This new Target Weight indicator helps you size positions in your portfolio using risk parity.

You can of course diversify your portfolio over 15 to 30 companies and invest the same amount in each company.

But is that the best way to think of your position sizing?

This approach has a problem…

If you do this you will invest the same amount in a volatile (big up and down movements) stock as in a company with a more stable share price?

Think of an investment in Nestle compared to very undervalued small cap company with problems.

The same amount invested = more risk

If you invest the same amount in each company you increase the risk in your portfolio towards the most volatile companies.

This means the profits (or losses) of your portfolio will mainly be dependent on the more volatile companies because they have larger movements.

To give the more stable companies the chance to give you the same amount of profit you should invest a larger amount in them, and less in the volatile companies.

It is called risk parity

This idea is called risk parity – it means the position size of each investment is based on the volatility of the company’s stock price.

We call it Target Weight

In the Quant Investing screener we call it Target Weight and it is simply the volatility adjusted recommended position size (in %) for a stock in your portfolio.

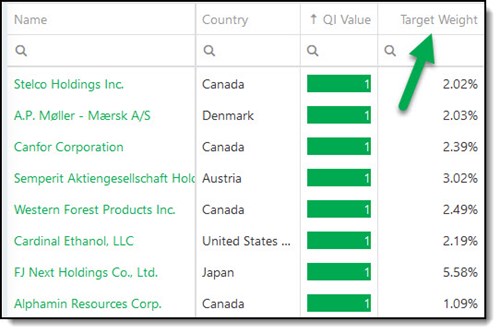

This is what it looks like:

Suggested portfolio weight (Target Weight) based on the stock’s volatility

How is it calculated?

Don’t worry about the calculations below the screener does it all for you. I included it here to show you exactly how risk parity works and how it is calculated.

This is the formula:

This is how risk parity is calculated.

Number of shares to buy = (Total capital you have to invest * Risk Factor) / Average True Range (ATR)

Total capital you have to invest

Total capital you have to invest is simply the total size of the amount you want to invest.

Risk Factor

Risk factor is simply an arbitrary number that you select to where you determine the daily impact of a stock in your portfolio.

For example, if you choose 0.003, then you are setting the daily movement impact for this stock on your portfolio of 0.3%.

This of course assumes that the ATR (explained below) stays on more or less the same as in the recent past.

The lower you set the Risk Factor, the smaller your investment in the stock will be.

Target Weight uses 0.1%

In the screener to calculate the target weight we use a risk factor of 0.001 or 0.1%

Average True Range - ATR

Average True Range (ATR) is the average volatility of the company’s stock price measure as the maximum of the days move (high or low) from the previous day.

ATR is shown in the value of the stock’s price movements, for example $1.3 or €0.4.

In the screener we use the past 20 trading days (past month) to calculate the average True Range (ATR).

Target Weight example

Here is an example so you can see how Target Weight is calculated in the screener:

- Total capital you have to invest: €100,000

- Risk Factor: 0.001 (equals 0.1%)

- ATR of the stock: €1.10

- Current share price: €43.50

The number of shares you should buy is: (100,000 x 0.001)/1.10 = 91 shares

Value of the transaction = 91 shares x €43.50 = €3,959 or 3.96% (3,959/100,000) of your portfolio.

Maximum position of 7%

In the screener the position size or Target Weight varies from 0% to 7%.

We have limited the maximum position size to 7% or 15 positions.

We chose this number because 15 companies give you most of the benefits of diversification. This of course only applies to the companies with the lowest volatility.

Please remember that the Target Weight is only a suggestion, you are free to use whatever weighting you feel comfortable in your portfolio.

But it changes all the time

But the volatility of a stock changes all the time, you may be thinking. That is correct and that is why the Target Weight changes on a daily basis.

This does not mean that you must change your position size all the time - that will cost too much in trading fees.

To keep trading costs low we suggest that you check your position size on a monthly basis and only trade if the Target Weight has changed by more than a certain percent that you can set yourself, a change of 2% or more, for example.

This means if the Target Weight was 5% when you invested you will only adjust your investment in the stock if the Target Weight changes by more than 2%, to 3% for example. If this happens you sell some of the stock until the company makes up only 3% of your portfolio.

If a stock price has a large movement in a day, for example more than 10% you may want to adjust your investment immediately as this move signals that something important has happened which makes an adjustment necessary.

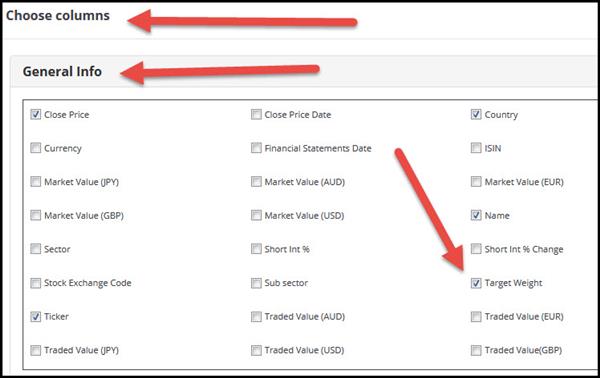

Where can you find it?

In the screener the Target weight is available for all of the more than 22,000 companies.

To see the Target Weight simply select it as an output column of your screen.

How to select Target Weight as an output column

How to keep track of the Target weight for your whole portfolio?

As mentioned the Target Weight changes on a daily basis. To keep track of it (and all the other ratios for your portfolio) simply save a Watchlist of all the companies you want to track.

To find out how to do this click the following link: How to create and edit Watchlists in the Quant Investing screener

PS To get Target Weight - risk parity position sizing - working in your portfolio sign up here.

PPS It is so easy to forget why not sign up right now, before you get distracted.