This is the editorial of our monthly Quant Value Investment Newsletter, published on 2023-09-05. Sign up here to get it in your inbox the first Tuesday of every month.

More information about the newsletter can be found here: This is how we select ideas for the Quant Value investment newsletter

This month you can read why steady always beats wild returns.

Tortoise Beats the Hare: Why Slow and Steady Wins the Return Race

This month I would like to show you why steady returns are much better than wild and extreme movements.

When we talk about investment success, most people mention wild returns over short periods. But as you know this is mentioned by beginners.

As an experienced investors you know you must look at another, much more important factor, which is how much these returns fluctuate.

This is crucial for your long-term investment success.

Hare and tortoise investments compared

Let's look at two investments, A and B, both have an average annual return of 10%.

Investment A gives 10% returns each year for two years, growing your $100 to $121.

Investment B has a bumpy ride, with a -50% loss in the first year but a 70% gain in the second, still averaging 10% annually.

BUT a $100 investment in B would only grow to $85 after two years due to wild movements and the sequence the movements took place.

The difference shows you how volatility affects the overall return. Mainly how high volatility can drag down your long-term performance.

Why is it important to limit large losses?

It is especially important that you avoid large losses.

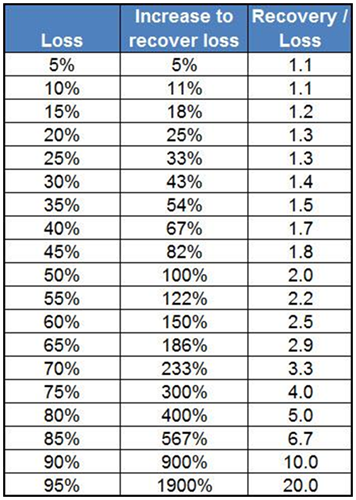

Why is best shown with the following table:

The table shows the return you must generate (column 2 "Increase to recover loss") to recover from the "Loss" in column 1.

A 5% loss is still easy to recover from. But if you suffer a 20% loss you need a return 1.3 times (column 3) the loss to recover your investment.

It only gets worse

Should you suffer a 60% loss you need a return 150% or 2.5 times the loss to recover your capital.

Diversification helps

Diversification help you counter this effect, as shown when comparing the S&P 500 with individual stocks like Tesla for example.

Stocks like Tesla may have higher short-term gains, but their wild ups and downs lead to lower overall returns over longer time periods.

While you may fear missing out on big winners by diversifying, the REAL benefit you get is having lower losses during downturns.

Wild losses need big returns

As mentioned, if you have a wild loss, you must have a big return to make up for the loss. But you know large gains are hard to find.

And you do not know if the stock that gave you the large loss will have a big gain again.

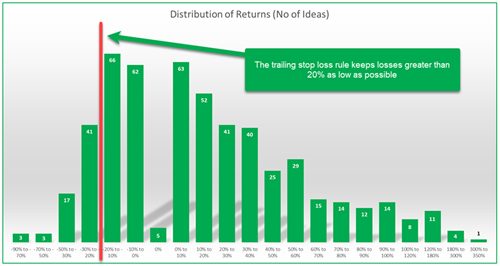

Just look at the return of the companies recommended in the newsletter:

Of the over 500 companies recommended you can see there were a few large returns, 24 of over 100% but most of the returns were between 0% to 40%.

Also notice how the strict stop loss keep losses low, the chart left of 0% is a lot shorter.

Summary and conclusion

So, what does this mean for our portfolio?

Slow and steady returns from a well-diversified portfolio outperforms wild returns over time AND it lets us sleep better.

That is why the newsletter recommends no more than 2% positions worldwide. It’s the easiest and best way to diversify your portfolio.

It is also the reason why you should only smile when a friend talks about wild gains he made in some single stock or high-risk crypto investment.

His overall long-term return is very likely below what you achieved with your well diversified portfolio. And you slept comfortably, every night.

What’s not to like about that?

Not a subscriber? Click here to get ideas from the BEST strategies we have tested NOW!