If you are looking for growth investment ideas these 14 ratios lets you find fast growing companies.

These are the new growth ratios added to the screener:

- 5yr Growth Sales

- 5yr Growth EBIT

- 5yr Growth EBITDA

- 5yr Growth FCF

- 5yr Growth Net Profit

- 5yr Growth Cash Flow

- 5yr Growth Total Debt

- 1yr Growth Sales

- 1yr Growth EBIT

- 1yr Growth EBITDA

- 1yr Growth FCF

- 1yr Growth Net Profit

- 1yr Growth Cash Flow

- 1yr Growth Total Debt

How are they calculated?

As always you can see exactly how all the ratios are calculated on the Glossary page.

But here is a quick summary of the growth ratios and how they are calculated.

Five year growth ratios

The following ratios are calculated as the five year annual compound growth rate of a company’s:

- 5yr Growth Sales

- 5yr Growth EBIT

- 5yr Growth EBITDA

- 5yr Growth FCF

- 5yr Growth Net Profit

- 5yr Growth Cash Flow

- 5yr Growth Total Debt

Remember – all ratios TTM

All ratios in the Quant Investing stock screener are calculated on a trailing 12 months (TTM) basis.

This means the last twelve months (not the company’s financial year) is compared to the same period in the past.

We do this to make sure your search uses the most up to date financial results of the company.

One year growth ratios

The following ratios are calculated as the one year percentage growth in:

- 1yr Growth Sales

- 1yr Growth EBIT

- 1yr Growth EBITDA

- 1yr Growth FCF

- 1yr Growth Net Profit

- 1yr Growth Cash Flow

- 1yr Growth Total Debt

Remember – all ratios TTM

The same as the five year growth ratios these ratios are calculated on a trailing 12 months (TTM) basis. This means the last twelve months (not the company’s financial year) is compared to the same period in the past.

Where can you find them?

You can use these growth ratios as primary screening factors or in the columns where the results of your screen are displayed.

Screening with growth as a primary factor

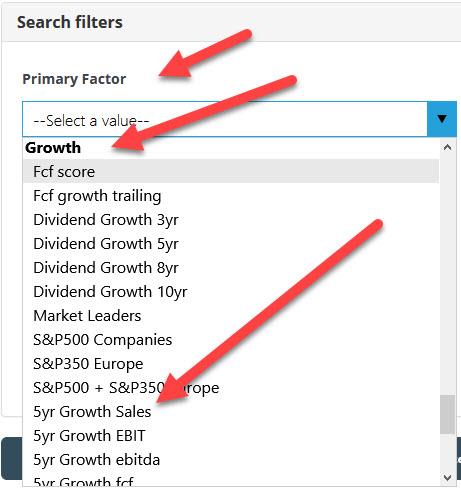

To select any of the growth ratios click on the drop down arrow below any of the four factors and scroll down to the Growth factors.

You can also find the ratio fast by clicking in the block -Select a value- and type the name of the ratio. As you type a list will appear below the box. Select a ratio by clicking on it.

How to select a growth ratio for screening

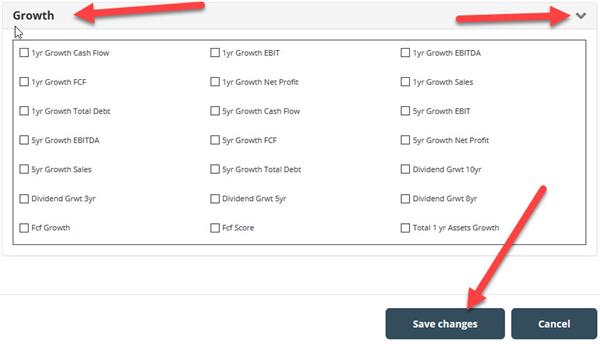

Select a growth ratio as an output column

You can of course select any of the growth ratios as an output column of your screen.

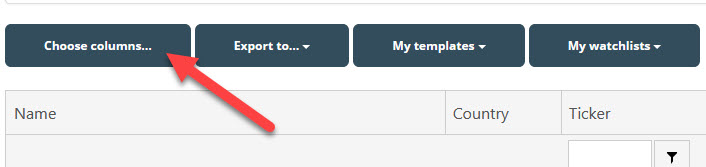

To do so click on the Choose columns button.

How to select growth ratios as an output column

In the pop-up box click on the drop down arrow next to Growth and then simply tick all the boxes next to the growth ratios you would like to see in the results of your screen.

Once you have selected all the columns you would like to see click the Save changes button.

PS To start using these growth ratios to find investment ideas for your portfolio sign up here.

PPS It is so easy to get distracted, why not sign up right now while it is still fresh in your mind?