The Altman Z-score (or Z Score) is a formula for predicting bankruptcy was published in 1968 by Edward Altman when he was an Assistant Professor of Finance at New York University.

You can use the Z-Score to predict the probability that a company will go into bankruptcy within the next two years. The Z Score is calculated using a company's income statement and balance sheet and it measures the financial health of a company.

In a series of back tests covering three different time periods over 31 years (up until 1999), the Z-Score model was found to be 80-90% accurate in predicting bankruptcy one year prior to the event, with an error rate of 15-20%.

The Z Score is calculated as follows:

Z-score = 1.2T1 + 1.4T2 + 3.3T3 + .6T4 + .999T5.

T1 = Working Capital / Total Assets.

T2 = Retained Earnings / Total Assets.

T3 = Earnings Before Interest and Taxes / Total Assets.

T4 = Market Value of Equity / Book Value of Total Liabilities.

T5 = Sales/ Total Assets.

The Z Score is interpreted as follows:

Z-score > 2.99 = Safe

1.8 < Z-score < 2.99 = Middle or grey

Z-score < 1.80 = Distress

How to use the Z Score

Available as a screening ratio: No

Available as an output column ratio: Yes - To filter out companies with a bad Z Score simply set a filter by clicking on the funnel icon in the column heading and enter > 2.99.

The Altman Z Score in the stock screener

You can easily use the Altman Z-Score in any of your stock screens.

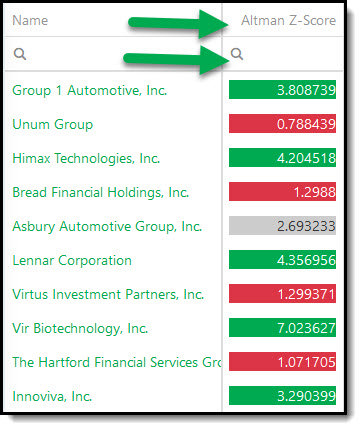

Simply add Altman Z-Score as one of the output columns of your screen. You can then use the filter function (click the funnel icon) to screen out companies with a bad Z-Score of less than 1.80.

You can see in the screenshot below that the Z Score values are colour coded so you can easily see what is good (green), middle is (black) and distress (red).

Click here to start using the Z-Score to find safer investments NOW!