2016 was a rather boring investment year that turned out surprisingly profitable if you used the investment strategies that worked.

I missed the boat

I largely missed the best strategies boat as my portfolio was over 60% in cash throughout the year. In spite of that I was still able to earn a respectable 5%.

What has worked in 2016 – value is not dead

So what worked in 2016?

Here is a short summary:

- Price to book worked VERY well +36.5% (who would have thought that)

- Value Composite 1 (+28.4%) and Value Composite 2 (28.7%) did very well

- Earnings Yield (EBIT to EV) did well up 24.6%

- Qi Value did well up 24.1%

- Middle sized market value companies did well, up 21.7%

- Momentum was a disaster

Before I show you the exact strategies and their returns first some information on what and how we calculated the returns.

What we tested – 7,000 companies worldwide

We looked at the performance of the following 17 investment strategies over the 12 month from 1 January 2016 to 31 December 2016:

- Large vs small companies

- Book to Market value (inverse of price to book)

- Earnings yield (EBIT / EV)

- Qi Value ranking

- Value Composite One rank

- Value Composite Two rank

- Shareholders Yield (Dividend yield + Percentage of Shares Repurchased)

- Dividend Yield

- Dividend growth 5 years (The geometric average dividend per share growth rate over the past 5 years)

- Qi Liquidity ranking (Adjusted Profits / Yearly trading value)

- Free Cash Flow (FCF) Score (Calculated by combining Free cash flow growth with free cash flow stability)

- Price Index 6m (Current share price / Share price 6 months ago)

- Price Index 12m (Current share price / Share price 12 months ago)

- ERP5 ranking (Ranking based on Price to Book, Earnings Yield, Return on invested capital (ROIC), 5 year average ROIC)

- Magic Formula (developed by Joel Greenblatt) ranking

- Piotroski F-Score

- Gross Margin Novy Marx (gross profits / total assets)

Only companies worth more than $50 million

We excluded companies with a market value less than $50 million, to make sure that we only look at companies you can buy and sell easily.

Markets worldwide

We included markets worldwide because only when you look at markets worldwide can find the best companies that fit your investment strategy.

The following stock markets were included:

- USA

- Canada

- Eurozone countries

- United Kingdom

- Switzerland

- Norway

- Denmark

- Sweden

- Australia

- New Zealand

This gave us a list of about 7,000 companies.

All companies in five groups – Quintile 1 the best

For each of the strategies on 1 January 2016 we divided all the companies into five groups (20%) or quintiles.

Quintile 1 shows the companies that scored best in for all the strategies we tested - Quintile 5 the worse.

For example, Quintile 1 shows the return of the 20% of companies with the highest book to market ratio (lowest price to book) at the start of the year. And Quintile 5 shows the return of companies with the lowest book to market ratio (highest price to book ratio).

For Price Index 6m quintile 1 show companies with the best momentum (biggest share price increase over 6 months) and quintile 5 companies with the biggest price fall in the previous 6 months.

For F Score quintile 1 shows the return of companies with the best Piotroski F-Score (9 or 8) and quintile 5 those with the worse F-Score.

For the size strategy quintile 1 shows the return of the 20% of companies with the biggest market value and quintile 5 the 20% smallest companies.

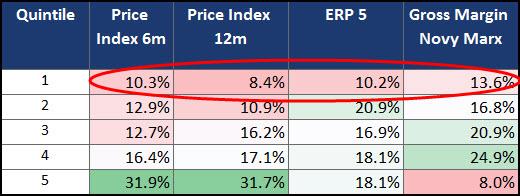

What did not work?

Let us first look at what strategies did not work in 2016.

The following strategies did not do well:

- Companies with good 6 and 12 month momentum (increasing share price) in fact just the opposite worked. If you bought the companies with the biggest 6 and 12 month share price fall at the beginning of 2016 you would have earned 31.9% and 31.7%

- Companies with the best ERP5 score did not do well, only up 10.2%. Any other ERP5 score would have done better.

- High quality companies with good gross profit margin on assets (Gross Margin Novy Marx = sales minus cost of goods sold) / total assets) did not do well (+13.6%). If you bought bad quality companies (but not the worse) you would have had a gain of nearly 25%.

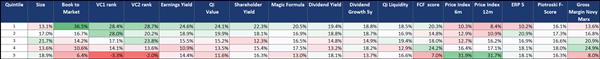

What worked?

Far more interesting of course is what strategies did do well.

Click image to enlarge

This would have been your best strategies in 2016:

- Low price to book companies did VERY well +36.5%

- James O’Shaughnessy’s Value Composite One and Two ranking

- Earnings Yield

- Qi Value

- Shareholder Yield

- Magic Formula

Here are all the results

Here is the complete table of the return of all 17 strategies.

Click image to enlarge

Your crystal ball is better

Please remember just because a strategy did well so far this year does not mean it will continue to do so.

Bad strategies may be your best bet

In fact your best strategy for 2017 may be to look at the strategies that performed the worse and as they may be the biggest winners in 2017, 6m and 12 months momentum for example.

PS: To get this report on a daily basis as well as the tools to implement them in your portfolio why not sign up now, it costs less than an inexpensive lunch for two, just click here: join now

PPS It is so easy to put things off why not sign up right now!

Further reading about the best yearly returns:

Your absolute best strategy in 2016

Your absolute best investment strategy in 2017 – nearly everything worked

The best investment strategies in 2018 - World-Wide

What investment strategies performed best in 2019 – 19 strategies tested