Are you wondering where to find great investment returns in 2025?

This article explains why no one can predict the best-performing stocks or asset classes this year and how hindsight often makes past winners seem obvious. More importantly, it provides actionable steps to help you succeed despite the uncertainty.

You’ll learn how to focus on proven strategies, test them for long-term results, and even prepare for a market crash.

Estimated Reading Time: 6 minutes

Yes 2024 was a great year if you were 100% invested in the S&P 500 or the NASDAQ but who was?

But now its 2025 and the question I am sure you are asking is:

Where can I get great investment returns this year?

Who knows if:

- The tech and AI bubble will burst.

- Tesla will keep on hitting new highs.

- Zombie companies with too much debt will collapse.

- The crypto boom will continue.

No one knows or can know, but in hindsight, everyone says it was a no-brainer.

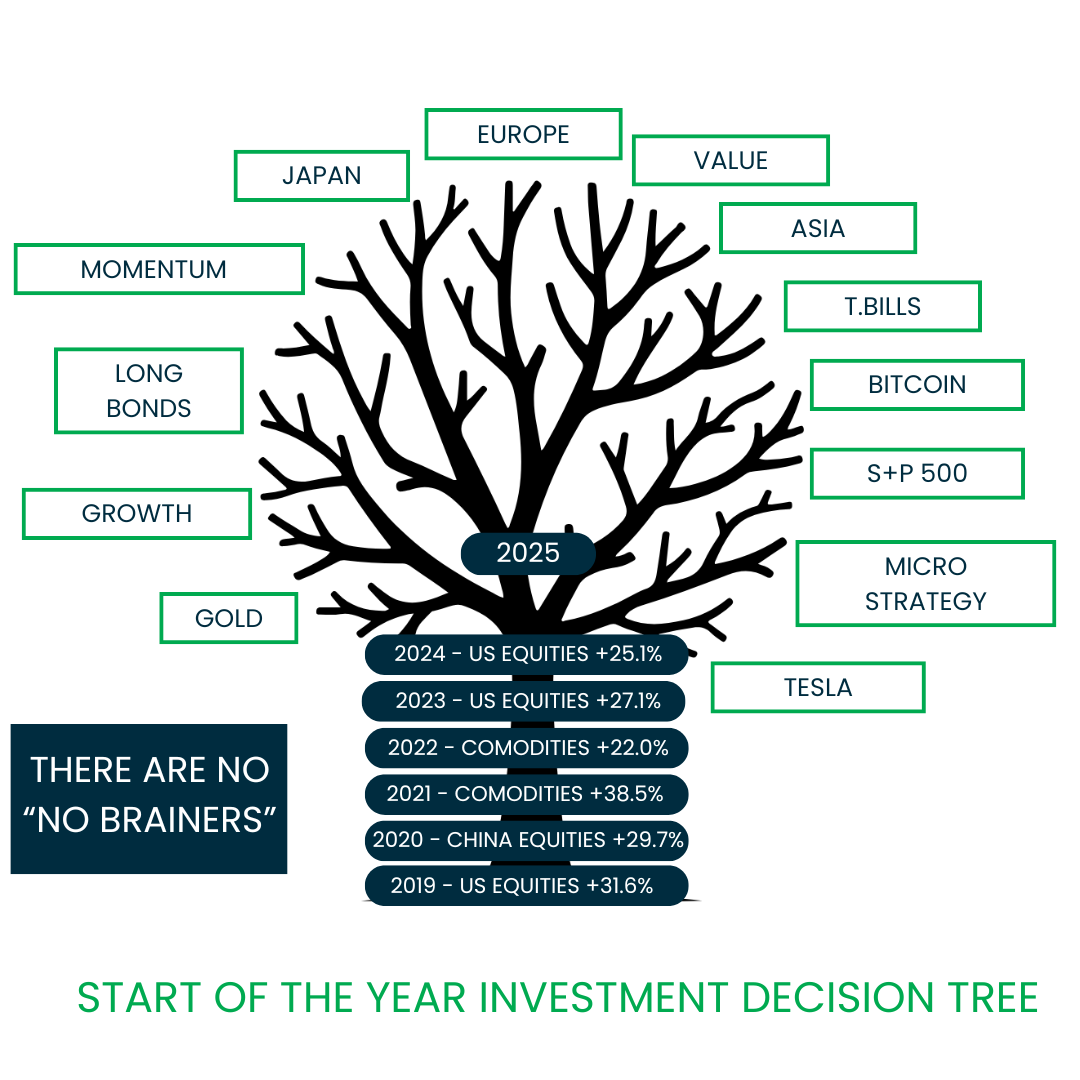

There Are No No-Brainers

The following image shows you where we are today:

Hat tip to Annie Duke Thinking in Bets for the idea

Click to enlarge

The trunk shows the best asset class performance over the past six years.

The branches show you your possible investments for 2025

What branch will perform best?

We do not know, and the thing is no one knows. BUT at the end of the year there will be a lot of people saying the best investment was obvious. It wasn’t and never has been.

The thing is you must decide NOW and invest.

Here are a few ideas to help you.

What Can You Do Now

So, if no one knows what will happen and there are a lot of bubbles and wild speculation going on, what can you buy now? You must go back to basics or first principles and look at what worked over the long term in up and down markets.

For possible strategies that have stood the test of time look at our strategies page here: The best investment strategies we have tested.

Find Your Best Investment Strategy

If you are unsure what investment strategy is the right one for you take a look at this article: How to find your best investment strategy – not the one you expect

If you have found a strategy you like you can back test how it would have performed over the past nine years. This article shows you exactly how to do it: How to back test your investment strategy - Real world example

Worried About a Market Crash

If you are worried about a crash this article gives you my best ideas on how to prepare: Crash Proof Your Portfolio: Essential Prep Tips

Your 80/20 solution

If all this research looks like it will take up too much of your time, or if investing is not your thing, our newsletter service may be what you are looking for.

You can read all about it here: Get Investment Ideas from Only the Best Strategies

I have tried to keep this as short as possible. So, the only thing left to say is…

I wish you great returns in 2025.

Click here to start finding ideas that EXACTLY meet your investment strategy.

FREQUENTLY ASKED QUESTIONS

1. How can I pick the best-performing investment for 2025?

Answer: You can’t predict which branch (investment type) will do best. No one knows, even the experts. The key is to focus on strategies that have worked long-term in both good and bad markets.

This gives you the best chance of success rather than trying to guess the next big thing. Look at tested strategies to guide your decision.

2. What if there’s a market crash this year?

Answer: Crashes happen, but you can prepare. Diversify your portfolio, avoid speculative investments, and make sure you’re not taking on more risk than you’re comfortable with. If you want a step-by-step plan, check out this guide: Crash Proof Your Portfolio: Essential Prep Tips.

3. What’s the best way to start investing if I’m unsure where to begin?

Answer: Start by finding an investment strategy that fits your goals and risk tolerance.

A good place to begin is this article: How to find your best investment strategy – not the one you expect. Once you’ve found a strategy, you can even back test it to see how it would have performed in past markets. How to back test your investment strategy - Real world example.

4. Is now a bad time to invest because of bubbles or speculation?

Answer: While bubbles and speculation are worrying, you don’t need to sit on the sidelines. Stick to basics: invest in solid companies, diversify, and use a time-tested strategy. Remember, the market’s unpredictability is always part of investing. Staying disciplined is your edge.

5. What’s the simplest way to invest if I don’t have much time?

Answer: If researching and managing investments feels overwhelming, consider subscribing to a newsletter service. It provides hand picked ideas from proven strategies, saving you time while helping you invest wisely. Get Investment Ideas from Only the Best Strategies.

6. How do I avoid making emotional decisions when investing?

Answer: A clear, rules-based investment strategy is your best defence against emotional decisions. This takes the guesswork out of investing. Focus on what you can control: your strategy, risk management, and long-term goals. Avoid jumping in and out of investments based on news or fear. This article can help you: Get Higher Returns By Mastering Emotions

7. Can I really beat the market, or should I just invest in the S&P 500?

Answer: Investing in the S&P 500 is a great option for long-term growth, but if you want to potentially outperform, you’ll need to follow a disciplined strategy. Some strategies have outperformed the S&P over time, but it takes effort and consistency. Decide what fits you best—both approaches can work.

Click here to start finding ideas that EXACTLY meet your investment strategy.