With all the attention investors are giving low volatility investment strategies here is are a few low volatility S&P 500 investment ideas.

First a bit of background information.

What is volatility?

Volatility is the variability of a stock’s return over a period of time, measured using its standard deviation.

High volatility means that a stock price can change a lot, up or down.

Low volatility means that a stock price does not change wildly, but changes at a steady pace over time.

How is volatility calculated?

In the Quant Investing stock screener volatility is calculated as the standard deviation of the daily log normal returns of the stock price over 3, 6 or 12 months annualized. The result is shown as a percentage (%).

Volatility 12 months is calculated using the weekly log normal stock price returns.

The Quant Investing stock screener has three stock price volatility indicators:

- Volatility 3 months

- Volatility 6 months

- Volatility 12 months

- Volatility 36 months

Click here to start finding low volatility stocks NOW!

Low volatility S&P 500 stocks

To find the lowest volatility US 500 companies over the past six months this is what you should screen for:

- Selected all the companies in the US500 index - this is our index similar to the S&P 500

- Selected the 20% of companies with the lowest 6 month Volatility

- Sorted the results by Volatility 6 months from low to high

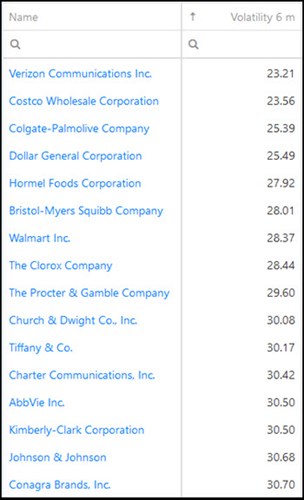

These are the low volatility companies the screen came up with:

As you would expect, high quality stable companies.

High volatility S&P 500 companies

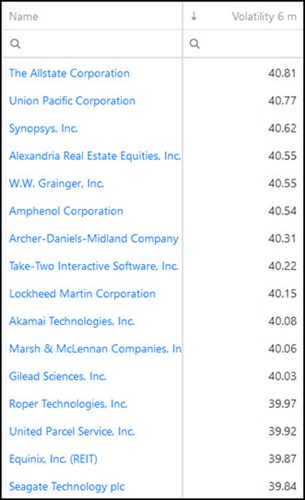

Just for interest here are the US 500 companies with the highest volatility.

This is what I screened for:

- Selected all the companies in the US 500

- Selected the 20% of companies with the highest Volatility 6 months

- Sorted the results by Volatility 6 months from high to low

A lot of companies that had a wild ride so far this year are on the list.

Click here to start finding low volatility stocks NOW!

Quality low volatility S&P 500 companies

To find quality low volatility US 500 companies I added the Piotroski F-Score to the screen.

You can read more on how well the F-Score works in this article: Piotroski F-Score back test

This is what I screener for:

- Selected all the companies in the US 500

- Selected the 20% of companies with the lowest Volatility 6 months

- Selected companies with a Piotroski F-Score greater than and equal to 7

- Sorted the results by Volatility 6 months from low to high

As you can see this list looks a lot different than the first low volatility list. These companies are definitely worth a second look as they have good fundamental momentum.

How you can find low volatility stock investment ideas?

It’s very easy to find low volatility investment ideas int he countries where you invest.

As mentioned the Quant Investing stock screener gives you three volatility indicators you can use:

- Volatility 3 months

- Volatility 6 months

- Volatility 12 months

- Volatility 36 months

The output is a percentage (%) and is calculated as the standard deviation of the daily log normal returns of the stock price over 3, 6, 12 or 36 months annualized.Volatility 12 months is calculated using the weekly log normal stock price returns.

Click here to start finding low volatility stocks NOW!

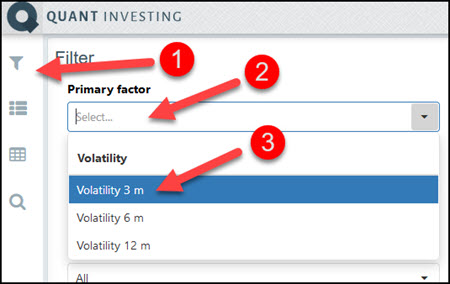

To select companies with low volatility this is what you do:

- Click on the Funnel icon to open the screener criteria

- Type “Volatility” into the text box below Primary factor

- Select the volatility indicator you would like to use

To only show companies with low volatility set the Range sliders from 0% to 20%

That is all you have to do to find low volatility investment ideas.

PS To start finding low volatility companies right now sign up here

PPS it is so easy to forget, why not sign up right now? It costs less than an inexpensive lunch for 2 and if you are not happy with the service you get all your money back. Sounds good? Then sign up here.