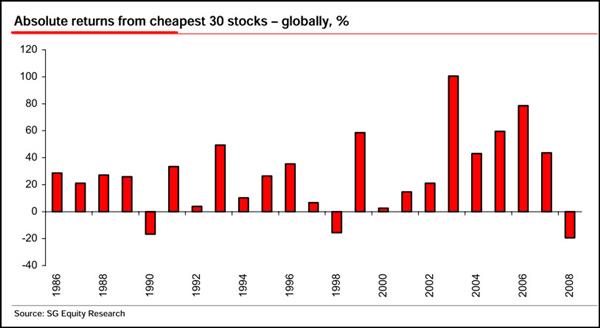

Your yearly performance

This is how the strategy of buying the 30 most undervalued companies performed on a yearly basis:

Click image to enlarge

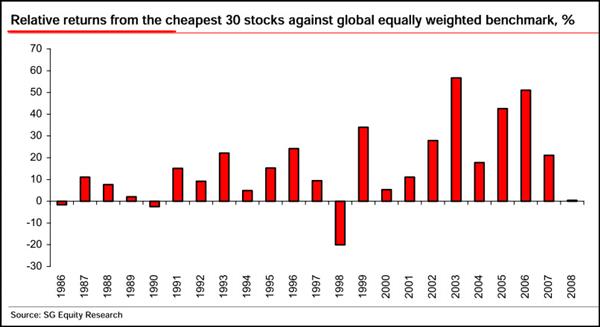

Your performance against the market

And this is what your performance would have looked like against all the companies in the back test universe:

Click image to enlarge

Concentrated can be more volatile but that isn’t risk

As you can imagine your returns from owning only 30 companies (compared to 1,800) would have been a lot more volatile.

But as you know volatility is not risk if you are a long term investor, risk is the permanent loss of capital and not a short term downward movement of a share price.

Less negative years than the market

If you look at the number of years of negative returns, the concentrated portfolio only had three yearly losses over 22 years compared to six negative years for the overall market.

Patience is rewarded

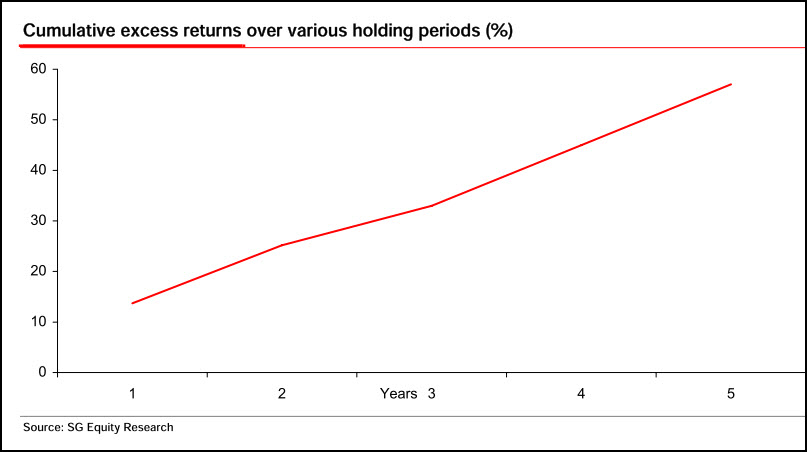

As shown above with this investment approach you get rewarded by being patient. And this is also true if you invest with a concentrated portfolio.

The following chart shows the concentrated portfolio’s excess return over the market with holding periods from one to five years.

Click image to enlarge

As you can see patience is very important with the undervalued companies continuing to substantially outperform the market over the five year period.

Conclusion, global value investing works

As you have convincingly seen global value investing works.

It is thus worth your while to look for the most undervalued companies irrespective of where in the world or in what industries they do business.

If you do this your portfolio will definitely not look like most people where you live or any of the investment funds most of your friends are invested in. But you should not care (I definitely don’t) because as you can see your returns are just so much higher.

How to build this strategy in the screener

The following few screenshots show you how you can quickly and easily build your own global value investing portfolio.

Composite value indicator

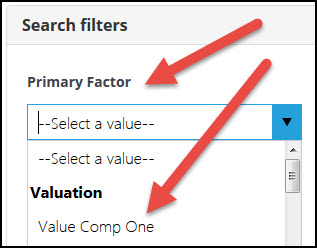

To find undervalued companies James used a combination of five ratios:

- Price to earnings,

- Price to book,

- Price to Cash flow,

- Price to sales and

- EBIT to EV.

The indicator in the screener closest to what James used is the Value Composite One (VC1) rank, developed by James O’Shaughnessy, and it is calculated using the following five valuation ratios:

- Price to earnings

- Price to book

- Price to cash flow

- Price to sales

- Earnings before interest, taxes, depreciation and amortization (EBITDA) to Enterprise value (EV)

To select the VC1 indicator simply click on the drop down list below Primary Factor and under Valuation click in Value Comp One as shown below.

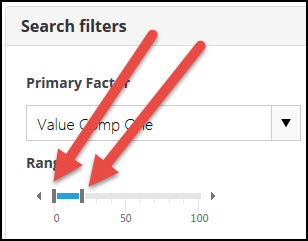

Only the cheapest companies

To select the most undervalued companies move the slider so that it selects 0% to 20%

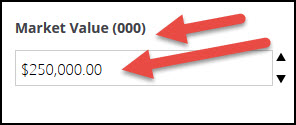

Companies over $250 million

To select only companies with a market value over $250m enter 250,000 in the Market Value field.

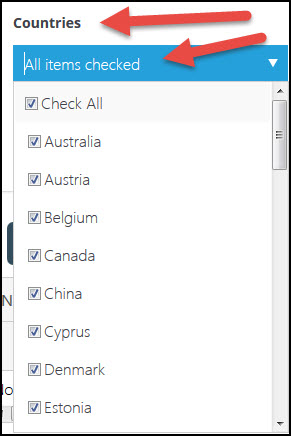

Select all the markets you can trade

James selected all developed and emerging markets in his back test.

As you may not be able to buy and sell in all markets (I can’t invest in South Korea for example) only select the countries you can invest in from the Countries selector.

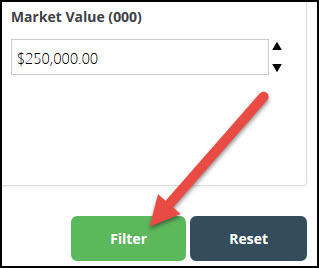

To get a list of companies click on the Filter button:

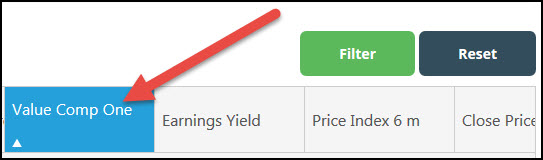

Sort the list by VC1

To sort the list of companies from cheapest to expensive simply click on the Value Comp One column heading.

That’s all you have to do

That is all you have to do to set up your own global value investment stock screen.

PS To start your world-wide investing right now you can sign up here

PPS It's so easy to put things off why not sign up right now while its still fresh in your mind?

Source:

Going global: Value investing without boundaries, James Montier, 16 September 2008

You can read more of James Montier’s work here: James Montier resource page