As 2023 unfolded, we faced a daunting investing landscape of high inflation, a US banking crisis, and aggressive monetary policies. Despite these hurdles, some strategies managed to yield impressive returns of over 40%.

Interested to know which ones soared above the rest? The results will surprise you!

What investment strategies performed best in 2023?

So, what worked best world-wide in 2023?

Here is a summary:

- Undervalued Value Composite One and Two (VC One and VC Two) ranked companies had the highest return of +25.4 and 24.6%

- Buying companies with a low price to book value returned +24.1%.

Before I show you the more detailed returns, first information on what and how we calculated the returns.

19 investment strategies tested – on 9,500 companies worldwide

We looked at the performance of the following 19 investment strategies from 1 January 2023 to 31 December 2023:

- Size - Large vs small companies (Quintile 1 = Biggest companies)

- Book to Market value (inverse of price to book)

- Earnings yield (EBIT/EV)

- Qi Value – the strategy we use in the newsletter and I use in my own portfolio

- Price Index 6m (Current price / Price 6 months ago) also known as 6 months Momentum

- Price Index 12m (Current price / Price 12 months ago) also known as 12 months momentum

- VC One also known as Value Composite One rank

- VC Two known as Value Composite Two rank (Value Composite One with an additional ratio: Shareholder Yield)

- ERP5 ranking (A composite ranking based on Price to Book, Earnings Yield, Return on invested capital (ROIC), 5-year average ROIC)

- Shareholder Yield (Dividend yield + Percentage of Shares Repurchased)

- Dividend Yield

- Dividend growth 5 years (The geometric average dividend per share growth rate over the past 5 years)

- MF Rank (Magic Formula investment strategy developed by Joel Greenblatt)

- Piotroski F-Score

- Qi Liquidity ranking Low liquidity stocks calculated as Adjusted Profits / Yearly trading value

- Gross Margin Novy-Marx (Gross Profits / total assets) – the best quality ratio we have tested

- Free Cash Flow (FCF) Score (Calculated by combining Free cash flow growth with free cash flow stability)

- Adjusted slope average (125-day, 250 day) – momentum

- Adjusted slope (90 days) – momentum

Market value over €50 million trading more than €25,000 per day

We excluded companies with a market value below €50 million and a median 30-day traded value less than €25,000.

This left a universe of around 9,500 companies which means each quintile world-wide consisted of about 2,000 companies. This large number of companies is good because it makes it unlikely that any one company impacted the return of any quintile .

If the ratio or indicator could not be calculated when the portfolios were formed the company was excluded ONLY for that specific strategy that year.

Markets worldwide then regions

The following stock markets (and regions) were included:

North American Markets

- USA

- Canada

European Markets

- All the Eurozone countries

- United Kingdom

- Switzerland

- Norway

- Denmark

- Sweden

Japanese Market

- Only Japan

Other Asian and Oceanic Markets

- Australia

- New Zealand

- Hong Kong

- Singapore

All companies in five groups – Quintile 1 the best

To test the strategies, we used point in time data (so no look ahead bias), on 1 January 2023 we divided all the companies in the universe into five 20% groups or quintiles.

Quintile 1 shows the companies that scored best in for all the strategies we tested - Quintile 5 the worst. For example, Quintile 1 shows the return of the 20% of companies with the highest book to market ratio (lowest price to book – cheap companies) at the start of the year.

And Quintile 5 shows the return of companies with the lowest book to market ratio (highest price to book ratio – expensive companies).

For Price Index 6m quintile 1 show companies with the best momentum (biggest share price increase over 6 months) and quintile 5 companies with the biggest price fall in the previous 6 months.

For the Piotroski F Score quintile 1 shows the return of companies with the best Piotroski F-Score (9 or 8) and quintile 5 those with the worse F-Score.

For the Size strategy quintile 1 shows the return of the 20% of companies with the biggest market value and quintile 5 the 20% smallest companies.

Return calculation

Returns for each quintile is calculated as the average percentage change from the stock price over the period, plus dividends.

No adjustments were made for currency movements.

The best investment strategy world-wide in 2023

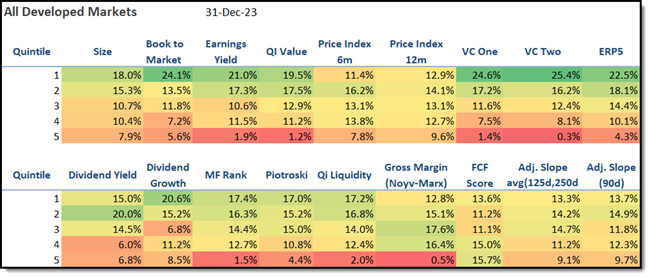

The following table summarises how all 19 investment strategies performed world-wide:

For reference the MSCI World Index gained 18.0%.

Click image to enlarge

Best performing strategies world-wide

How all the best rated companies (Quintile 1) perform?

- Average return Quintile 1 of all strategies: +17.7%

- Maximum return of Quintile 1 strategies: +25.4%

- Minimum return of Quintile 1 strategies: +11.4%

What worked?

Here are the two best performing Quintile 1 strategies:

- Undervalued Value Composite One and Two (VC One and VC Two) ranked companies did great returning +24.6 and 25.4%!

- Buying companies with a low price to book value returned +24.1%. Most likely because you Japanese companies but more on that later.

What did not work?

These were the worse Quintile 1 strategies:

- The worse strategy was investing in companies with good six months momentum +11.4%

- The second worst strategy was high quality companies with a high Gross Margin (Novy-Marx) +12.8%.

Click Here – To get all the tools you need to implement all 19 strategies NOW!

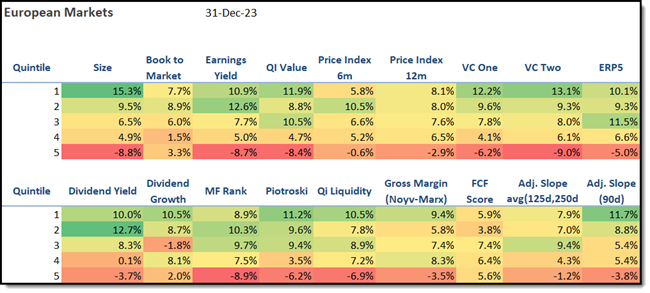

The best investment strategy in Europe in 2023

Below is the performance of all 19 strategies in Europe:

For reference the European STOXX 600 Index returned +12.7%.

Click image to enlarge

Best performing strategies in Europe

How all the best rated companies (Quintile 1) perform?

- Average return Quintile 1 of all strategies: +10.1%

- Maximum return of Quintile 1 strategies: +15.3%

- Minimum return of Quintile 1 strategies: +5.8%

What worked?

These were the best two Quintile 1 strategies:

- In Europe, the best strategy was simply buying large companies which returned +15.3%

- Buying cheap Value Composite Two (VC Two) companies would have given you the second highest return of 13.1%

What did not work?

The two worse performing Quintile 1 strategies were:

- If you invested in companies with the best 6 months momentum – Price Index 6m you would have had the lowest return at +5.8%

- If you invested in high FCF Score (high and stable FCF) companies it would also not have done well at +5.9%.

Click Here – To get all the tools you need to implement all 19 strategies NOW!

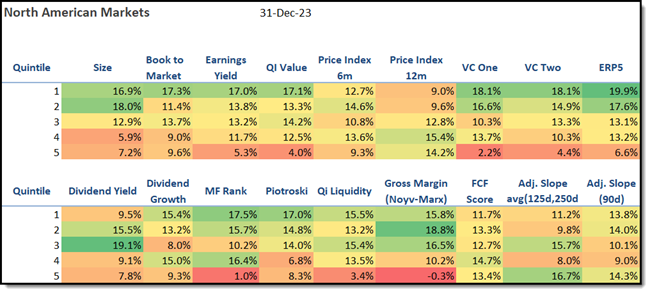

The best investment strategy in North America in 2023

Below is the performance of all 19 strategies in North America:

For reference the S&P 500 Index lost +24.2%

Click image to enlarge

Best performing strategies in North America

How all the best rated companies (Quintile 1) perform?

- Average return Quintile 1 of all strategies: +15.2%

- Maximum return of Quintile 1 strategies: +19.9%

- Minimum return of Quintile 1 strategies: +9.0%

What worked?

The two best performing Quintile 1 strategies were:

- Buying cheap ERP5 companies would have given you the highest return of +19.9%

- Buying cheap Value Composite companies (Both One and Two) both returned the +18.1%.

What did not work?

The two worse performing Quintile 1 strategies were:

- Buying the best 12 months momentum – Price Index 12m - companies would have given you the lowest return of +9.0%.

- Buying companies with the highest dividend yield would have given you the second lowest return of +9.5%.

Click Here – To get all the tools you need to implement all 19 strategies NOW!

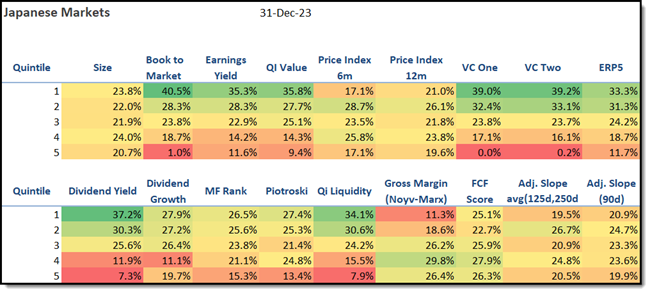

This was your best investment strategy in Japan in 2023

Below is the performance of all 19 strategies in Japan.

For reference the Japanese Nikkei 225 Index gained 28%.

Click image to enlarge

Best performing strategies in Japan

How all the best rated companies (Quintile 1) perform?

- Average return Quintile 1 of all strategies: +28.8%

- Maximum return of Quintile 1 strategies: +40.5%

- Minimum return of Quintile 1 strategies: +11.3%

What worked?

The two best performing Quintile 1 strategies in Japan were:

- Buying companies with a high Book to Market (Low price to Book) ratio was the best strategy that returned +40.5%.

- Buying cheap Value Composite companies (Both One and Two) returned the +39.0% and 39.2%.

What did not work?

The two worse performing Quintile 1 strategies, if you can all then that, were:

- The worst strategy was high quality companies with a high Gross Margin (Novy-Marx) which returned 11.3%.

- Buying the best 6 months momentum – Price Index 6m - companies would have given you the second lowest return of +17.1%.

Click Here – To get all the tools you need to implement all 19 strategies NOW!

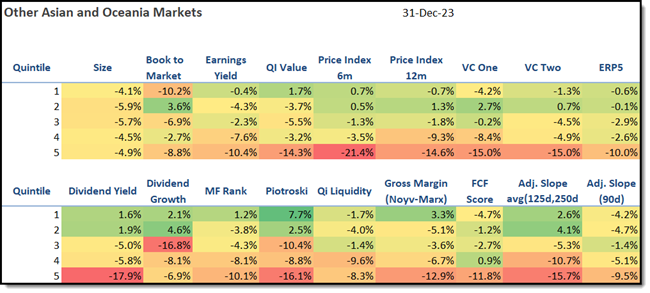

The best investment strategy in Asia and Oceania Markets in 2023

Australia, New Zealand, Hong Kong, and Singapore companies are included in this analysis.

For reference the iShares Core MSCI Pacific ex-Japan ETF (Australia, New Zealand, Hong Kong, and Singapore companies) returned +6.4%.

Click image to enlarge

Best performing strategies in Asia and Oceania

How all the best rated companies (Quintile 1) perform?

- Average return Quintile 1 of all strategies: -0.8%

- Maximum return of Quintile 1 strategies: +7.7%

- Minimum return of Quintile 1 strategies: -10.2%

What worked?

The two best performing Quintile 1 strategies were:

- If you invested in quality companies with a high Piotroski F-Score, you would have had the highest return of +7.7%.

- If you bought quality high Gross Margin (Novy-Marx) companies, you would have had the second highest +3.3%.

What did not work?

The two worse performing Quintile 1 strategies were:

- Buying companies with a high Book to Market (Low price to Book) ratio was the worst strategy that returned -10.2%.

- If you invested in high FCF Score (high and stable FCF) companies, it would also not have done well and lost -4.7%.

Returns all over the place – This is normal

As you can see no one strategy worked everywhere – sometimes exactly the opposite worked. For example, low price to book worked great in Japan returning +40.5% but the same strategy was the worst performer in other Asian markets losing -10.2%.

This just proves that over the short-term anything is possible.

A warning – investment strategy may stop working

Remember just because a strategy did great in 2023 does not mean it will continue to work. As you can see the same strategy performed well in one region underperformed in another.

Jumping on the best performing strategy is most likely a bad idea - possibly your worst idea for 2024.

Perhaps your best strategy this year was the worst strategy in 2023 as it may turn around as happens a lot to under-performing strategies.

Like you I have no idea as to what strategy will work best and if someone says he does, he or she is lying – you can be sure of that.

The best investment wisdom applied here

The same investment advice that has always worked also applies here. If you use a time-tested good performing investment strategy, that suits your nature so you can stick with it through thick and thin, you will have great returns over the long term.

If you want to read more about the best strategies we have tested, click here: Best investment strategies we have tested at Quant Investing

The diverse performance of investment strategies in 2023 teaches us an important lesson: Markets are unpredictable, and past success is no guarantee of future out-performance. As we look forward to 2024, approach your investing with a blend of caution, research, and an open mind.

Wishing you profitable investing in 2024!

PS To get this report on a weekly basis as well as the tools to implement all 19 strategies (for less than an inexpensive lunch for two) sign up here.

PPS It is so easy to put things off, why not sign up right now?

Click Here – To get all the tools you need to implement all 19 strategies NOW!