To help you find better quality companies we have added five year average return on invested capital (ROIC) to the stock screener.

Helps you Identify wide moat companies

Return on invested capital is a great ratio to find out if a company has got a moat (protective wall) that protects its business as only companies with a moat will be able to earn a high return on its invested capital over long periods of time.

This is why we added five year average ROIC to the screener. The ratio is called ROIC 5yr Avg

How is 5 Year average ROIC calculated?

Five year average Return on invested Capital (ROIC) is calculated as follows:

ROIC 5yr Avg = Five year average EBIT / Five year average ((Net working capital) + Net Fixed Assets)

How to select it in the screener

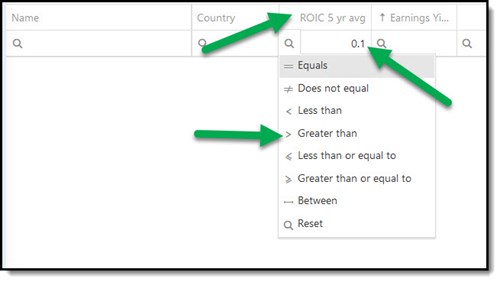

To use it in the Quant Investing stock screener, this is what you need to do.

Simply select ROIC 5yr Avg as one of the output columns of your screen.

You can then refine your search by requiring that companies has a minimum five year average ROIC of 10% as shown in the screenshot below.

How to select companies with a five year average Return on invested Capital (ROIC) of more than 10%

Five year average ROIC back test

This back test on five year average ROIC may interest you: Do TTM or normalized ratios give you higher returns? – data driven

PS To get five year average ROIC working in your portfolio sign up here.

PPS It is so easy to get distracted, why not sign up right now?