We just added Market Leaders, Large Companies on Steroids, as defined by James O'Shaughnessy in his excellent book What Works On Wall Streets, to the Quant Investing stock screener.

Market Leaders are large companies on steroids

The name Market Leaders come from the book What Works On Wall Street where James O'Shaughnessy tested an investment strategy of only investing in market leading companies which resulted in market beating performance.

James defined Market Leaders as Non-utility companies with larger than average:

- Market value

- Number of shares outstanding

- Free Cash flow and

- Sales above 1.5 times the average of the universe

James used mainly US companies and foreign companies listed in the USA, when he tested his strategy but in the stock screener we include companies listed in all developed markets worldwide from the database of over 22,000 companies when calculating the Market Leaders universe.

To make sure that the large number small companies does not pull the average down, companies with a market value of less than €50 million, are excluded from the average calculations.

Outstanding performance +889.3%

Back tests we have done were VERY encouraging.

If you, over the past 14 years, bought the 20 most undervalued Market Leaders worldwide you would have earned a compound yearly return of 18.5% (889.3% over 14 years) compared to only 8.3% per year (105.3% over 14 years) that the index returned over the same 14 year period.

And remember these were large companies, we are not talking about the small company effect here.

These are companies with a market value starting at €1 billion, that are available to trade at nearly all brokers, and easy to buy and sell.

Click here to start finding Market Leaders for your portfolio Now!

Already available in the stock screener

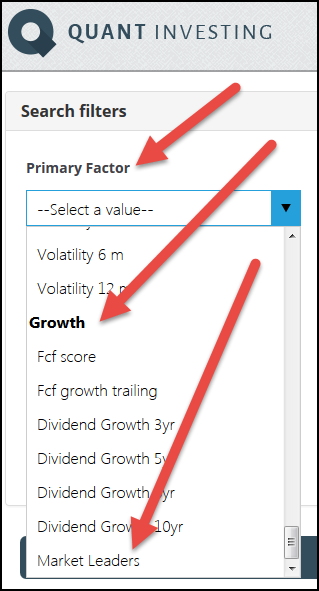

And Market Leaders are already available for you to use in the screener.

To select them click the drop down list of any of the four sliders and under the heading Growth click on Market Leaders.

Note: Because Market Leaders gives you a list of companies that meet the above criteria the slider cannot be used to change the Market Leaders selection.

Use it with your favourite valuation measure

Even though Market Leaders outperform the market as a group you can do even better if you select undervalued Market Leaders.

You can do that with your favourite valuation measure but we suggest you use Qi Value.

PS To get the Market Leaders universe working in your portfolio today sign up here

PPS It is so easy to forget why not sign up right now!

Click here to start finding Market Leaders for your portfolio Now!