Are you looking for 2025 Magic Formula stock ideas in Europe? This article introduces the Magic Formula, a simple, research-backed strategy created by Joel Greenblatt. It helps you find great companies at bargain prices using two key factors: earnings yield and return on capital.

Even better, we’ve improved the formula by adding momentum, boosting returns by over 600%. You’ll also get a list of top Magic Formula stocks in Europe for 2025 and step-by-step instructions on how to use this strategy today.

Estimated Reading Time: 5 minutes

Are you struggling to beat the market? I've found something that works - the Magic Formula investment strategy. Over 15 years of testing shows it consistently outperforms the market by finding quality companies at bargain prices.

You don't need to be a stock market expert or spend hours analyzing financial statements. The Magic Formula does the heavy lifting for you by focusing on just two things: how cheap a company is and how efficiently it uses its capital.

Why the Magic Formula Works

Joel Greenblatt, a highly successful hedge fund manager, created this strategy and explained it in his book "The Little Book That Still Beats the Market."

The formula looks at:

- Earnings yield - shows how cheap a company is

- Return on invested capital - shows how well the company uses its money

Think of it as shopping for quality brands at discount prices. Just as you love finding your favourite products on sale, the Magic Formula helps you find excellent companies when they're trading at bargain prices.

Our Enhanced Version

We've improved the Magic Formula by adding six-month price momentum. This simple addition increased returns by over 600% in our tests.

Our enhanced version gives you:

- Quality companies at attractive prices

- Stocks already moving in the right direction

- Lower risk of buying "value traps" (cheap stocks that keep getting cheaper)

With just a few mouse clicks in our screener, you can find these market-beating investment ideas today.

We've made the Magic Formula even better by testing it with other factors. The biggest improvement came when we added momentum - looking at how well the stock has done in the past six months. This simple change boosted returns by over 600% in our tests.

Our improved version gives you the best of both worlds. You get quality companies at low prices that are also moving up in price. This means you're more likely to make money and less likely to buy "value traps" - cheap stocks that keep getting cheaper.

Look at the returns in column Q1. They show the returns generated by first selecting the best Magic Formula companies (most undervalued) and then sorting them by the items in the Factor 2 column.

Best combination +783% was Momentum

This means you could have earned the highest return of 783.3% over 12 years if you invested in the best ranked Magic Formula companies that also had the highest 6 month price index (price momentum).

No on to the 2025 European Magic Formula investment ideas.

Click here to start finding your own Magic Formula ideas NOW!

Best Magic Formula investment ideas in Europe for 2025

Europe European companies often trade at lower prices than similar companies in the USA. This means you can find even better bargains. Here are the best European Magic Formula stocks.

Magic Formula only investment ideas

This is what the screen looked like:

-

EU countries, Scandinavia and the UK selected

-

Top 20% Magic Formula companies

-

Minimum daily trading volume of $100,000

-

Minimum company market value of $100 million

-

Financial statements updated in the last 6 months

-

Results sorted by Magic Formula from best to worse

| Name | Country | MF Rank |

|---|---|---|

| CoinShares International Limited | Sweden | 94 |

| PetroNor E&P ASA | Norway | 218 |

| Smiths News plc | Great Britain | 236 |

| Liontrust Asset Management PLC | Great Britain | 260 |

| Avance Gas Holding Ltd | Norway | 294 |

| Record plc | Great Britain | 311 |

| Bure Equity AB (publ) | Sweden | 340 |

| Braemar Plc | Great Britain | 345 |

| S.A. Fountaine Pajot | France | 353 |

| Aker BP ASA | Norway | 355 |

| Rainbow Tours S.A. | Poland | 363 |

| Nordic Paper Holding AB (publ) | Sweden | 372 |

| OKEA ASA | Norway | 377 |

| Sogefi S.p.A. | Italy | 399 |

| Equinor ASA | Norway | 423 |

| RWS Holdings plc | Great Britain | 435 |

| 2020 Bulkers Ltd. | Norway | 442 |

| MT Højgaard Holding A/S | Denmark | 454 |

| Text S.A. | Poland | 473 |

| Supreme Plc | Great Britain | 482 |

Magic Formula combined with Price Index 6 month

This is what the screen looked like:

-

EU countries, Scandinavia and the UK selected

-

Top 10% Magic Formula companies

-

Minimum daily trading volume of $100,000

-

Minimum company market value of $100 million

-

Financial statements updated in the last 6 months

-

Results sorted by Price Index 6 months (Momentum) from best to worse

| Name | Country | MF Rank | Price Index 6m |

|---|---|---|---|

| Serabi Gold plc | Great Britain | 1,156 | 2.19 |

| Kernel Holding S.A. | Poland | 881 | 1.99 |

| MT Højgaard Holding A/S | Denmark | 454 | 1.81 |

| Lubawa S.A. | Poland | 553 | 1.66 |

| VEON Ltd. | The Netherlands | 1,048 | 1.65 |

| Asseco Poland S.A. | Poland | 1,288 | 1.56 |

| Intellego Technologies AB | Sweden | 1,209 | 1.52 |

| Comp S.A. | Poland | 1,596 | 1.42 |

| The Alumasc Group plc | Great Britain | 1,394 | 1.41 |

| CoinShares International Limited | Sweden | 94 | 1.38 |

| ENEA S.A. | Poland | 752 | 1.37 |

| Magyar Telekom | Hungary | 1,308 | 1.36 |

| Imperial Brands PLC | Great Britain | 797 | 1.33 |

| Technip Energies N.V. | France | 1,392 | 1.32 |

| PetroNor E&P ASA | Norway | 218 | 1.31 |

| RCS MediaGroup S.p.A. | Italy | 956 | 1.30 |

| Rainbow Tours S.A. | Poland | 363 | 1.28 |

| Cairo Communication S.p.A. | Italy | 1,344 | 1.28 |

| Trigano S.A. | France | 560 | 1.28 |

| Betsson AB (publ) | Sweden | 697 | 1.27 |

Click here to start finding your own Magic Formula ideas NOW!

How to Implement the Magic Formula In Your Portfolio

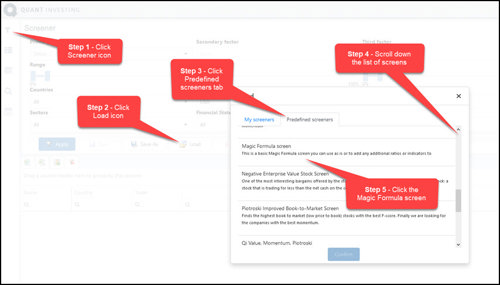

Using this strategy is easy. We've already saved the Magic Formula screen in our stock screener. All you need to do is:

-

Log in to the screener

-

Click the screener icon

-

Click "Load"

-

Choose "Magic Formula" from the saved screens

-

Pick your countries,

-

Set your minimum daily trading volume and company size

-

Click "Apply"

You can make the strategy even better by adding momentum. Just move the slider under "Price Index 6m" to select companies whose price has gone up the most (the top 40% of all companies) in the past six months. This simple change has boosted returns by over 600% in our tests.

Why Act Now

Right now, is a great time to use the Magic Formula strategy. Markets have been up and down lately, which means there are more chances to find good companies at low prices. Plus, many investors are worried about the economy, making them sell good companies for less than they're worth.

The best part about starting now is that you can build your portfolio slowly. Buy a few companies each month until you own 30-40 stocks.

This way you spread your risk and don't have to worry if one company does poorly.

Next Steps

Here's what you should do next:

-

Load the Magic Formula screen

-

Start building your watch list

-

Buy your first Magic Formula stock

You don't have to do this alone. We're here to help you every step of the way.

Our screener makes finding these companies easy, and our newsletter keeps you updated on new opportunities.

Click here to start finding your own Magic Formula ideas NOW!

Remember, investing doesn't have to be complicated. The Magic Formula gives you a simple, proven way to find good companies at bargain prices.

Why not get started right now?

FREQUENTLY ASKED QUESTIONS

I'm new to investing. Is the Magic Formula too complicated for me?

Not at all! The Magic Formula was designed for regular investors like you. You only need to understand two simple ideas - how cheap a company is (earnings yield) and how well it uses its money (return on capital). Our screener does all the math for you.

You just pick the stocks from the list it creates. Many beginners find this approach much easier than trying to pick stocks on their own.

How many Magic Formula stocks should I buy for my portfolio?

We recommend owning 20-30 Magic Formula stocks. This gives you enough variety to spread your risk but isn't so many that you can't keep track of them.

Start slowly - buy 2-3 stocks per month until you build your full portfolio. This way, you don't invest all your money at once, which could be risky if the market suddenly drops.

How often should I update my Magic Formula portfolio?

Joel Greenblatt suggests holding each stock for one year. After a year, sell the ones that no longer meet the Magic Formula criteria and replace them with new ones.

This annual rotation keeps your portfolio focused on undervalued, quality companies. I find setting calendar reminders for each stock purchase date helps me stay organized.

I've heard value investing is dead. Why would the Magic Formula still work today?

This is a common worry, but history shows the Magic Formula still works. Value strategies sometimes underperform for a few years, but they always come back. Why?

Because human emotions don't change. Investors still overreact to bad news, creating bargains. Adding the momentum factor (as we suggest) has made the strategy even more effective in recent years. I've seen this work in my own portfolio through different market cycles.

What's the minimum amount of money I need to start using the Magic Formula?

You can start with as little as $1,000, though $5,000-$10,000 works better. With $1,000, you might buy just one stock to start. With $5,000, you could buy 3-5 companies, giving you better diversification. The key is starting small and adding more stocks over time.

I began with just three stocks and built from there as I gained confidence.

How do I avoid value traps when using the Magic Formula?

This is why we added the six-month price momentum filter! A value trap is a cheap stock that stays cheap or gets cheaper because the business is truly declining. By selecting Magic Formula stocks that have shown positive price movement over the past six months, you greatly reduce the risk of buying these traps. In my experience, this simple addition has saved me from several bad investments that looked good on paper.

Will the Magic Formula work during a market crash or recession?

Yes, but expect short-term losses like with any strategy. The Magic Formula actually does quite well after market crashes because it finds quality companies at even deeper discounts. During the 2008 financial crisis, Magic Formula stocks fell with the market but recovered faster and went higher afterward. I've learned to see market drops as opportunities to buy great companies at fire-sale prices.

Click here to start finding your own Magic Formula ideas NOW!

Please note: This website is not associated with Joel Greenblatt and MagicFormulaInvesting.com in any way. Neither Mr Greenblatt nor MagicFormulaInvesting.com has endorsed this website's investment advice, strategy, or products. Investment recommendations on this website are not chosen by Mr. Greenblatt, nor are they based on Mr Greenblatt's proprietary investment model, and are not chosen by MagicFormulaInvesting.com. Magic Formula® is a registered trademark of MagicFormulaInvesting.com, which has no connection to this website.